The new normal: Coming soon to an office near you

Momentum is growing toward a return to normal. Vaccinated populations are increasing, inching us closer and closer to the activities we once took for granted – including going to the office as part of one’s daily work routine.

As more and more organizations make plans for a return to the office, there are three fundamental questions that organizations are grappling with: 1) when will we go back, 2) how will we go back, and 3) what changes to physical space are needed?

To get more insight into these questions, we at MRI Software along with a few partners, surveyed the three stakeholders most directly involved and impacted by these decisions: landlords, tenants/employers and employees.

When: Closer to the end of 2021

“When” is the hardest question to answer at the moment, as there are many factors that will influence actual outcomes for a return to the office. A combination of virus control, herd immunity, comfort with public transport, availability of consistent schooling/childcare, and adjusted workspaces will all contribute to the logistics and timing of “when” for each organization.

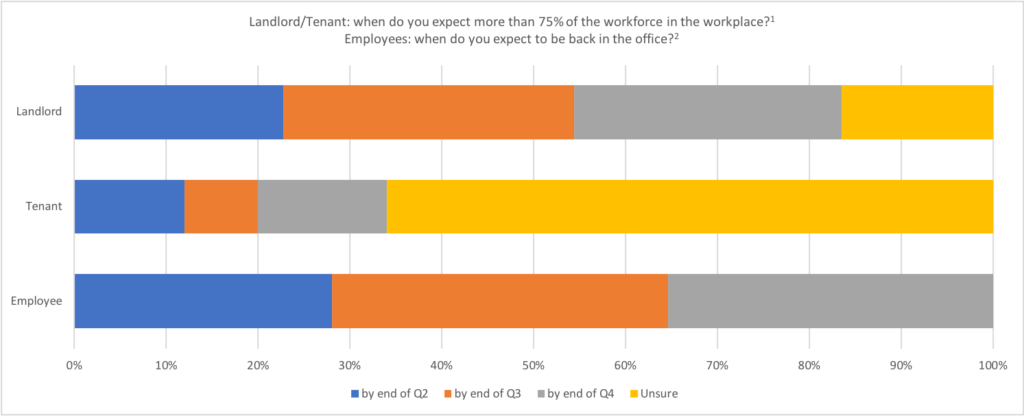

When each of our three stakeholder groups were asked about timing, the results show some misalignment. Landlords and tenants/employers were asked when they expect to have more than 75% of the workforce in the workplace. Employees were asked when they expect to be back in the office.

The end of Q3 is favored by landlords as well as the employee population. This timing makes sense as summer months, when children are home, create childcare challenges in the best of times for working parents. Seeing a preference for an end of Q3 return feels pragmatic, considering the context of the traditional school year which enables parents to leave the home and go to the office without having to solve for childcare issues. This timing will also allow for further adoption of vaccines.

The tenant population, however, is less certain about getting the masses back to the office as they work through plans for re-opening and reconfiguring space to meet new expectations. Respondents who indicated a timing preference favored Q4, but clearly there is still work to do on the time-based plans for a return to the office – which leads us to the second question: how?

How: Nimbler and More Flexible

The first item on the HOW list is its anagram, WHO. We have seen from the last 12+ months that remote work can be successful over a sustained period. In fact, 34% of employees feel more productive at home as compared to 29% feeling less productive and 37% reporting no difference or indifference.2 In total, we lean a bit toward the positive as far as impact on productivity.

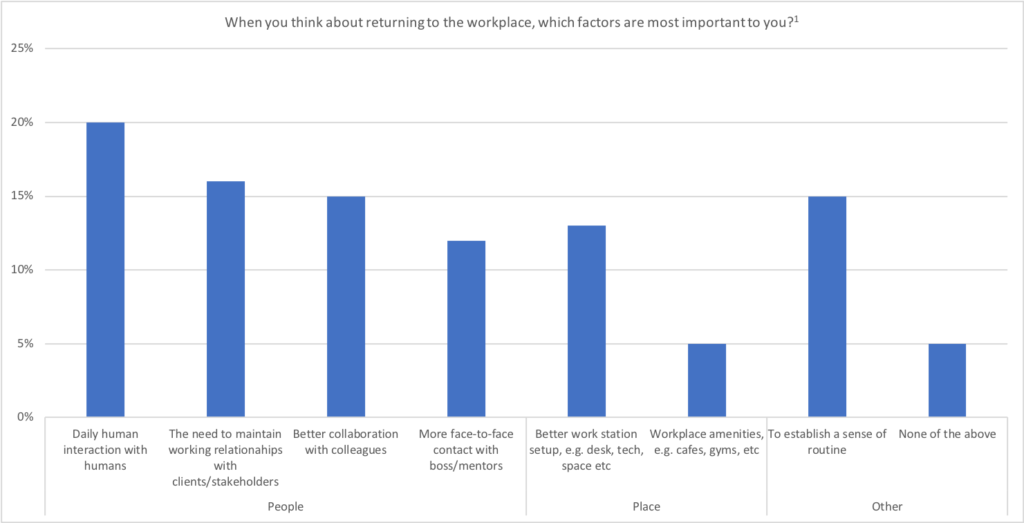

Many employees do, however, find value in working in the office.

When asked about the most important factors in a return to the workplace, 53% chose people-oriented reasons, citing a variety of face-to-face experiences with clients, colleagues, supervisors as well as simple human interaction. Another 18% were place focused, citing amenities or workstation quality as their drivers, while 15% yearn for a sense of routine.2

The big question is how to balance remote and in office work and for which roles. When asked when they see themselves returning to the office, 18% of employee respondents said their remote work would continue permanently.2 This lines up with nearly 90% of employer/tenants saying they would allow remote work post-pandemic, up from 66% prior.1

From WHO we move to the other WHEN, focused on the type of daily attendance expected. Once an organization settles on a macro policy for remote work, role-specific details must be understood, and it is unlikely remote work will be available to everyone. Even during the pandemic, up to 25% of workers remained on site performing essential tasks.1

Nearly 60% of employer/tenant respondents indicated that some employees would be allowed to work remotely while others would be on site. This compares to roughly 39% who indicated all employees would be eligible for remote work and a final 1% who are moving to a fully virtual office.1

Further, for those offering a mix of on-site and remote work, they were split 55% (yes) to 45% (no)1 on having a formal policy about days in and out of the office for specific group or individuals. Similarly, there was no consensus on how many days would be required, if any.

Employees also have concerns about returning to the office full time. Nearly 60% balk at the idea with the remaining population less concerned. Further, 40% prefer working from home and only 24% prefer to work on site, with 35% preferring a balance of the two.2

Unfortunately, there is no clear consensus on managing a workforce that is blended between on-site and at-home participation. Likely, there will be a substantial learning curve as to what works for specific individuals, teams, and organizations. It is also likely that there will be more formal guidance on attendance as opposed to letting teams self-organize or leave things to chance.

Considering changed attendance habits, it is not shocking that nearly 52% of tenants cite less staff on site as a reason for needing less overall office space.1

Seeking to be more nimble and to optimize their use of real estate, 54% of tenants are increasing their use of hot-desking, complementing another 14% that are maintaining or growing their hot-desking approach. Increased hot-desking leads to changing physical layouts, which leads us to the third question.1

What: More safety-conscious and collaborative spaces

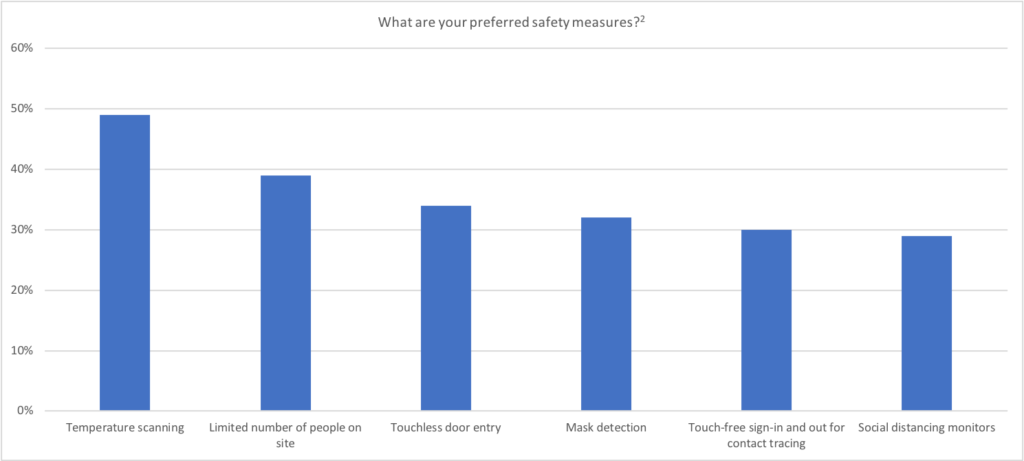

Employees were asked what solutions would give them the most confidence in returning.

Temperature scanning tops the list, with a nearly 50% response rate followed by limited people on site at almost 40%. Touch-free doors and touchless sign-in and sign-out are two of the top five, indicating a preference for additional awareness of hygiene as it related to commonly used surfaces. The second most popular response indicates a preference for a limited number of people on site.2 This is consistent with the aforementioned plans to allow more remote work post-pandemic.

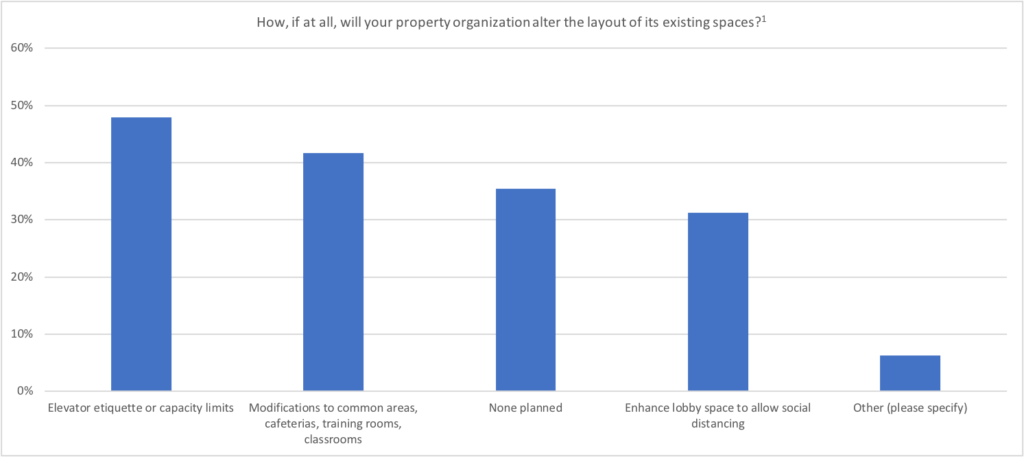

Landlords, when asked about plans to alter existing spaces, report alterations that are in line with these employee views, focusing on enhancing common areas.

The confined space of elevators is at the top of the list for changes and is followed by common area adjustments that better consider social distancing.

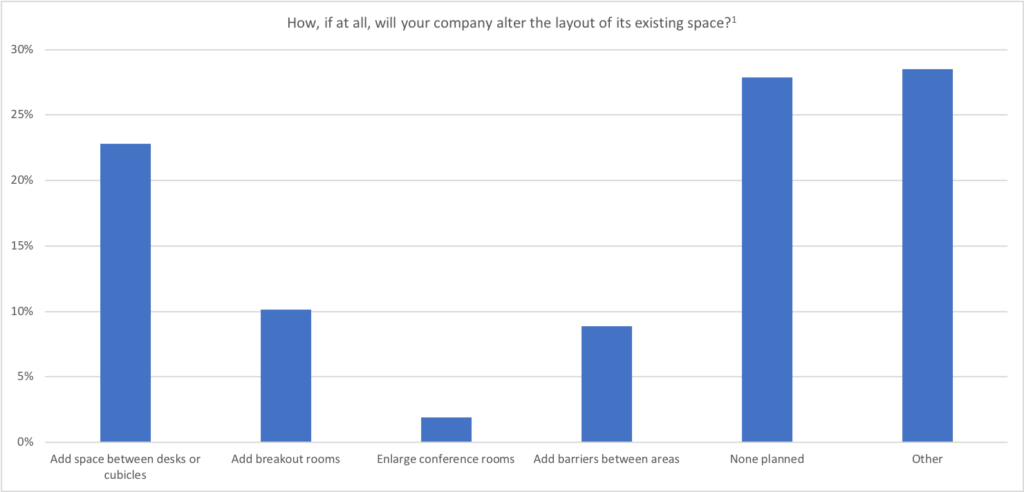

Employers/tenants are also working on alterations to their workspace as evidenced in their responses to a question about altering the layout of existing space.

Adding space between cubes and desks tops the list and signals a reversal of recent trends towards increased density and open plan offices. Additional breakout rooms and larger conference rooms will provide more collaborative spaces for groups and teams. This is especially important to provide two essential capabilities:

- With increased hot-desking, teams will need spaces to collaborate.

- With an ongoing mix of remote and on-site staff, technology needs to be available to ensure remote staff are equally present and enabled during collaborative processes. After a year of digital, video-powered collaboration, we cannot go back to the days when those who aren’t in the office have trouble hearing and seeing what’s taking place in the meeting room.

The “Other” population in this response group often cited multiple items from the list, indicating that the specific results may be a bit understated.

Changes ahead for landlords, tenants and employees

Landlords are making changes to facilitate a return to the office. Tenant/employers are making changes and refining plans as they work to bring their staff back. Employees are increasingly vaccinated, ready to return to the office and recognize the value of face-to-face interaction, even if it only happens a few days a week.

It is almost poetic that Labor Day, the US federal holiday that recognizes the labor movement and the works and contributions of laborers to the development and achievement of the United States, likely stands as the milestone, the turning point where many will be getting back to the office.

Get the full survey data from the reports:

1Market Insights: Getting Back to the Office, by MRI Software and CoreNet Global

2Home Unbound: Transitioning to The Office After COVID, by Brivo and WhosOnLocation

Do you know the real cost of moving?

Whether starting the search for a home or simply moving to a different community, almost every consumer should know that the true cost of their next move will probably be higher than “sticker price.” Don’t be caught off guard. Simply fill out the for…