Multifamily rental growth update through July 2023

This analysis looks at current rental growth trends for twelve markets across Texas, Arizona, Georgia, Tennessee, North Carolina, and Florida.

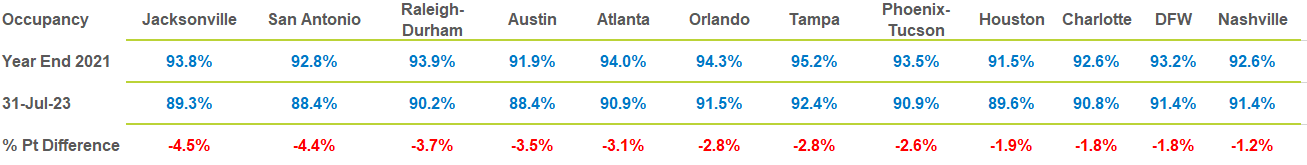

Occupancy

The post-pandemic economic reopening and shift to remote work prompted massive Sun Belt migrations that boosted job growth, pushing occupancies near all-time highs by the end of 2021. However, current occupancy levels continue to trend lower as illustrated by the data table below. Jacksonville, at 4.5 percentage points, sustained the largest drop in occupancy of the twelve metros we serve. The impact of occupancy decline lessens as you move from left to right on the data table, with Nashville holding its occupancy drop to only 1.2 percentage points from year-end 2021 through July 2023.

The dynamics behind this sustained concert of lower occupancy include a steady and strong delivery of new units and an absorption response insufficient to match the volume of new deliveries. In addition, there have been persistent net move-outs in all classes of stabilized product, most likely attributable to the increased costs of housing.

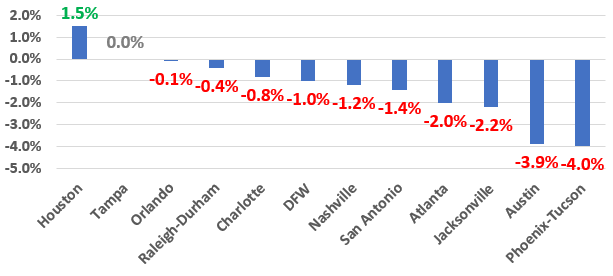

Current rent growth

Lower occupancies put rent levels under pressure. As of the end of July, 10 of the 12 markets we cover are experiencing negative rent growth with Tampa totally flat at 0.0% and Houston, the only positive rent growth contributor, at 1.5 percent. However, all markets reporting negative rent growth in June were able to move rent levels higher in July.

Figure A – 12 Month Rent Trend as of July 2023

What this means for 2023

2023 is proving to be a challenging year as supply and demand issues plague all markets. During July, rent moved in a small but positive direction. Still, the negative-to-flat direction of these trends is concerning, and when viewed in conjunction with rising costs of insurance, taxes, and financing, it becomes distressing. As these markets absorb the shock of new supply and move-outs in stabilized product, does the remainder of 2023 appear poised to return higher rent levels? Stay tuned as we continue this series with updated reporting on market conditions for 2023.

Interested in learning more? View additional detail on rental rate, occupancy and absorption trends in our monthly Market Line Reports.

Multifamily Industry Review: Leaving 2023 Behind and Discussing 2024 Trends

The economic fluctuations, slowing job growth, and surging supply that defined the multifamily market in 2023 are poised to prolong the pattern of market unpredictability that has become the new normal. As rent trends and job growth settle back into …