From AI to legal tactics: The apartment industry’s battle against fraud and bad debt

Fraud and bad debt are no longer occasional headaches for multifamily operators—they’ve become persistent operational challenges. According to a new research report from the National Apartment Association (NAA), sponsored by MRI Software, the rental housing industry continues to combat fraudulent applications and unpaid rent, driven by increasingly sophisticated tactics and economic instability.

The rise of application fraud

The application process presents the highest risk for apartment fraud, and the abundance of generative AI tools has made it alarmingly easy for bad actors to fabricate documents like paystubs, bank statements, and even IDs. An NMHC survey conducted between November 2023 and January 2024 found that 80% of apartment owners, developers, and managers encountered applicants misrepresenting information on rental applications. Deloitte projects that AI-generated fraud could result in losses of $40 billion by 2027.

Often overlooked, subletting fraud is harder to detect and increasingly common. MRI Software has heard from several management companies that have prevented applicants from attempting to lease multiple apartments under different identities, presumably to sublet the units.

The impact of fraud on housing costs

The financial implications of fraud are significant. The estimated loss is typically more than $10,000 per incident, including lost rent and eviction-related expenses. By some estimates, eviction costs can average between $20,000 to $25,000 per apartment.

But housing providers are not the only victims of fraud. The NMHC Pulse Survey points out the link between rising fraud, rising rents, and evictions. An Apartmentalize 2025 session titled “How to fight fraud in the age of AI” stated that the majority (77%) of multifamily operators believe that rental fraud is leading to increased housing costs and perpetuating the housing affordability crisis.

The burden of bad debt

Unpaid rent continues to be a problem for multifamily operators, especially in rural communities still recovering from the pandemic’s repercussions and lingering economic concerns. In NAA’s Navigating Challenges in the Apartment Industry report, survey participants indicated that the legal processes involved in vacating a property with unpaid rent can take six months or longer, and many times, it involves significant legal expenses plus repair costs. These delays not only strain budgets but also disrupt operational efficiency.

How are multifamily operators responding to rental fraud and bad debt?

To combat these issues, the professionals interviewed by NAA’s research team emphasized the need for effective verification, monitoring and training systems. This involves a combination of technology and traditional practices:

- Document verification technology: Most companies now use third-party platforms to verify documents, supported by employee training to prevent fraud and cybersecurity breaches.

- Collection strategies: Legal partnerships and incentives like deposit returns are used to encourage voluntary move-outs and reduce bad debt.

- Traditional screening: Despite digital advancements, many firms still rely on background checks (21%), credit and ID verification (17%), and employment checks (16%).

- Emerging tools: Automated fraud detection tools (16%) and AI-based screening systems (13%) are gaining traction, though trust and adoption gaps remain.

Some operators report persistent fraud even after using established platforms, prompting them to add human oversight—such as in-person interviews, direct verification calls, centralized rent collection roles, and performance-based bonuses for reducing bad debt.

A balanced approach: AI-powered, human-supported

The right technology offers significant progress toward reducing property fraud, while simultaneously alleviating the burden on property managers and leasing agents. MRI Software’s fraud prevention solution has already saved clients an average of $1 million per year and prevented $1.8 billion in bad debt since 2017.

According to the NAA research report, multifamily operators are skeptical of handing over the responsibility entirely to the machines – and rightly so. Many screening services that offer instant results have a higher likelihood of generating false positives, which can result in denying qualified applicants and failure to comply with the Fair Housing Act.

As the sector continues to embrace innovation and tech adoption, human-led processes are still essential. A strategy that includes multiple layers of prevention, including cross-referencing tenant information and applying common sense, can provide the best results.

Protecting your multifamily property: What you can do

To safeguard your multifamily assets:

- Invest in document verification and fraud detection technologies.

- Train staff regularly on fraud prevention and cybersecurity.

- Maintain human oversight in screening.

- Monitor legal trends and adjust collection strategies accordingly.

Fraud and bad debt may be rising, but with vigilance, the right tools, and a balanced approach, multifamily professionals can stay ahead of the curve.

To learn more about how the multifamily industry is responding to fraud and other challenges, read the full report: Navigating Challenges in the Apartment Industry

NAA Report - 2025

A research report by the National Apartment Association (NAA) sponsored by MRI Software explores how today’s rental housing industry is responding to challenges.

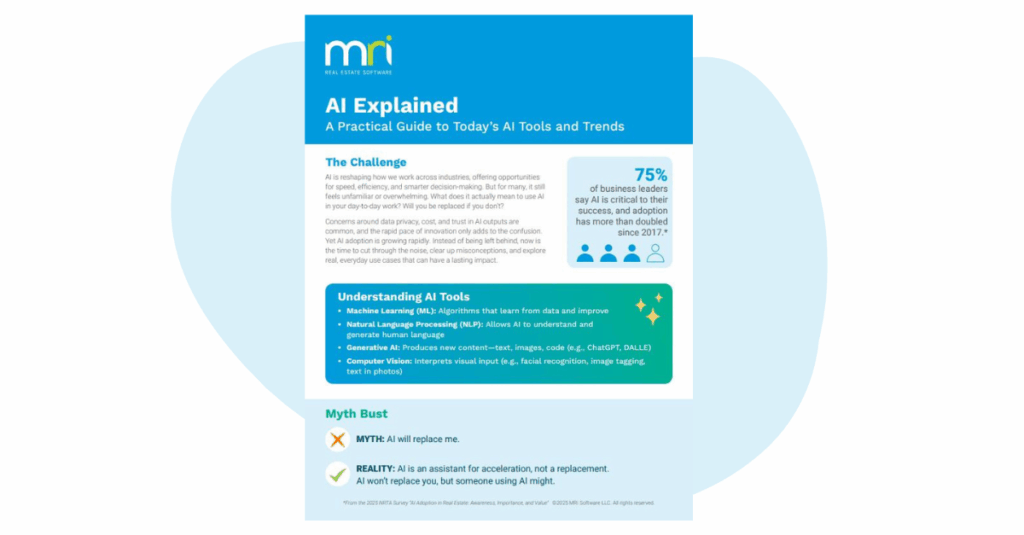

AI Explained: A Practical Guide to Today’s AI Tools and Trends

AI is reshaping how we work across industries, offering opportunities for speed, efficiency, and smarter decision-making. But for many, it still feels unfamiliar or overwhelming. What does it actually mean to use AI in your day-to-day work? Will you …