What is a lender inspection?

When you’re securing financing for a multifamily property, there’s a good chance your lender will want to inspect the property. These lender inspections are a routine part of the loan process, designed to protect both your investment and theirs. Understanding how they work can make the entire experience smoother and more predictable.

Below you’ll learn what is a lender inspection, what it involves and why it’s required. We’ll explain what lenders are looking for, how often inspections happen, and how to handle any issues that arise. You’ll also find tips, common mistakes to avoid, and answers to frequently asked questions.

What is a lender inspection for multifamily property?

A lender inspection is a check to confirm that your property or project is on track and meeting expectations. It gives your lender confidence that their funds are being used properly and that the work matches the loan terms. For multifamily properties, these inspections are especially common during new builds or significant renovations.

They’re also closely tied to how your financing is structured. Instead of receiving the full loan upfront, funds are released in stages called draws. A lender inspection typically happens before each draw to confirm that progress justifies further funding.

What does a lender look for during an inspection?

During a lender inspection, the goal is to ensure everything is moving in the right direction. Inspectors want to confirm that the work completed aligns with the amount of money already disbursed. They’ll also check for quality, safety, and anything that could delay your project, here’s what they typically assess:

- Progress vs. the amount of loan funds used

- Quality and type of completed work

- Safety issues or delays that could affect the timeline

If they spot a problem, your lender might pause future disbursements until it’s resolved. This could include issues like incomplete work, safety violations, or poor-quality materials. Resolving these quickly helps keep your project moving and avoids funding delays.

How often do lender inspections occur?

The frequency of lender inspections depends on your loan type and how your project is set up. Construction loans usually involve regular inspections, often before each draw is released. This could happen monthly or after each major milestone is reached.

For refinancing or purchasing a completed property, you might only have one inspection at the beginning. These are mainly used to verify the current condition of the building. Always review your loan agreement to understand what your lender expects.

Who pays for the lender inspection?

As the borrower, you’re usually the one covering the cost of lender inspections. These fees may be built into your closing costs or billed separately during each draw. It’s an expense that’s easy to overlook, so it helps to plan ahead, depending on the lender, the inspection could be completed by:

- A third-party company hired by the lender

- An in-house inspector from the lender’s team

- Your project team, like a general contractor or architect, who may also attend

Factoring in these costs early makes for smoother planning in multifamily lending. It helps you avoid surprises that can throw off your budget later in the project. Being financially prepared also shows your lender that you’re organized and reliable.

What happens if a property fails a lender inspection?

Failing an inspection doesn’t mean your project is doomed, but it can definitely cause delays. Your lender might hold off on releasing funds, increase your costs, or request that specific issues be fixed before moving forward. In rare cases, serious failures could trigger foreclosure, but that’s typically only if the loan is already at risk.

Let’s say your construction timeline slips and you miss a key leasing season. That alone could reduce your rental income and put extra pressure on your budget. Staying on schedule, utilizing multifamily management software, and addressing concerns early helps prevent those setbacks.

Can a borrower dispute a lender inspection’s findings?

Yes, if you feel something in the inspection is inaccurate, you can challenge it. Start by reviewing the report and gathering proof, such as photos, updated schedules, or written statements from your contractor. Having clear documentation makes your case much stronger.

In some situations, your lender may agree to a second inspection. This is especially helpful if new progress has been made or if the original report had errors. Keep your tone professional, and work collaboratively with your lender to resolve the issue.

Are lender inspections required for all types of loans?

Lender inspections are most common with construction, renovation, and development loans. If your funding is split into draws, inspections help ensure that progress matches payments. It’s a standard part of risk management in multifamily lending.

For purchase or refinance loans, you might only have to deal with one inspection. This usually happens early in the process to confirm the property’s condition. Either way, it’s important to check your loan documents so you know what’s expected.

Want to learn more about the latest from MRI?

Join us for MRI Innovation Days to see how MRI Software’s technology is changing the game!

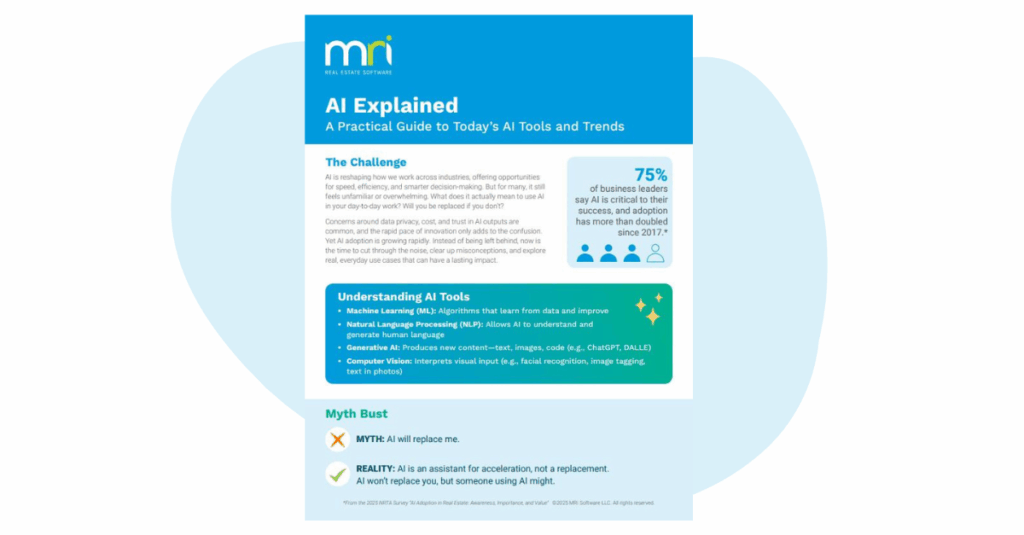

AI Explained: A Practical Guide to Today’s AI Tools and Trends

AI is reshaping how we work across industries, offering opportunities for speed, efficiency, and smarter decision-making. But for many, it still feels unfamiliar or overwhelming. What does it actually mean to use AI in your day-to-day work? Will you …