Four Years Post Pandemic – Retail

23rd March 2020, the world went into lockdown as the Coronavirus pandemic took hold across the globe. Little did we know this would be the start of a seismic shift in behaviours and attitudes towards everyday life; at work, in education and at home.

Individuals, business owners, healthcare, retail and many more were forced to pivot strategies overnight; in some instances, accelerating 3-5 year plans in a matter of days and weeks.

This short content series shines a spotlight on some of the sectors we work with and the advances we’ve witnessed since the pandemic before we conclude with our predictions for the future of the sector.

How retail has embraced change through a turbulent era

The retail sector has undergone significant transformations which were largely accelerated by the lockdown measures put in place four years ago. As a result, the way in which consumers interact with brands and shop for products and services has witnessed a seismic shift. Some trends have remained while others have emerged, shaping the sector’s landscape in unprecedented ways.

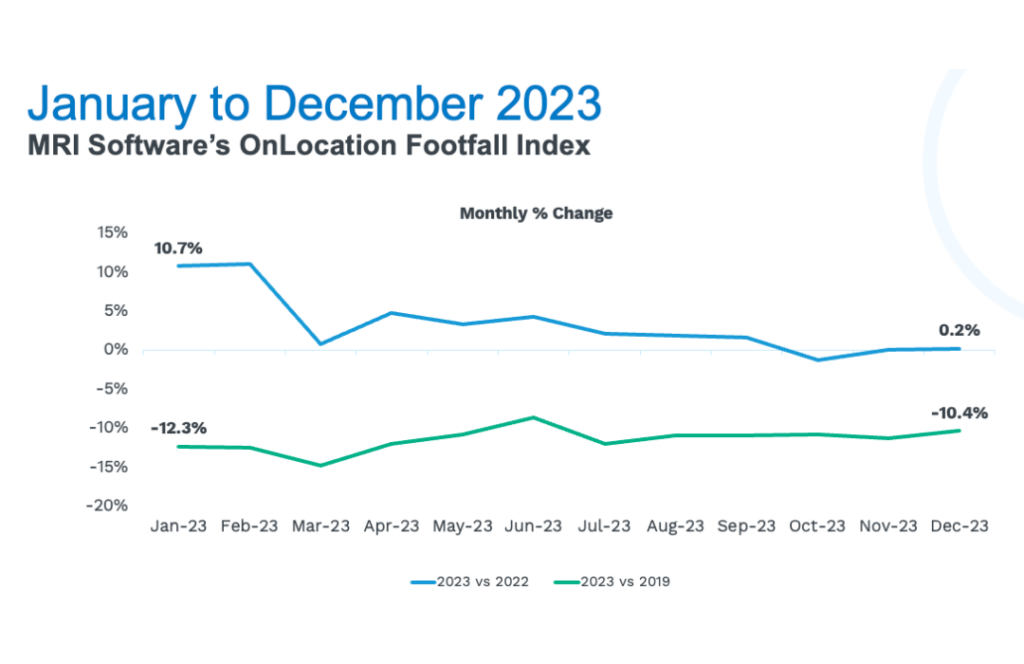

This has likely contributed to footfall remaining, on average, -13.7% lower than 2019 levels for 2024 year to date, according to MRI Software’s OnLocation Footfall Index, with much of the delta being seen through the rise of online spend which was growing steadily in the years before the pandemic, as well as changes in consumer behaviour. With convenience and safety in mind, consumers are increasingly opting for a seamless blend of both online and offline channels. More so, the current cost of living crisis has compelled retailers to pivot their strategies towards delivering enhanced value to their audience, focusing on affordability without compromising quality; the value add.

Alongside these shifts, the prominence of hybrid working has further influenced changes in consumer behaviour, prompting retailers to adapt to changing patterns of demand and consumption. The use and hunger for data rose significantly throughout the pandemic, retail property leaders were keen to understand footfall trends to their stores and destinations and how consumers were behaving in store. Armed with the correct information, this then enabled a shift in strategies, adjustments of trading times, and more importantly, repurposing in-store layouts to cater for the consumer focusing on the experiential factor.

In the wake of the seismic shifts bought about by the pandemic, the core priorities for the retail sector have pivoted compared to pre-March 2020. Survival has always been fundamental for retail businesses, however the pandemic accelerated the urgency to not just survive but also thrive in an increasingly volatile environment. This involves adapting to meet the evolving needs and wants of consumers and as behaviours and preferences continue to change, retailers need to ensure they have the tools available to accommodate.

Furthermore, the adoption of a data-driven approach has emerged as a critical strategy for retailers, ensuring that they remain dynamic in response to real-time insights.

The rise and resilience of retail parks during challenging times

Retail parks have demonstrated resiliency since the pandemic, maintaining steady levels of footfall week on week, month on month, and year on year. Currently, 2024 footfall levels within UK retail parks sit, on average, -2.1% lower than 2019 levels, according to MRI Software’s Retail Park Footfall Index, highlighting the investment and changes they have made to emerge as the go-to destination for consumers, outperforming shopping centres and high streets.

What sets retail parks apart, and contributes to their growth, is their ability to offer a comprehensive shopping and leisure experience under one roof. From leading brands to diverse dining options and entertainment venues, retail parks provide a one-stop destination for consumers seeking convenience, variety, and safety, with free parking being the icing on the cake. Combine these factors together, and it’s not difficult to envision retail parks emerging as the next big destination in the evolving retail landscape.

That’s not to say other retail destinations aren’t able to follow suit. High streets appear to experience more challenges with external factors such as weather and rail disruptions, which in turn provides volatile footfall trends however it isn’t all doom and gloom. In 2023, key milestones for high streets came in the form of the Easter break, where footfall rose by +17% week on week, October half term (+10.5%) and most importantly Black Friday where high streets led the charge with a +10% week on week rise symbolising a strong start to the festive trading period. The penultimate week before Christmas also saw high streets witness the highest rise in footfall (+7.9%) out of all three destination types monitored by MRI Software, suggesting the festive events, markets and attractions put on by many towns and cities paid dividends in driving footfall.

Creating vibrant, engaging experiences which entice visitors and encourage repeat visits should be at the heart of the high street strategy. Additionally, repurposing vacant units with experiential, value-driven propositions is also essential for revitalising the high street landscape as it brings together a sense of community and enhances the appeal of the high street as a destination beyond just retail transactions.

What does the future look like for the retail sector?

We have witnessed a natural year on year decline in footfall since MRI Software started publishing its benchmarking data in 2009, which is to be expected given the rise in online shopping over the years. However, retail parks have bucked the trend seeing an average rise of +1.7% from 2014 to 2017. 2023 saw footfall rise by an average of +3.3% across all retail destinations and we expect that footfall will remain steady in 2024 but anticipate a marginal uplift in retail parks. This isn’t surprising given the economic conditions, international conflicts and a general election set to take place this year. It also means consumers are likely to remain cautious and continue to spread the cost, purchase cheaper, alternative brands, and make considered purchases.

Catalysed by the pandemic, retailers are in a unique position as they set out on a journey of adaptation, innovation and evolution. Embracing a data-driven approach to fuel strategic decision making will be paramount as consumer behaviours and preferences continue to shift.

Sustainability will be a key theme for both consumers and retailers alike. With higher household bills constraining budgets, consumers will prioritise value in their everyday essential and fashion purchases looking for long-lasting, sustainable solutions, which retailers will need to deliver. For the retail sector, it has been encouraged by the British Retail Consortium that they work to achieve net zero emissions by 2040; a decade ahead of the government’s 2050 target for the UK as a whole. Achieving this goal means implementing operational efficiencies from warehouses to headquarters through to physical stores. In order for these efficiencies to be implemented and achieved by the deadline, retailers need time and need to start considering their sustainability strategy now which begins with robust energy management.

The blend of online and offline shopping experiences will redefine the retail landscape, offering consumers unparalleled convenience and flexibility, as well as the experiential factor. Moreover, sustainability will emerge as a non-negotiable priority, with eco-conscious practices driving both consumer demand and industry standards.

As the retail sector continues to evolve amidst these dynamics, collaboration and agility will be key in how retailers adapt and will contribute to the retail stronger becoming stronger, more resilient, and better equipped to meet the evolving needs of consumers in a rapidly evolving world.

Find out more

Watch our on-demand webinar to learn more about the intricate world of retail benchmarking data, which is essential knowledge every retailer needs to be armed with to stay ahead in today’s competitive landscape.

Footfall Analytics

Boost performance with actionable insights based on AI-driven footfall analytics

Learn more

MRI OnLocation UK Monthly Commentary – March 2024

Retail footfall shows signs of stabilising as early Easter break provides a modest rise from February Each month MRI OnLocation delivers insights on retail performance for UK retail destinations. March saw a modest rise in retail footfall across the …