Multifamily rental growth update through June 2023

This analysis looks at current rental growth trends for twelve markets across Texas, Arizona, Georgia, Tennessee, North Carolina, and Florida.

Market conditions

Following wild swings in job growth and interest rates, the post-pandemic economy has settled into a very unique set of circumstances. Job growth at all-time highs, combined with unemployment at all-time lows, normally result in strong renter demand. Additionally, high mortgage rates typically redirect demand from would-be home buyers who opt to rent and remain renters for longer periods of time. Yet, what would normally generate more than sufficient demand from these sources does not currently match the influx of new deliveries.

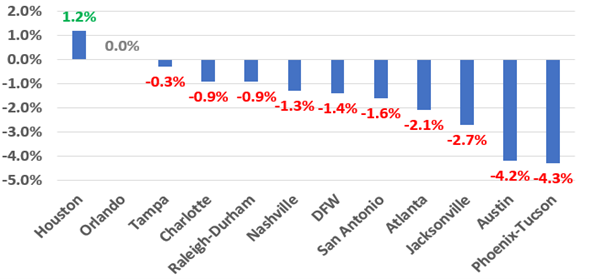

To summarize, Class A delivery of new units is outpacing absorption and spurring on more concessions, while a mass exodus of tenants from all other apartment classes centers around current cost of living. Rent levels remain under extreme pressure. As of the end of June, ten of the 12 markets we serve are experiencing negative rent growth with Orlando totally flat at 0.0% and Houston the only positive rent growth contributor at 1.2%.

Current rent growth

Figure A – 12 Month Rent Trend as of June 2023

What this means for 2023

2023 is proving to be a challenging year as supply and demand issues continue to plague all markets. The negative-to-flat direction of these trends is concerning enough, but when viewed in conjunction with rising costs of insurance, taxes, and financing, it appears distressing. As these markets absorb the shock of new supply and move-outs in stabilized product, does the remainder of 2023 provide the runway to claw-back to higher rent levels? Stay tuned as we continue this series with updated reporting on market conditions in the coming months.

Interested in learning more? View additional detail on rental rate, occupancy and absorption trends in our monthly Market Line Reports.

Multifamily market transitions: the changing dynamics of supply, demand, and financing

The multifamily market activity we’ve witnessed since the end of the global pandemic has become a familiar pattern of instability, characterized by extreme shifts in rental growth, supply levels, and absorption rates. Several factors, including the m…