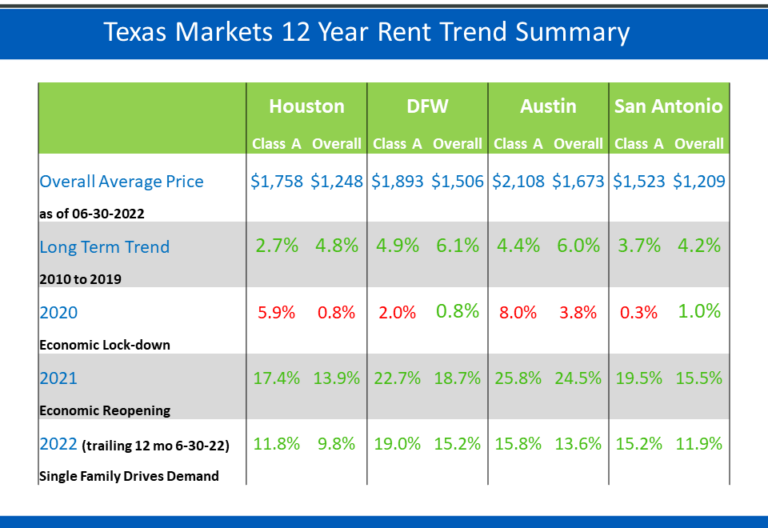

Texas apartment market rent trends summary, mid-year 2022

This analysis looks at long term and recent trends in rent for the major metro markets of Texas. While growth is cooling, rental rate growth continues to be strong in Austin, Dallas/Fort Worth, Houston and San Antonio. Bruce McClenny breaks the trends down by each city, below.

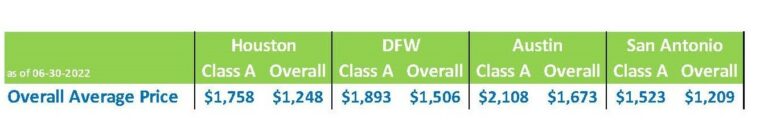

Overall average price

At the end of Q2 2022, overall rent levels for Houston and San Antonio are most similar with Houston at $1,248 and San Antonio at $1,209. When compared to DFW, these markets are priced at least 20% less which nominally equates to a $250 to $300 difference in overall rent. When compared to Austin the difference is much more dramatic. Austin’s overall rent level is 33% greater than that of Houston and San Antonio. On average, it costs $425 to $460 more per month to rent an apartment in Austin than in Houston or San Antonio.

Generally, Class A product in any metro is comprised of the highest priced properties representing approximately one quarter to one third of the overall supply. Austin’s Class A price towers over all others driving the overall premium for the metro. Ironically, the most affordable metro, San Antonio, is a short distance from Austin but a world-away in other respects, where it is almost $600 cheaper per month for Class A. Twelve years ago, Houston’s Class A was $200 higher than DFW’s. After years of divergent economies and a stronger Post-Covid rent growth, DFW’s Class A is now $135 more per month than Houston’s.

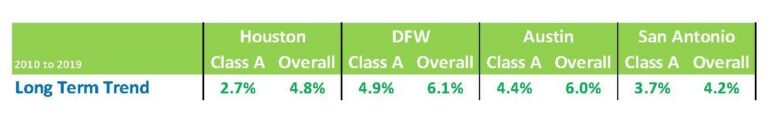

Long term trend

To calculate the long-term trend, the rent levels from December 2010 and December 2019 are used. The extremely volatile years from 2020 forward are left out of this equation and are analyzed separately. Houston and San Antonio can be paired again for similar overall rent trend performance in the 4.0% to 5.0% range with DFW and Austin rents realizing a 6.0% per year growth over the nine-year period used.

Notice that Class A rent trends lagged the overall trends in every metro. During this time frame, abundant amounts of new supply were delivered which kept a competitive governor on rent trends for Class A. Alternatively, all other classes grew organically and with value-add during the longest running recovery on record. Houston’s Class A performance is exceptionally weak because of the Fracking Bust which sent rent plummeting by $116 from June 2015 to December 2016 as other metros were not impacted and continued to move forward.

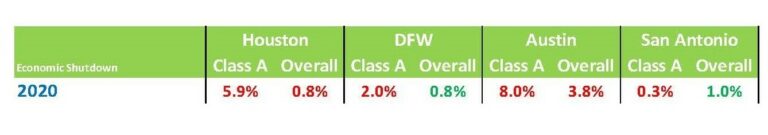

2020

2020 started normal enough, but by Mid-March the Covid Pandemic forced the Economic Lock-down. Historic job losses created soaring unemployment, and the apartment market struggled as evidenced by the negative rent trend performance. Class A’s were most acutely impacted with Austin suffering the strongest downturn at 8.0 percent. Houston’s Class A followed with a 5.9% decline. DFW and San Antonio were able to claw-back from the initial negative shock of the Economic Lock-down to realize overall positive results at or near 1.0 percent with Class A’s minimizing their losses.

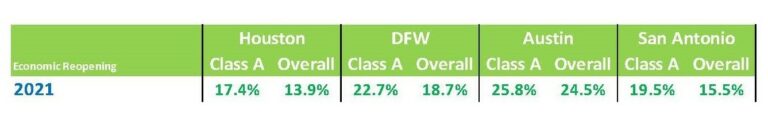

2021

The Economic Re-opening reversed historic job losses into historic job growth. In addition, migration was ignited from the East and West Coast Metros from corporate relocations as well as a new-found freedom to work from anywhere. All this activity drove demand for housing and absorption, the industry measure for demand, more than doubled from any metros long term average. The resulting surge in leasing traffic and higher occupancy levels embolden the industry to more than treble the long-term overall trends and elevate Class A Long-term trends by factors of 4 to 6-fold. This is a prime example of the principles of supply and demand playing out in the apartment industry, just as we’ve seen in other industries such as the automotive, energy and food sectors

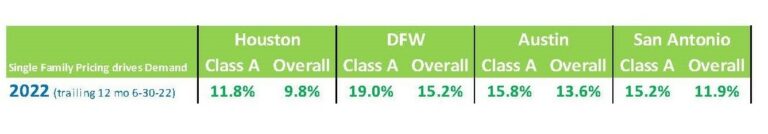

2022

The hyper-economic activity and rent growth of 2021 is not sustainable. The rent trends displayed represent the 12-month trailing as of 06-30-2022 which means that half of the trend determination is from 2021. Trends are settling down but are still elevated well above long-term trends. Rentals continue to benefit from the run-up in prices of single-family homes and the doubling of mortgage rates which severely limits home buying activity.

As year-end 2022 approaches, the rent trends will continue to settle. Look for Houston and San Antonio to realize a 5.0% to 7.0% overall rent growth and DFW and Austin to achieve an 8.0% to 9.0% overall rent growth.

Multifamily market transitions: the changing dynamics of supply, demand, and financing

The multifamily market activity we’ve witnessed since the end of the global pandemic has become a familiar pattern of instability, characterized by extreme shifts in rental growth, supply levels, and absorption rates. Several factors, including the m…