How affordable and public housing are plowing ahead with technology during 2021

As we approach the month of March, the one-year mark since all 50 states initially reported cases of COVID-19, we have our first opportunity this year to examine the ongoing impact of the pandemic on the low-income housing industry. Still working through the health crisis, low-income housing operators remain committed to their residents and operating their portfolios. In the meantime, MRI’s Affordable and Public Housing group, with its comprehensive set of software products, continues to help housing organizations keep residents safe and operate efficiently. This month, I’m delighted to highlight our RentPayment platform, one of the many solutions low-income housing operators are leveraging to thrive during these challenging times.

January 2021 MRI Market Insights Report

Although new Coronavirus cases and hospitalizations are down in America and around the world; sadly, we have surpassed 500,000 deaths in the United States. The emergence of new variants, possibly more contagious and more lethal, has caused concerned and is increasing the urgency to make the vaccine widely available. In addition, we continue to follow employment trends given the economy’s impact on the ability of residents to keep up with rent payments. After initial jobless claims experienced recent highs from late December to mid-January, mid-February data indicates that the recovery’s momentum has stalled. It may be months before the pandemic is effectively contained and the economy is consistently trending upward. Nonetheless, as reported in the latest edition of MRI Software Market Insights: The Impact of COVID-19 on the Affordable and Public Housing markets, the early weeks of 2021 show that low-income housing operators are pulling through.

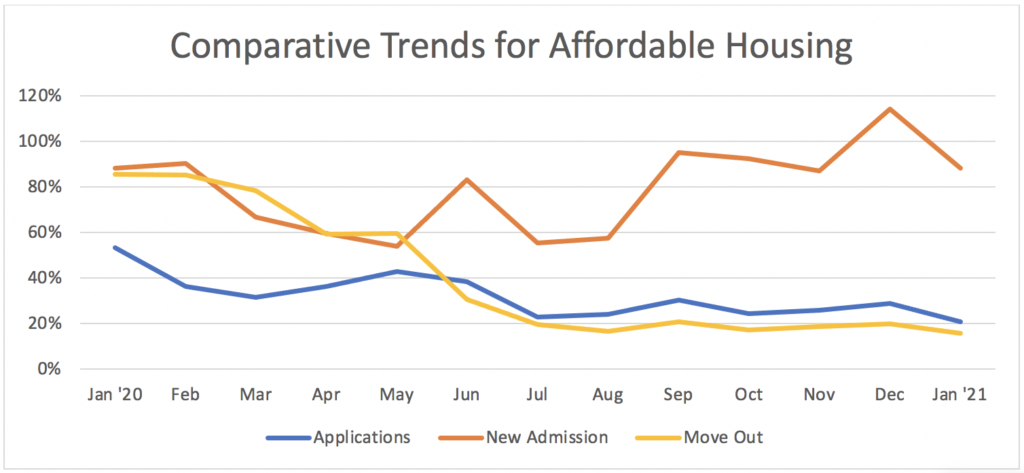

In the affordable and public housing sectors, residents continue to generally stay in place. In the affordable segment, January 2021 new admissions were at 88% of the prior year level and applications and move-outs were significantly lower than the prior year (close to 20% for both metrics).

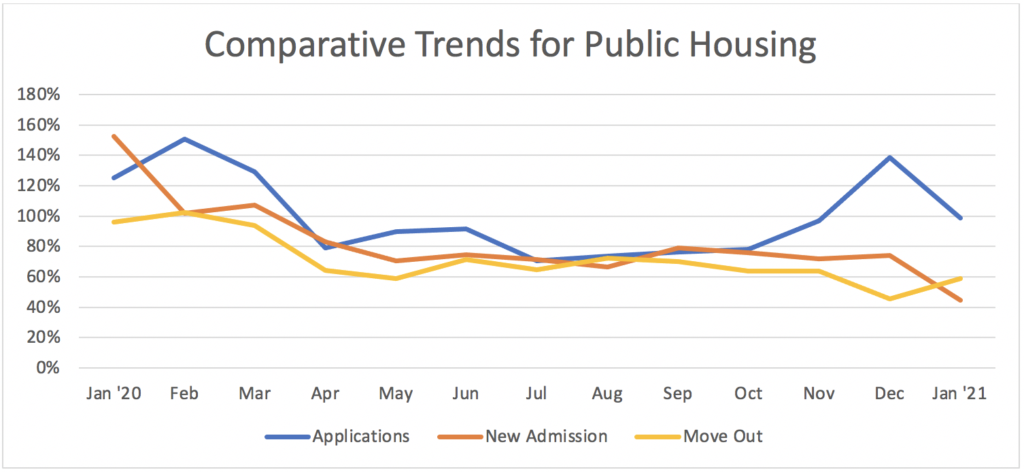

On the public housing side, applications during January are comparable to the prior year but new admissions and move-outs were both well below the prior year levels.

Rent collection for low-income housing

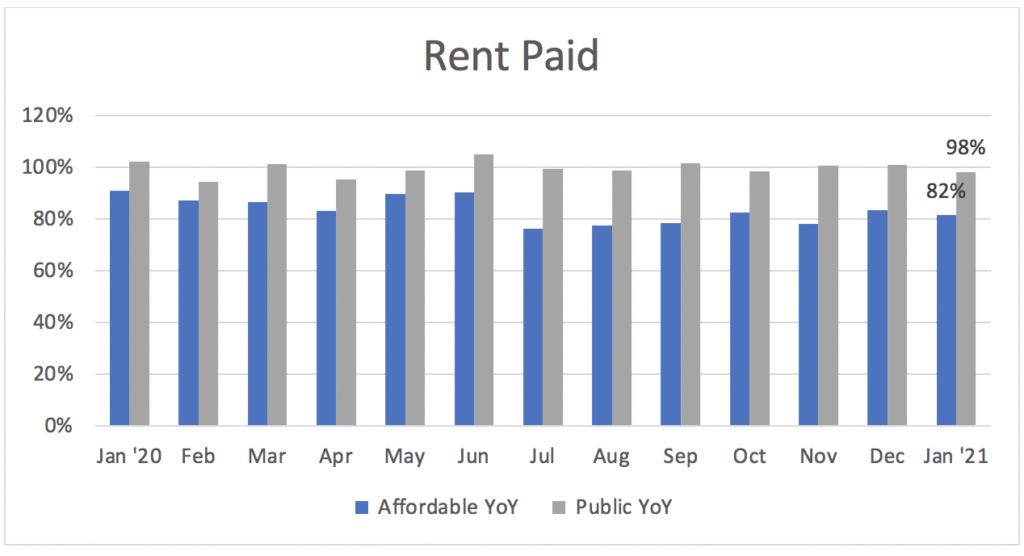

One of the most important trends we continue to follow in the low-income housing industry is rent collection. Through January 2021, affordable housing payments remained above 80% of the prior year and public housing is only 2 percentage points off the prior year level.

Although overall rent collection is down, low-income housing properties have managed to stay afloat by relying on rental subsidies and residents who have benefited from federal assistance. The second COVID relief bill signed in December provides $600 in direct payments and $300 per week in extra unemployment insurance for 11 weeks.

The latest on the policy front

The December relief bill also includes $25 billion in emergency rental assistance (“Emergency Rental Assistance” program) to be distributed and overseen by the U.S. Department of Treasury. The funds are being sent to states and local jurisdictions and is intended for past and present rent, as well as fees and utilities. Residents must show that they suffered financial hardship due to the pandemic, have incomes below 80% of their area median income and are at risk of experiencing homelessness.

An analysis from Mark Zandi, chief economist of Moody’s Analytics, and Jim Parrott, a fellow at the Urban Institute, reminds us that this federal assistance can only address a fraction of the overall problem. Their analysis concludes that the typical multifamily renter who is behind on rent payments now owes $5,600, nearly four months behind on their monthly payment. Overall, approximately $57 billion is owed. Zandi and Parrott’s analysis also indicates that if the $25 billion in rental assistance is deployed efficiently (a major unknown), it could help to decline the arrears until April. By March approximately 6.3 million renters would be behind on payments, with total accrued back rent of about $33 billion. Then the numbers would begin to increase again.

The current administration is proposing an additional $25 billion in rental assistance in its stimulus package and the extension of the federal eviction moratorium through the end of September 2021. The bill also includes $1,400 in direct payments and $400 in extra unemployment benefits through August. The unemployment checks approved in December are set to expire in March. While this relief package and several of its core aspects have not yet been finalized, the House is expected to vote on the bill later this week.

The continuing role of technology

As affordable and public housing operators await new developments on the policy front, at MRI, we continue focusing on how to help low-income housing operators brave the early months of 2021. Before the pandemic we witnessed greater adoption of technology by managers who sought more efficient systems for exchanging information and documents with residents, working remotely and operating more efficiently. However, the health crisis and need to work socially distant led to an exponential rise in the use of online tools.

How our industries have handled payments is a fitting example of this recent trend. Among the many ways managers and residents are keeping safe during the pandemic is by using online tools to manage rent payments. Beyond the traditional check there are a few ways in which managers are leveraging technology to collect rent. The most convenient method is by allowing payments via a website using a resident portal that accepts ACH, debit and credit cards.

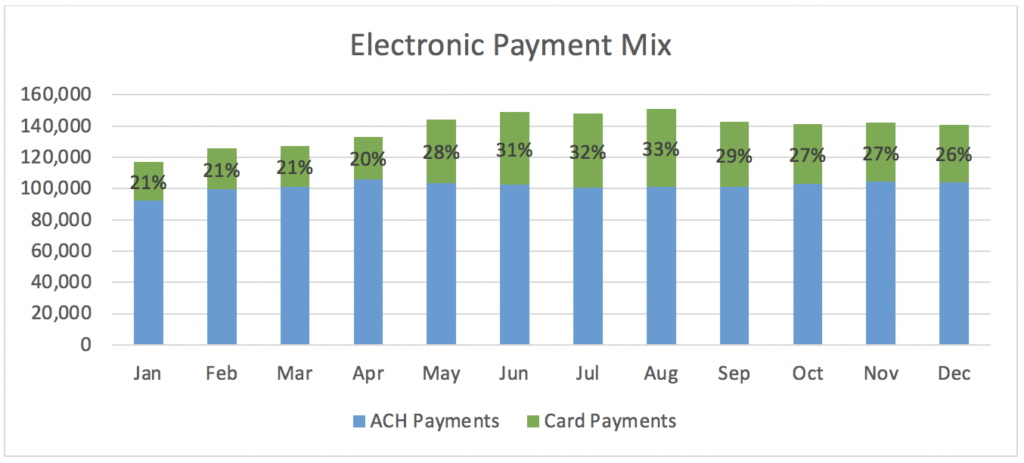

According to the MRI Insights data, during 2020, the multifamily rental industry experienced an increase of over 19% in electronic payments with a disproportionate volume of payments occurring via credit or debit cards. ACH payments increased 11% on average and card payments increased on average 52%.

Comprehensive payments solution

RentPayment from MRI Software offers the industry a comprehensive solution for managing payments. This platform gives renter’s the convenience of paying rent online or through a variety of other methods – including check, money order, or cash-based payments – within an efficient, fully integrated solution. RentPayment allows property managers the ability to collect rent online while also leveraging the time of leasing staff and site managers and offering convenience to the residents. This product also integrates with MRI Living, our comprehensive residential management system, and with our various affordable and public housing compliance and property management solutions, allowing operators to capture and store payment data to be used for other vital management tasks. RentPayment helps operators increase on-time payments, reduce manual workload and streamline the onboarding experience for new residents.

Using online rent payment tools offers direct economic, operational and health benefits for low-income housing operators and residents. These tools can also help indirectly address credit reporting issues afflicting many low-income residents as highlighted in the February 14, 2020 HUD press release, “New Report Explores Problems of ‘Credit Invisibility’ Among HUD-Assisted Households: First-of-its-kind study examines reporting rent payments to credit reporting agencies.” This release reminds us that low credit scores can limit housing choice and employment opportunities for low-income families and it highlights a study from HUD and the Policy and Economic Research Council (PERC), Potential Impacts of Credit Reporting Public Housing Rental Payment Data, which concludes that many households would cease being “credit invisible” if the rent payments of HUD-assisted families are reported to credit reporting agencies. The study analyzed credit scores of more than 9,000 HUD-assisted households in Cook County, Illinois; Louisville, Kentucky; and Seattle, Washington, and it found that reporting rental payment information led to a significant increase in the number of HUD-assisted tenants. RentPayment offers a feature that provides credit reporting to the credit bureaus.

During these early uncertain months of 2021, MRI is not only delighted to play a small part in helping low-income residents remove barriers to obtaining quality housing, but we’re also proud to serve affordable and public housing operators as they plow ahead.

TRACS Talk: Navigating Affordable Housing Compliance

View our latest, affordable housing-specific compliance webinar! Navigating the ever-evolving landscape of affordable housing compliance can often feel like traversing uncharted territory. With each new update, regulation, or amendment, the path to m…