Voice of Property Manager

EMEA Edition | 2025

On behalf of MRI Software, I’m delighted to welcome you to the latest Voice of the Property Manager report for the EMEA region.

Managing Director, EMEA Property Management Solutions

The EMEA Voice of the Property Manager Survey aims to build an understanding of the key challenges and opportunities facing property managers. As well as understanding industry-level trends, we asked respondents how they felt about their jobs, from current training needs to their aspirations for the future.

This edition comes at a time when economic changes are shaping tenant and owner needs along with the future of the industry. Ongoing market shifts combined with regulatory changes and economic pressures are driving property management firms across the EMEA region to review their strategies. The rise of flexible and hybrid office space is resulting in a boom in repurposing and change of use, driving new service offerings. Demands for retail space are shifting as retailers turn to innovative data-driven approaches to engage customers and combine enhanced in-person experiences, in turn leading to expanded demand for warehousing space to serve the continued growth in online shopping.

As economic uncertainty puts downward pressure on profit margins, property management professionals are being expected to deliver more to remain competitive, adapting quickly to changing preferences, capturing new opportunities, and keeping pace with legislative change, all while ensuring an efficient and flexible working environment for their own teams. In these changing times for property owners and investors, it’s more important than ever that we learn from best practice across the industry. For this reason, we’ve chosen to expand our survey from the UK to cover the broader EMEA region, collecting insights from a wide base of property professionals.

The Voice of the Property Manager survey paints a picture of a committed and resilient group of leaders, ready and willing to meet the challenges the future holds.

Many are already investing in the technology they need to achieve their goals, combined with training and development to ensure that the professionals within the sector are prepared for changes in legislation.

However, there are always opportunities for improvement, and the survey data highlights areas where the sector could move faster, leveraging cutting-edge AI-driven technology not only to capture efficiencies but to derive key strategic insights from the vast volume of data filtering through the business. Firms also need to prioritise enhanced training to help teams get the most out of the systems they’re investing into, as well as to help attract and retain new entrants into what shows some signs of becoming an aging industry.

We trust that this report will provide some insights into the ways the sector is evolving, and some hints of what the future might hold.

Here’s what property managers said about some of the key factors in their professional lives – including job satisfaction, wider industry challenges and opportunities and the part technology plays in their day-to-day role.

Workplace

Workplace

56%

work more than 40 hours per week

42%

still work full time in office

82%

agree they work with great people

65%

feel satisfied with the level of support from their managers

Technology

Technology

38%

agree that they need better technology to do their job

69%

agree technology eases their workload

37%

see AI as a driver of enhanced efficiency

30%

believe better integration between systems would make their job easier

Industry

Industry

84%

enjoy their job

38%

are satisfied with their salary

46%

expect to work in the property sector long term

36%

expect more flexible working over the next 5 years

Priorities

Priorities

30%

say aggressive owners or tenants are their biggest challenge

69%

say increasing client satisfaction is their top priority

83%

are prioritising reductions in operating costs

19%

received training in legislation and compliance in the past 12 months

Survey respondents reported above average working hours, although job satisfaction levels remain high.

Fifty-six percent of respondents reported working more than 40 hours per week. Those based in Africa and the Middle East were most likely to work long hours, with 23% of African respondents working over 50 hours per week compared to less than 3% in the UK. Despite a lower average workload in Europe and the UK, hours worked were still higher than the UK average weekly workload of 36 hours, with 32% of UK property professionals and 50% of those in Europe working more than 40 hours per week.

Respondents in senior leadership positions were most likely to work long hours, with 73% reporting working over 40 hours per week. However, 56% of property managers also reported working more than 40 hours per week, suggesting that workloads are high across the sector.

How many hours per week do you work?

How many hours per week do you work? (by job title)

How many hours per week do you work? (by country)

Property managers return to the office

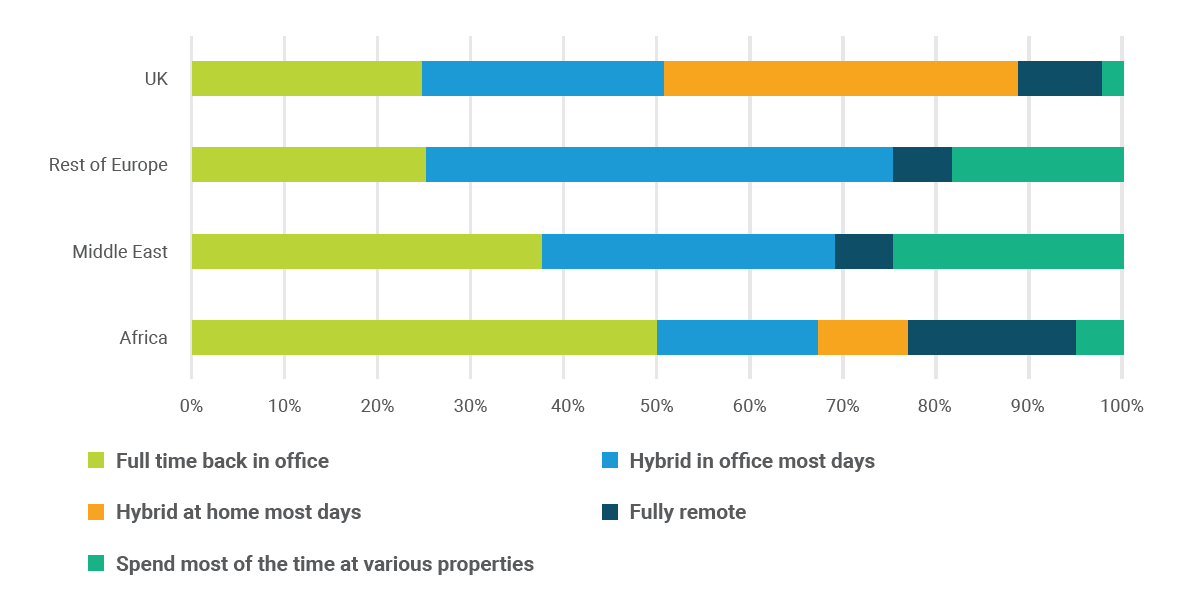

Despite the shift towards hybrid working in many organisations, over 40% of respondents work full time at the office and 20% work hybrid with most days in the office.

Those based in the UK were most likely to work from home, with 46% working entirely or mostly remotely, while those in Africa were most likely to do no remote working at all, with just under half of respondents working full time in the office. Property professionals based in the Middle East spent a higher percentage of time at their properties than any other group, with 25% working this way compared to just 2.6% in the UK.

While hybrid and remote working are more popular since the pandemic, this trend suggests that the office environment remains an important part of the property management industry for some organisations. This brings with it a need to ensure that property management firms provide the right working environments for their staff – MRI Software’s recent report on office transformation in partnership with Worktech Academy highlights that less than half of surveyed workplaces offer employees a high-quality workplace experience, with employees frequently of the opinion that they can work as efficiently, if not better, from home.

What best describes your working environment? (by region)

Turning to technology to manage workload

Property professionals are feeling the pressure of their long working hours, with two thirds agreeing that they often feel too busy and a third saying that this affects their mental health. Technology is seen as an important tool in handling busy workloads, with 69% agreeing that the technology they use eases their workload and 38% stating that they needed better technology to do their job.

With property firms investing in a wide range of technologies from property management platforms to AI automation (detailed later in this report), it’s clear that PropTech is seen as an important tool for property professionals to help them deal with often hectic schedules.

To what extent do you agree or disagree with the following…

High job satisfaction – but limited opportunities?

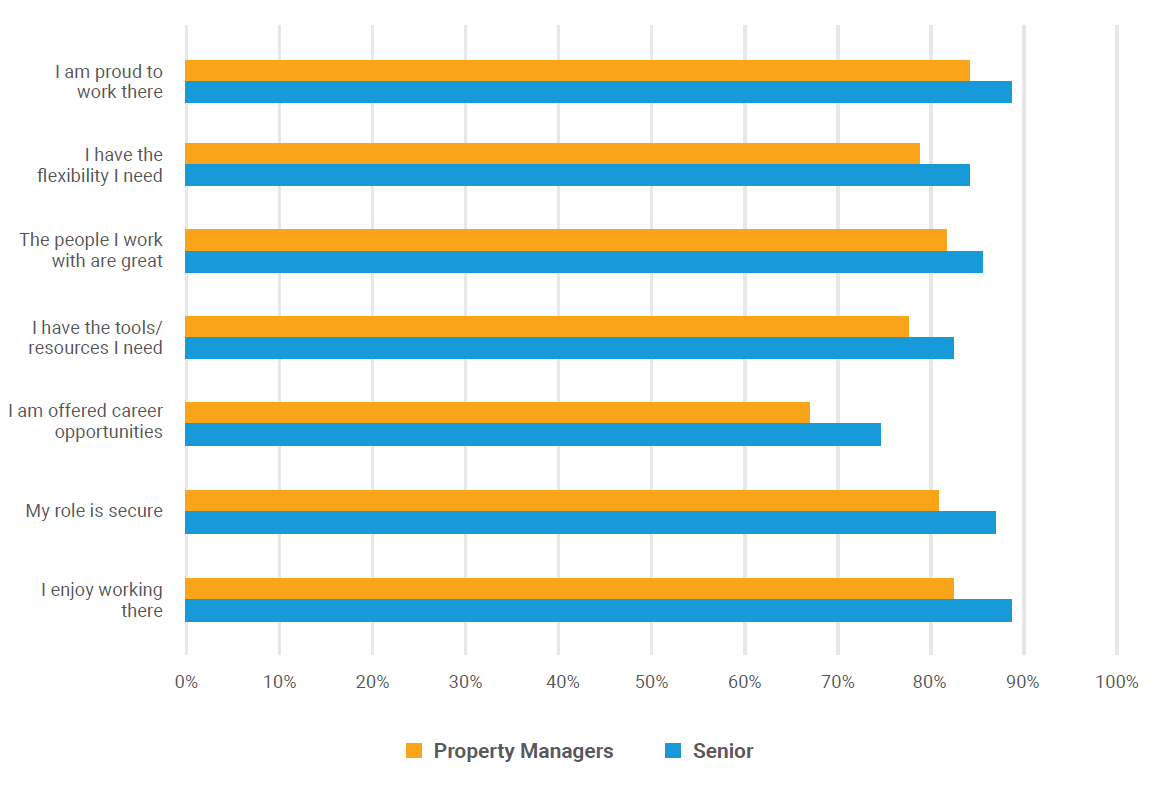

Despite challenging workloads, those surveyed reported high levels of job satisfaction, with 84% agreeing they enjoyed their job. Generally, those working in property are happy and secure in their roles, although they are less optimistic about the tools and resources available to them, as well as their future career prospects, scoring these two areas lowest in terms of overall satisfaction.

Those in senior roles demonstrated higher levels of enthusiasm for their jobs across the board, scoring every aspect more highly than those in management roles. However, over half (52% of respondents) gave negative or neutral responses when asked about career opportunities. This increased to 83% among the under 25’s.

Combined with the earlier data highlighting a relatively low level of younger people entering property management, this suggests that the industry may not be doing enough to attract and develop new talent.

Flexible roles, but pressure on salaries

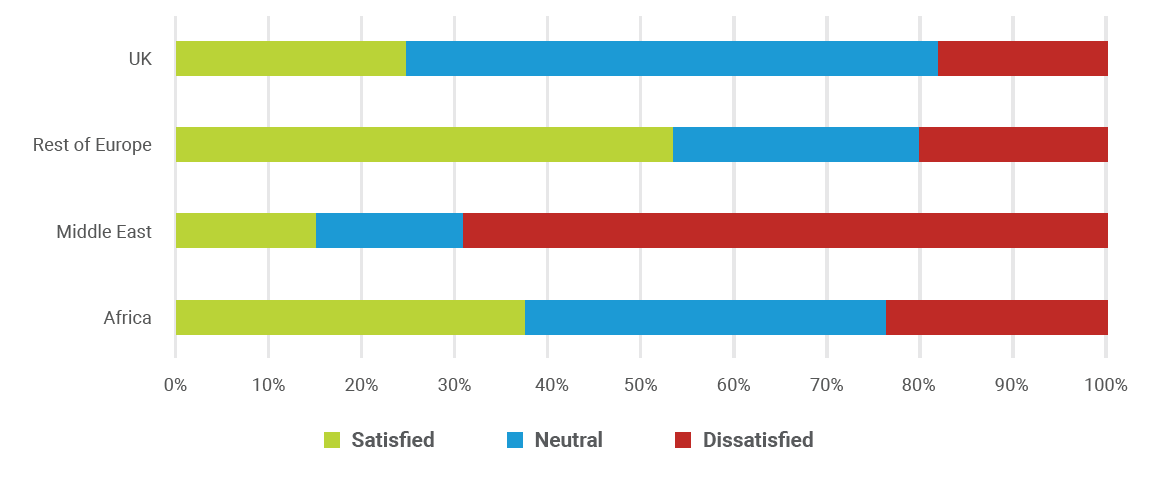

When asked about different aspects of their roles, respondents stated that they were most satisfied with the flexibility offered, with this feature topping the scores. However, around a quarter said they are dissatisfied or very dissatisfied with their salary, with 56% of those in the Middle East expressing dissatisfaction with pay. Respondents in Europe were most likely to be satisfied with their salary at 50%, while 34% in Africa were happy compared to 22% who were dissatisfied.

Over 40% of respondents reported being dissatisfied with the technology they use. More than 4 out of 10 respondents are dissatisfied with the technology they use, identifying the opportunity to improve employee experience and satisfaction by investing in improved solutions.

How satisfied are you with…

How satisfied are you with your salary?

Tenant satisfaction – and dealing with the fallout of issues – remains a high priority for property managers. Dealing with frustrated owners and tenants took the top spot for the most challenging part of the job for the second time (coming top in the first Voice of Property Manager survey conducted), with 30% stating this was their biggest challenge.

Interestingly, those in senior property roles were more likely than managers to consider this their biggest challenge, with 36% of departmental or senior managers versus 27% of managers selecting this option. While the overall percentage was relatively stable across regions, it was lowest for businesses managing more than 1,000 units (21%), suggesting that larger businesses may have more established processes for handling issues and complaints, perhaps driven by their capacity to invest in more scalable maintenance processes or technology to support communication.

Managing workload was the second most popular choice at 17%. Respondents reported few challenges with technology; just 3% stated this was their biggest challenge.

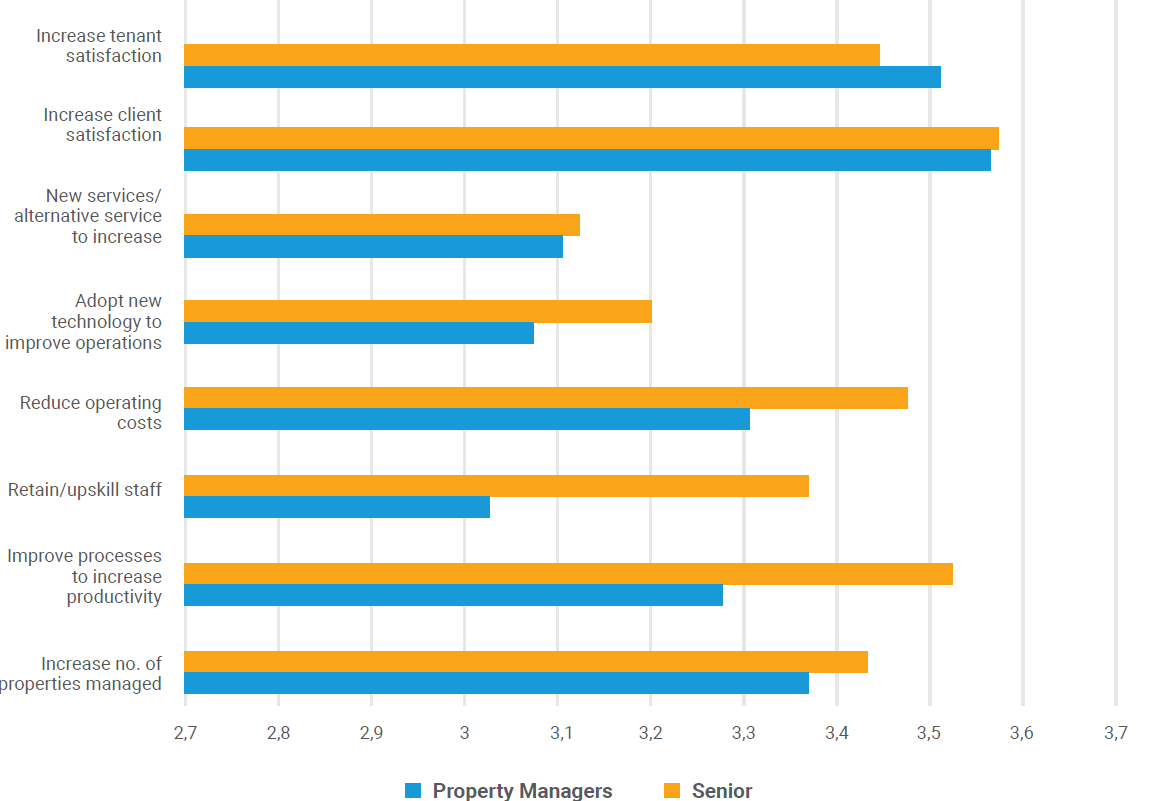

When asked about organisational priorities, both property managers and those in senior roles ranked increasing client and tenant satisfaction most highly. Property managers also ranked increasing the number of managed properties as a priority for their organisation. Retaining and upskilling staff was ranked lowest by property managers.

Those in senior roles were much more likely to prioritise reducing costs, upskilling staff and streamlining processes to increase productivity. Considering the long hours and workloads, this priority is not a surprise. Senior management focus on upskilling staff and streamlining processes should help deal with the overall satisfaction of employees in the sector.

How much of a priority are the following to your organisation?

Technology opportunities and legislative risks

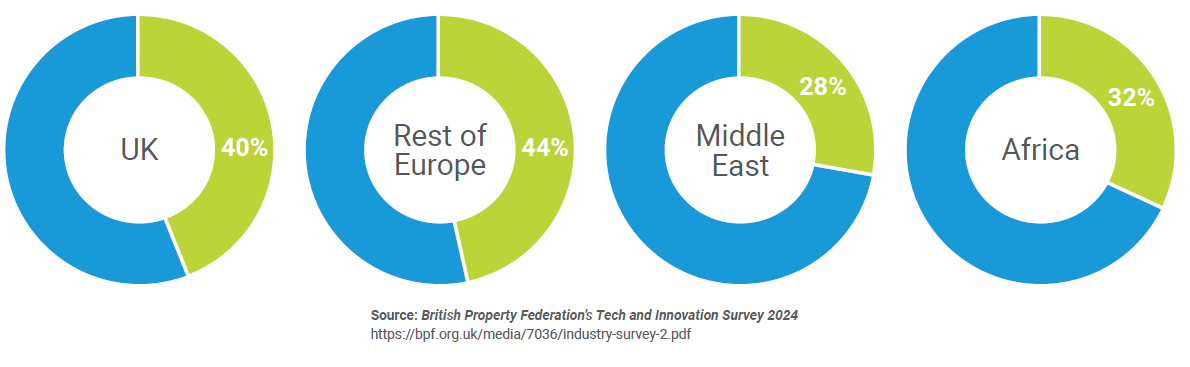

Survey respondents ranked new technology as a significant opportunity, with nearly a quarter seeing this as essential. Interestingly, 21% think new technology has little to no impact on the industry, and this paints a more sceptical picture than survey data collected in other studies, for example the British Property Federation’s Tech and Innovation Survey 2024, which found that 60% of property professionals expected AI to have a significant impact on the sector in the next 3-5 years.

What factors do property managers think are challenges, and where are there opportunities?

Thirty percent see legislative changes as a key challenge for the industry, with only 22% seeing them as an opportunity. With increasing pressure on property managers driven by rising occupant expectations and shifts in behaviour patterns as well as ESG goals, it’s unsurprising that teams are struggling to navigate this fast-changing aspect of the industry.

Thirty percent also see change of use or flexible space in properties as an opportunity, while 14% cite this as a challenge.

Respondents are divided on the impact the changing political landscape could have on the industry, with 37% considering it a challenge while 33% expect it to have little to no impact. In the Middle East, respondents were significantly less likely to see political or legislative change as a challenge than in other regions.

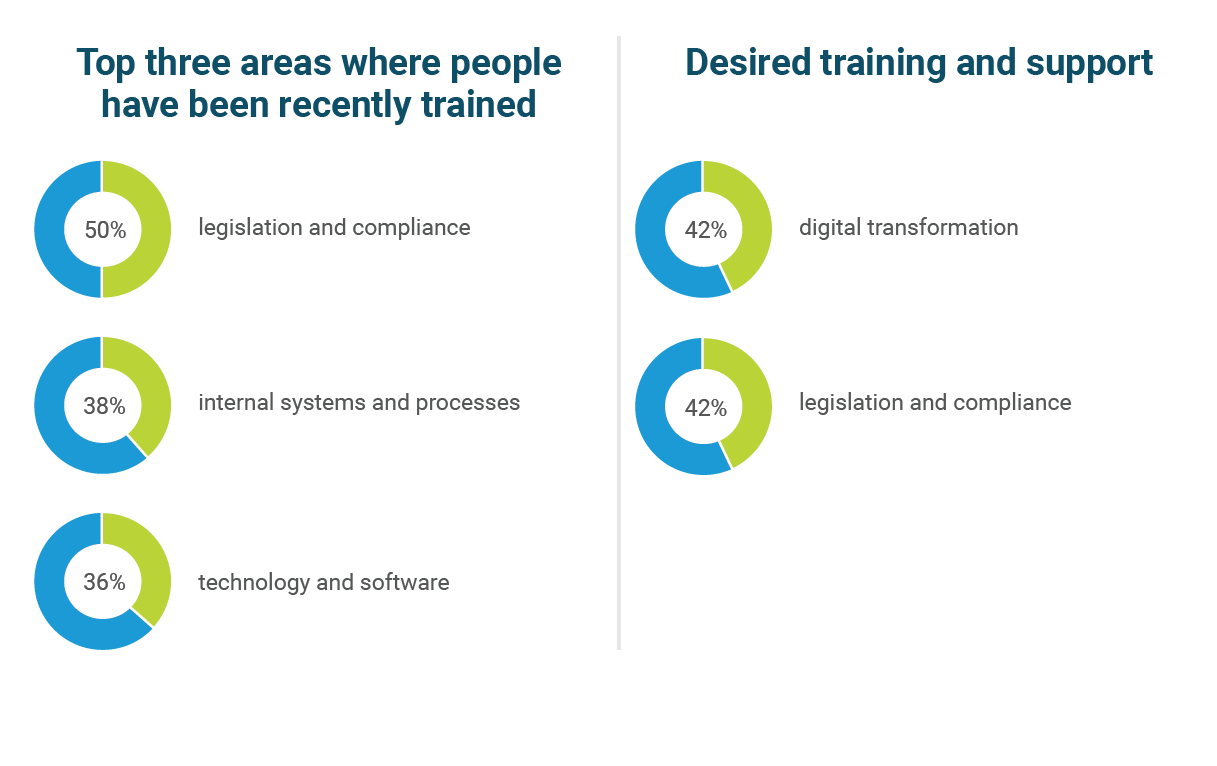

Property management professionals are generally happy with the training they receive, but digital and mental health training are missed opportunities.

In terms of training and support, legislative compliance, internal systems/processes and technology and software topped the scores, indicating that businesses are focusing more on ensuring compliance, effective processes and training people on tools to do their job.

Digital transformation training topped the scores for most desired training, indicating a need from property professionals to be more tech savvy in future. This reflects not only the pressure to increase efficiency to deal with high workloads, but to attract new entrants to the industry.

Mental health and wellness, along with thought leadership were lowest scoring areas of training that people received, however one third of respondents said they would like to have more training and support in these areas.

With a high percentage of the industry working long hours and struggling with the personal demands of dealing with unhappy tenants, it’s clear that mental health support is an important priority of the industry to ensure long term staff wellbeing and retention.

70% agreed or strongly agreed they had suitable training for their role

What training have you received in the last 12 months?

What training have you received in the last 12 months?

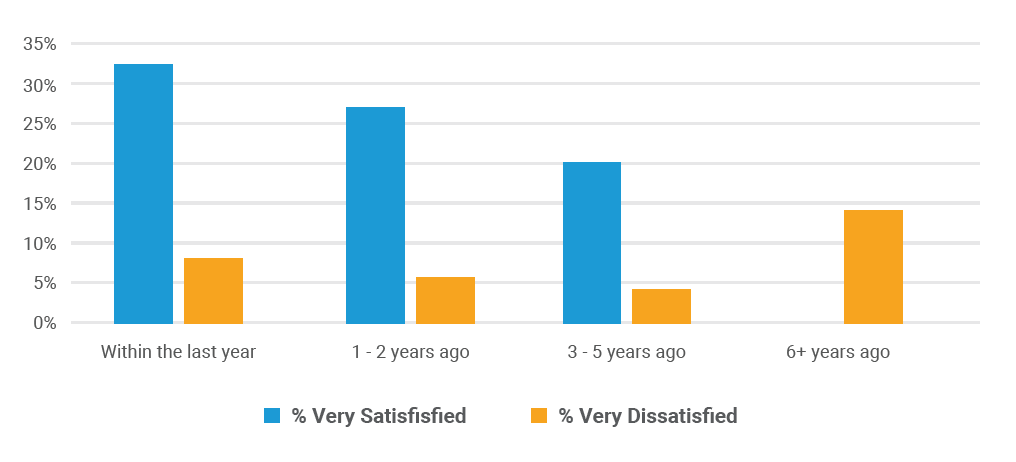

High satisfaction with property management software

Almost 6 out of 10 respondents said they rely on a centralised property management system or platform. Three in ten navigate between various applications and systems to manage their properties and related services and data.

Seventy-five percent of respondents were happy with their property management system, 25% said they were “very satisfied”.

45% of respondents stated that their system was last updated or changed within the last 12 months, and 10% reported having changed in the last 1-2 years. While overall satisfaction levels remained relatively stable for the first 5 years a system was in place, there was a clear correlation between the amount of time since a system had been updated and the percentage of respondents who were very satisfied or very dissatisfied with their software – those who last updated their system more than 6 years ago were twice as likely to be “very dissatisfied” than those who had made a change within the last year. It’s not clear whether this is the result of businesses outgrowing their previous platforms, or other issues such as lack of continued training to keep teams up to date with new features or a failure to reconfigure software to meet changing needs over time.

How satisfied are you with the current property management system?

Keeping up with the pace of change

Over a third of respondents said that it was “likely” or “very likely” that their business would need to update or change their property management system in the next 12 months. Unsurprisingly, those who were dissatisfied with their current system were most likely to anticipate a change.

However, over a quarter of businesses who were currently satisfied with their software also expected to update their property management platform, suggesting a clear understanding of the relationship between business success and the drive to stay on top of technological trends.

How likely is it that your company needs to make changes in your property management system in the next 12 months?

These findings show how likely respondents are to make system changes in the next 12 months, based on the level of satisfaction with the current property management system in place.

Investing in technology to drive efficiency

When asked for the reasons for their decision to change systems, almost 40% said that they’d do so to gain efficiencies and process improvements. Given the high priority senior respondents put on increasing productivity elsewhere in the survey, it makes sense that businesses would look to upgrade their systems to streamline workflows and take advantage of cost saving opportunities.

What would be the main reason to implement or change property management systems?

Integration with other systems was also a high-ranking response at 15%, suggesting that those operating off multiple systems recognise the potential business benefits of having a central source of truth over siloed data and systems.

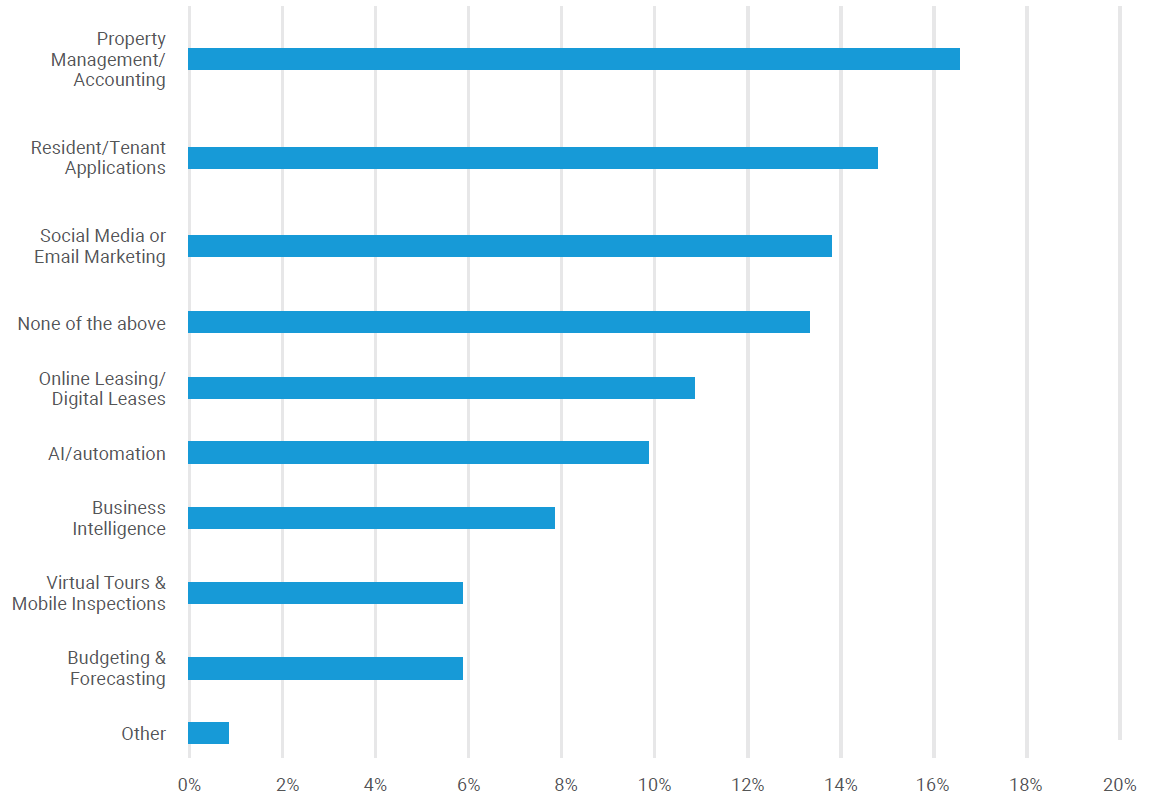

Targeted tech to meet business objectives

Property management and accounting tech was the most adopted over the past 18 months, with 16.5% of businesses investing in this, followed closely by resident and tenant applications at 14.7%. This aligns with respondents placing high priority on improving client and tenant satisfaction, as well as the desire to capture operational efficiencies.

Around 10% of respondents stated that they had adopted AI or automation tools to support their workflows, suggesting that while growth in these areas is slower, there is interest in the potential benefits of automation as a way of improving productivity. Over a third of respondents stated that they thought AI had the potential to make them more efficient, suggesting that AI uptake could increase significantly in the coming years.

Which technologies have you/your team adopted within the last 18 months?

The push for integration

Property leaders were clear that integration is key to reducing some of the pressures surrounding their role, with 30% choosing it as the single feature that would make their jobs easier.

With 30% also relying on multiple separate systems rather than a centralised property management solution, it’s no surprise that this is the case, and those who said that they’d like better reporting, or centralised data would also benefit heavily from reducing data silos, allowing them to gather and combine data to draw out insights more effectively.

What one function/feature would make your job easier?

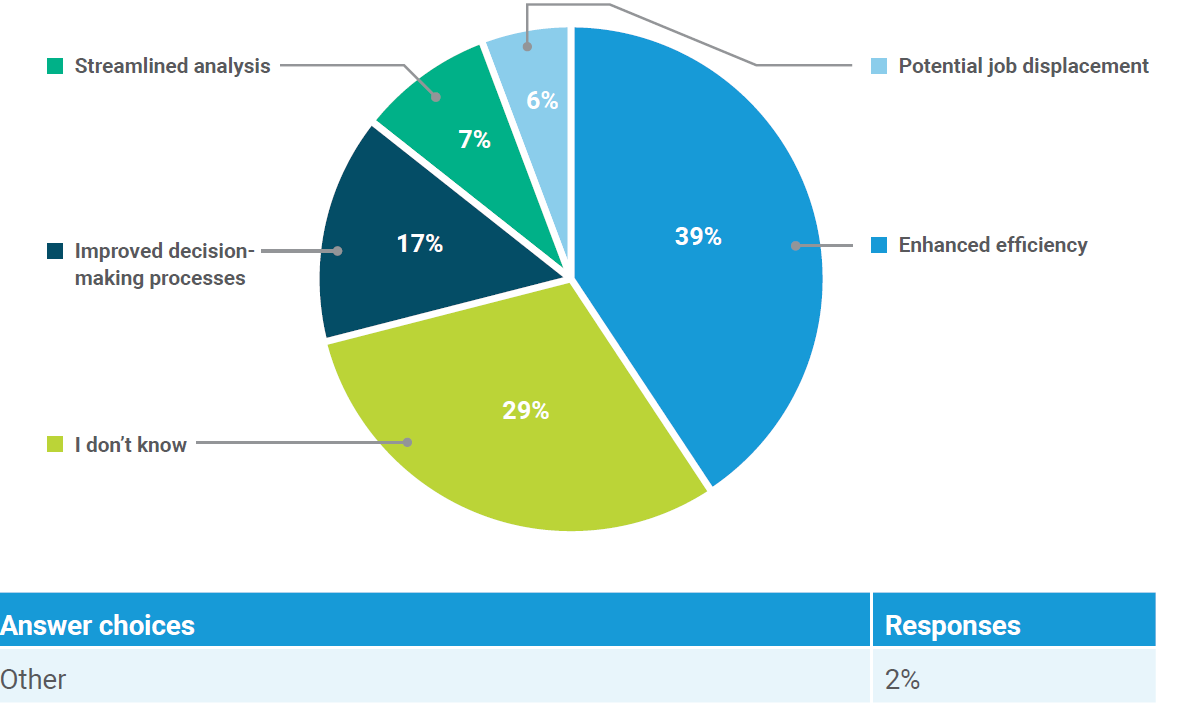

AI – an underestimated technology?

While 30% of respondents weren’t clear on what impact AI could have on their role, over a third thought that it would make them more efficient.

Just 17% recognised AI’s potential to benefit decision making and analysis capabilities within the property management sector, however, suggesting that some of the potential of these technologies is not yet well-understood.

Only 7% thought that AI may pose a threat to their roles, understanding that some of the human elements of their role are very unlikely to be replaced by artificial intelligence.

What do you think the main impact of AI will be on your role?

The survey asked property management professionals for their views on how the industry

might change over the coming five years.

Respondents are divided on whether the number of property managers in the industry will increase or decrease, with 31% expecting a higher head count in the industry while 26% expect this to shrink. With 39% expecting more self-managed properties, likely as a response to financial pressures on investors leading them to bring management services in-house to reduce fees, it’s clear that some property managers are concerned that financial trends such as the higher cost of capital could impact the industry.

Property professionals also expect improvements to their working conditions in future, 39% of those surveyed think that property managers will enjoy more flexibility in the coming years.

The table below shows a comparative view of opinions from the first survey conducted in 2022, and the most recent survey results.

2022 Results

Property management as a career

Property managers are typically positive about their roles, scoring their likelihood to recommend their career path to others at a 6.5 out of 10. Forty-five percent say they plan to work in the sector long term (more than 5 years), with a further 13% planning to stay for at least the next 3-5 years.

On a scale of 0 to 10, (where 0 is not at all likely and 10 is extremely likely), how likely is it that you would recommend working in property

management to a friend or colleague?

Those based in Africa and the Middle East were most likely to say that they expected to work in the sector long term, at 45% and 44% respectively compared to 32% of those in the UK and just 19% in Europe.

Those based in Africa and the Middle East were most likely to say that they expected to work in the sector long term, at 45% and 44% respectively compared to 32% of those in the UK and just 19% in Europe.

Only 7% of respondents said that they’re likely to leave the sector in the next 5 years, and those who expected to leave the sector imminently were mostly aged 45 or over, suggesting that those who are already working in the industry mostly expect to stay until retirement.

Property managers also show some entrepreneurial spirit, with 15% stating that they’d like to start their own property-related business at some point. Those aged under 35 were most likely to express a desire to work for themselves, with 33% of those aged 25-34 agreeing they’d like to start their own business compared to only 8% of those aged 45-54. In Africa, respondents were three times as likely to be keen to start their own property firm, with 13% of respondents stating this compared to just 4% in the UK.

What are your aspirations in your property career?

The 2025 EMEA Voice of the Property Manager report paints a picture of an industry facing a

range of challenges, and increasingly turning to technology to meet increasing demands.

From economic uncertainty and regulatory change to the impact of shifting client and tenant preferences, property managers are dealing with increased demands to ensure client satisfaction and maintain competitiveness. Many are working long hours to respond effectively, and some are showing concerning signs that overwork and pressure are starting to affect their mental health.

There are also worrying signs that the industry may be struggling to attract and retain younger talent, with the potential for this trend to amplify existing issues surrounding workload if it’s not addressed. It’s vital that firms are prepared to invest in the technology they need to provide an efficient and productive working environment, as well as the training new hires need to grow and thrive in their roles.

Much like the 2022 survey, the 2025 report shows a sector that’s remarkably resilient and optimistic. Property managers are generally happy and secure in their roles, enjoy their jobs and like their colleagues. Most intend to remain in the sector, and some even have aspirations of starting their own property businesses.

A key factor behind this sector-wide optimism is the resourceful and innovative use of technology to address challenges and deliver continuous improvements in efficiency and performance, with almost 70% of survey respondents agreeing that the technology they use helps to ease their workload.

Via foundational technology such as integrated property management software solutions, property managers can streamline their workflows, maintain a comprehensive view of their operations and draw out the vital data-driven insights they need to adapt and thrive in a changing environment. The survey results demonstrate widespread adoption of, and satisfaction with, property management technology, with many branching out to adopt more advanced systems such as landlord or tenant portals, or even AI-driven systems to automate processes and fuel better decision making.

The survey data shows that with the right technology implemented, property managers are more than capable of innovating and thriving. By embracing a data-driven approach to their operations and effectively integrating disparate systems, teams can effectively streamline their operations, maintaining compliance, cutting costs and delivering a high-quality experience for clients, stakeholders and tenants, as well as gaining access to the insights they need to achieve a competitive edge in their industry and achieve their goals.