Office trends: The path to an employee-centric workplace

Real estate occupiers have endured occupancy whiplash over the past few years. First there was the shift from full offices to empty ones, followed by managing various combinations of remote and hybrid roles. Heading into 2024, the landscape is shifting once again: it seems every few weeks another company announces its employees will be returning to the office. But how are return-to-office plans taking shape for different types of occupiers? And more importantly, what do the employees who want to – or must – come back want from these plans?

MRI Software has been following these trends for some time, from conducting surveys with CoreNet Global to having in-depth discussions with corporate occupiers, thought leaders, and fellow technology experts at industry events around the world. The insights we’ve uncovered about what’s really happening in corporate real estate can inform decisions for occupiers formulating their own return to office plans in the coming year.

Return to office trends differ by demographic

The first major trend we’ve seen is how different age groups view returning to office and continued in-office trends differently. People age 22–27 and 40–60 are much more likely to want to be in a physical office. However, each group has different motivations. Those who are entering the workforce are looking to define their work experience and want to tap into a company’s culture. This isn’t surprising, as many companies have been offering amenities tailored for that demographic for some time. However, those age 40–60 place a higher value on the connections made in meetings and watercooler conversations. Employees in this group are typically in higher leadership roles and want to encourage their teams to come in and collaborate.

The 28–39 age group is the least willing to go into an office. This group worked for 5–15 years before the pandemic. They may see the value of a physical space, but this generation is more likely to have small, growing families and obligations outside the office. Long commutes don’t mix well with their lifestyle, so returning to the office is ultimately a hinderance. The real issue arises when many in this demographic are mid-level managers who are most likely to be the mentors to younger employees looking for leadership and guidance, preferably in person.

Are office amenities still effective incentives?

Amenities continue to be a tool employers can use to help all demographics feel their organization fosters an employee-centric workplace. Most occupiers agree on the need to make amenities available that encourage buy-in from all demographics. Items like free food, coffee trucks and happy hours are a draw for all employees. However, when trying to get that middle demographic to the office, more lifestyle-targeted amenities like onsite (or even outsourced) childcare can be more effective at getting employees to come in.

No matter which demographic you’re targeting, employees must feel like they can be as productive in the office as they are at home. Long commutes to a day of virtual meetings that could have been done at home instead of meaningful in-person interactions can impact employee satisfaction. To help meet employee expectations, companies should provide workstations that let employees plug directly into the organization’s network and have the screens and peripherals they need to do their job. Another interesting idea is the concept of employee-led committees who work to ensure their colleagues are satisfied with hybrid work in relation to their employer.

The challenges of measuring productivity

Of course, there’s the big question: Will the pressure employers put on employees to come to an office produce the intended benefit? An effective answer needs to be measurable, but through many conversations we’ve discovered that quantifying productivity can be difficult. Employee satisfaction scores can be a periodic data point that might show productivity increases, but many factors including workload and direct management can influence the results. One alternative approach could be measuring productivity in terms of staff turnover. Some organizations see higher employee turnover among remote workers versus employees who have been coming into a corporate office. Some employees who are measured in terms of output (sales, production, etc.) show productivity gains when using physical locations.

Ultimately, the information and data we’ve found can lead to discussions on how leases should be valued and how tenants should negotiate terms that offer them more flexibility. Certain areas are embracing more flexible terminology in contracts, such as allowing businesses to use certain floors at certain times, or sub-leasing floors where appropriate.

What’s next in corporate real estate?

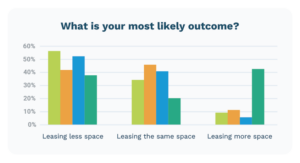

As mentioned above, MRI partnered with CoreNet Global for the fourth time to gain insights from its membership regarding workplace trends. Looking out into the future, the survey results are the most enlightening they have ever been. When asked about likely outcomes concerning space coming out of the pandemic, a significantly higher number of respondents planned to increase the amount of leased space.

The “Leasing more space” answer saw a massive swing increase – a potential signal of a strong CRE market early in 2024.

No matter how the commercial real estate market evolves in 2024, deciding what approach is the right fit for your organization requires bringing together and analyzing all your real estate data, as well as getting a deep understanding of what’s in your leases. The assistance of an experienced real estate technology partner like MRI Software helps make these decisions easier. Contact our team today to learn how to unlock the insights that can best guide your return to the office.

20 Ways Companies are Transforming Their Offices

The office is undergoing its most radical transformation in a generation. Around the world, office culture and even the very concept of the office is changing. Organizations of all types are adapting their spaces to create a better working future. In…