The road to new lease accounting standards

Is your real estate organization looking ahead to the new lease accounting standards? As you may already know, these new standards will change the way operating and finance leases are classified. ASC 842 and IFRS 16 were issued by the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) to fundamentally change the rules governing accounting for leases in order to add transparency. With these new standards, operating leases are now to be included on your organization’s balance sheet.

As you prepare to comply with these new standards, it’s important to find the answers to a few different questions, such as:

- What actually classifies as a lease?

- How do I sort through what’s an operating lease and what’s a finance lease?

How to successfully identify a lease

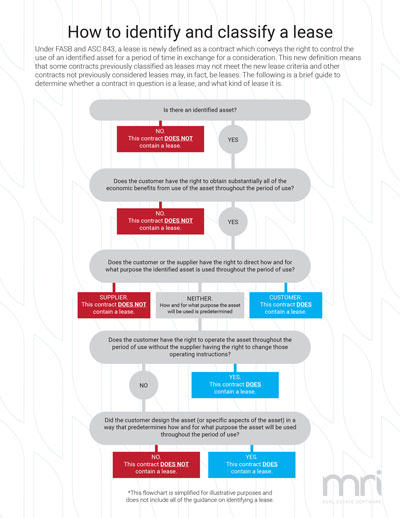

If there’s not an identified asset in the contract in question, and if the customer does not have the right to obtain substantially all of the economic benefits from use of the asset throughout the period of use, then it is not a lease. Still having some trouble figuring it out? We know it can get a little complicated. For a better idea of what a lease actually is, take a look at this diagram below.

Once you identify a lease, your next step will be to classify that lease as either an operating lease or finance lease.

So you’ve identified a lease. Now what? If that lease follows any one of these points, then you’re looking at a finance lease.

- The lease transfers ownership of the underlying asset to the lessee by the end of the lease term.

- The lease grants the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise.

- The lease term is for the major part of the remaining economic life of the underlying asset. However, if the commencement date falls at or near the end of the economic life of the underlying asset, this criterion shall not be used for purposes of classifying the lease.

- The present value of the sum of the lease payments and any residual value guaranteed by the lessee that is not already reflected in the lease payments equals or exceeds substantially all of the fair value of the underlying asset.

- The underlying asset is of such a specialized nature that it is expected to have no alternative use to the lessor at the end of the lease term.

If the lease in question does not follow any of these criteria, then it is most likely an operating lease. After making this distinction, you should have a better idea of which leases need to be included on your balance sheet.

What does your organization do now?

There are a number of different clarifications within these new standards as well, such as when your organization needs to comply, when other organizations like local government and nonprofit businesses need to comply, and how to properly list your operating leases. For more information about how you can classify your leases, download our lease accounting whitepaper.

If you’re looking at all of your operating leases and all of the underlying data listed in them, you may also find yourself wondering how you’re going to even organize that information yet alone list it on a balance sheet. It’s for this reason that MRI Software offers integrated real estate technology solutions that can help you organize your asset data and, by extension, better prepare yourself for the new lease accounting standards.

6 Ways Tenants Overpay on Leases

Optimize your lease agreement to avoid hidden costs and maximize value. Many commercial real estate tenants unknowingly overpay on their leases, a costly oversight that can erode business profitability. Hidden rebates, complex terms, and subtle claus…