A review of footfall performance during the Christmas period 2023

A review of footfall performance during the Christmas period 2023 (Covering the period from 18th – 30th December)

The final week before Christmas delivers a welcome boost in footfall for UK retail destinations

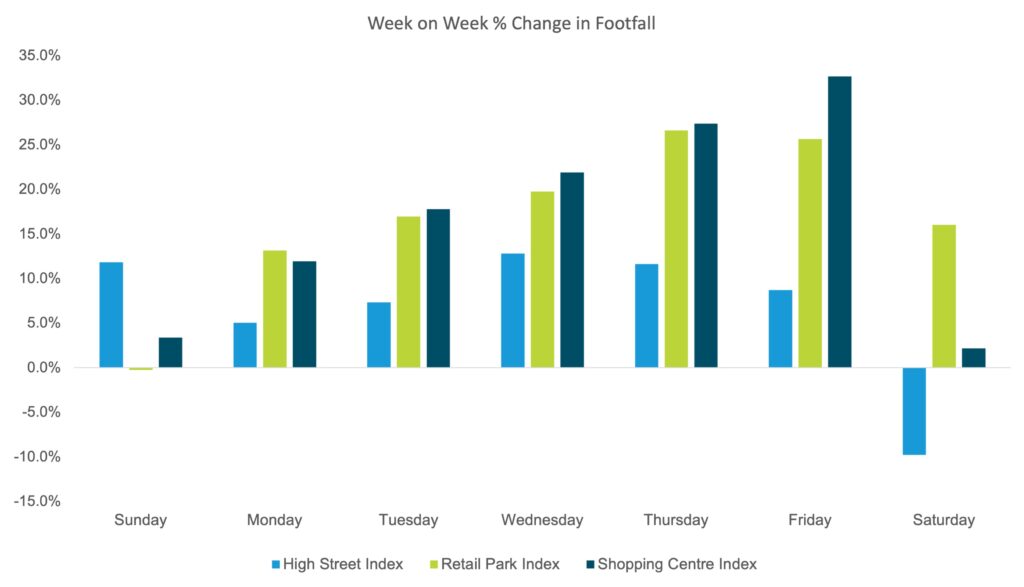

The final week before Christmas saw footfall rise across all retail destinations from the week before by +11.2% largely driven by a rise 3x higher in retail parks (+17.2%) and shopping centres (+16.4%) compared to high streets (+5.8%). Activity peaked on Wednesday, Thursday and Friday by an average of +18.2% across all destination types with much of this driven by shopping centres where footfall rose by an average of +27.3% during this period from the week before. This diminished as we approached the weekend with footfall declining by an average of -4.1% on Saturday and Sunday from the week before across all retail destinations largely driven by a decline of -12.3% in high streets.

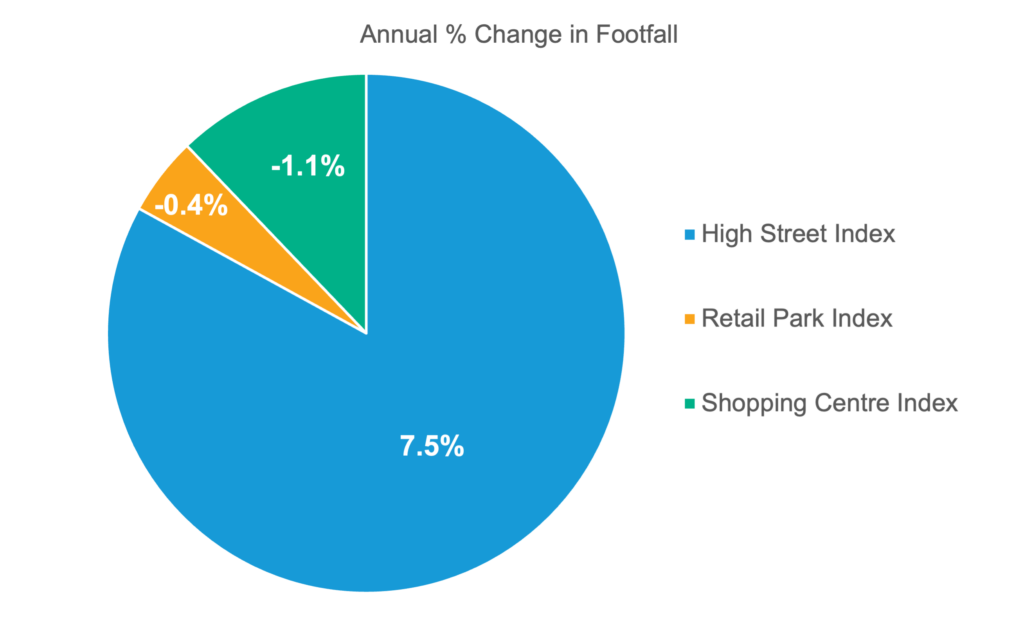

However, this boost was slightly lower than what retailers experienced in the same week last year which isn’t surprising given the financial pressures facing many consumers today and the cost-of-living crisis which has remained at the forefront for much of this year. This is particularly noticeable in footfall falling below the annual level marginally in retail parks and shopping centres. It’s likely that, given these economic pressures, many people will have spread the cost by starting their shopping earlier and booking their Christmas delivery slots for food to avoid the last-minute dash to the shops. Many will also have chosen to shop in the weekend prior (16th and 17th December) to avoid the rush in the weekend immediately before Christmas Day.

Due to a significant rise in activity in what was a full trading week before Christmas Day, footfall was higher than 2019 across all destination types monitored by MRI Software; +9.8% in high streets, +23.3% in retail parks, and +2.5% in shopping centres.

Footfall jumps by +5% on Christmas Eve as shoppers run to grab last minute items.

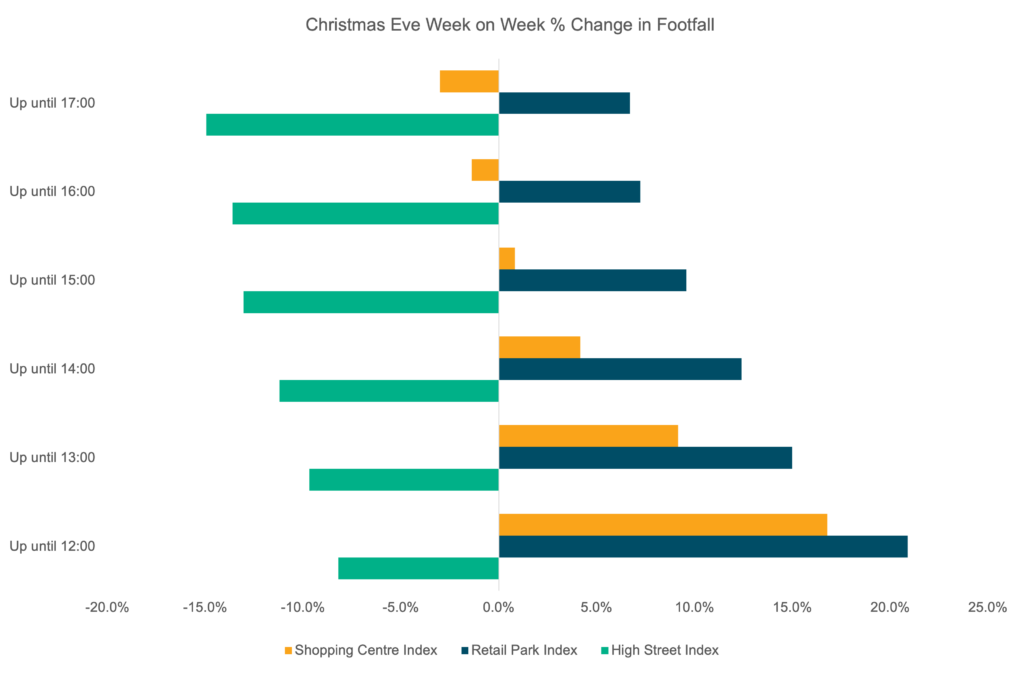

The latest insights from MRI Software’s OnLocation Footfall Index revealed that consumers were still shopping for final festive gifts and food items up to 12pm on Christmas Eve, as footfall rose by +5.0% compared to the week previous. The jump follows ‘Super Saturday’, which saw high street footfall surge, as Christmas celebrations and last-minute shopping continued through the weekend.

The surge in footfall was primarily driven by grocery shopping, which saw consumers favour retail parks and shopping centres, where shoppers were able to make the most of large car parks and a variety of stores in one location. Footfall at retail parks remained high throughout the day, rising by +20.9% against the week before up until 12pm, and by +16.8% in shopping centres, with shoppers out in force before stores close for Christmas.

Christmas Eve follows a strong period of trading for retailers. ‘Super Saturday’ saw footfall across UK high streets climb by +11.3% on 2022 levels, with consumers finalising festive shopping throughout the weekend. Footfall on Friday was up by +18.7% across all UK retail destinations compared to the week previous, as retail’s Golden Quarter finishes strongly.

Market towns noticed footfall surge +10.7%, compared to the week previous, suggesting that consumers stayed local on Christmas Eve. In comparison, footfall in regional cities (excluding London) dropped -32.4% with a similar fall experienced in Central London (-28.3%). Coastal towns also witnessed strong performance with footfall increasing by +25.0%.

However, footfall on Christmas Eve is down from 2022 levels, with a decline of -30.3% across all UK retail destinations compared to last year. The fall is largely due to Christmas Eve falling on a Saturday last year – making for a noticeably strong day of trading. This year, many stores and destinations adopted normal Sunday trading hours, suggesting a more subdued Christmas Eve than is typically expected for traders.

Boxing Day footfall gets a boost from high streets with a +4% rise across all destinations versus 2022

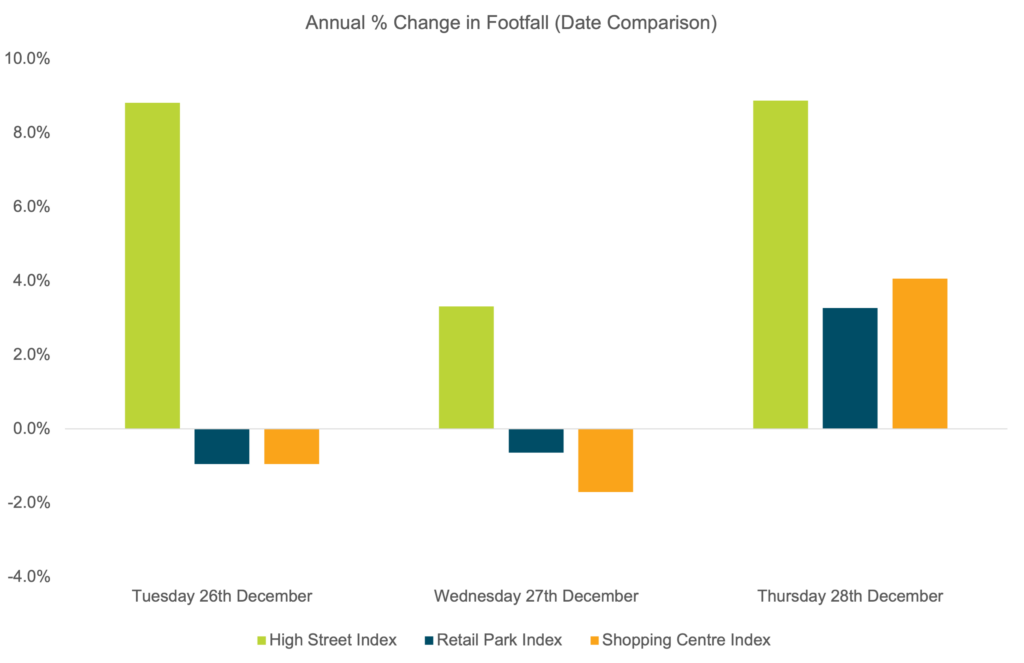

Boxing Day footfall in 2023 was +4% higher than Boxing Day 2022, primarily driven by high streets (+8.8%) whereas retail parks and shopping centres both experienced a year-on-year decline of -1%. Despite the increase, footfall on Boxing Day remained -14.9% lower than 2019 levels, indicating continued travel or online sales shopping which may have commenced on Christmas Day. It is also worth noting that Black Friday had taken place only a few weeks prior which may have deterred further spending alongside restrictions of the cost-of-living crisis as many were likely to have spread the cost of Christmas and started their shopping much earlier than normal.

Notably, Central London saw footfall rise by +10.6% compared with 2022, and by +1.6% against pre-pandemic levels.

Week on week, footfall remained -33% lower across all destination types monitored by MRI Software (high streets, retail parks and shopping centres). Shopping centres and retail parks witnessed a more severe decline of-34.9% and -47.5% from the same day in the week before. This is to be expected considering the notable increases witnessed in the week leading up to Christmas Day.

Footfall continued to rise year on year in the days following Boxing Day, when comparing against dates, with all destination types recording a year-on-year uplift on Thursday 28th December; high streets by +8.9%, retail parks by +3.3%, and shopping centres by +4.1%. This date appears to be key for consumers venturing out to possibly replenish groceries and explore Boxing Day sales.

Compared to 2019 levels, footfall remains -14.9% lower, indicating the continued impact of the rise of online shopping, the close proximity of Black Friday deterring further spend and the potential restrictions of the cost-of-living crisis.

The key trading period ahead of Christmas Day bought optimism to all retail destination types, particularly high streets as the investment made in festive events and attractions clearly had a positive impact in driving footfall to these locations.

MRI OnLocation UK Monthly Commentary – May 2025

UK retail footfall remains steady in May as half-term holiday boost offsets cautious consumer spend MRI Software’s latest retail footfall data for May revealed that retail footfall across the UK saw a marginal dip in May compared to last year.