Building a robust commercial real estate investment strategy to maximize ROI

When talking about real estate investing, residential real estate is typically the first to come to mind. This leaves out a key sector: commercial real estate. Investing in commercial properties such as offices, industrial spaces, retail centers, and multifamily rentals offers numerous opportunities.

To maximize your return on investment (ROI), you need effective commercial real estate investment strategies. This guide covers the core strategies and advanced methods you need to enhance your commercial real estate investments.

Why are commercial real estate strategies crucial for investors?

Gone are the days when you made real estate investment decisions based on a gut feeling that it might be profitable. Today, you need comprehensive, data-driven strategies to navigate the complex commercial real estate market. These strategies ensure that you accurately identify profitable opportunities, mitigate risks, and align your investments with your objectives.

Well-defined commercial real estate investment strategies have one defining feature: they provide a clear roadmap for your investments. By following a strategic plan, you can make informed decisions and maximize your returns. With a strategy in place, you can better predict market trends, allocate your resources efficiently, and adjust your investments accordingly.

Core strategies for commercial real estate investment

The base-level strategies for any commercial real estate investment are market and financial analyses. These enable you to identify lucrative opportunities and make well-informed decisions, ensuring your investments align with your goals.

Market analysis

Market analysis is the evaluation of the dynamics and trends of a specific real estate market. By analyzing supply and demand, rental and vacancy rates, and local regulations, you can understand the current conditions and potential future performance of the market.

Market analysis helps you answer questions like:

- What are the current supply and demand levels in the market?

- What are the prevailing rental and vacancy rates?

- What economic indicators, such as employment rates and population growth, are affecting the market?

- How are local regulations and zoning laws impacting real estate development?

- What is the competitive landscape like?

- What are the historical trends and future projections for property values in the area?

- What types of properties are in high demand?

- How does the local infrastructure, such as transportation and amenities, influence the market?

To perform market analysis, start by gathering data from reliable sources such as government reports, real estate agencies, and market research firms. Utilizing AI analysis, you can then quickly identify trends and patterns that can inform your investment decision.

Financial analysis and forecasting

Financial analysis and forecasting are vital components of commercial real estate investment strategies. Financial analysis involves evaluating a potential investment’s current financial health and performance. This includes examining key metrics like net operating income (NOI), capitalization rates, and cash flow.

Understanding the property’s current performance isn’t enough. You also need to project how the property will perform in the future. By using historical data and market trends, you can anticipate future income, expenses, and cash flow. This forecasting provides a realistic view of an investment’s long-term viability and profitability.

You should also conduct sensitivity analysis during the financial forecasting. This involves evaluating how different scenarios, such as changes in occupancy levels or operating expenses, can impact your ROI. This comprehensive approach ensures you can maximize your investment returns.

Regional insights

“Location, location, location” is often the first advice you’ll hear about real estate. While completing a local market analysis gives you confidence in your immediate area, it’s crucial to also analyze the national market. Understanding broader trends can provide a more comprehensive view and reveal opportunities or risks that local analysis might miss.

Regional trends examine broader economic, demographic, and infrastructural factors affecting a larger geographic area. This includes analyzing economic growth rates, population shifts, and major infrastructure projects. These trends offer a macro-level perspective, helping you identify patterns and potential hotspots for investment within a region.

For example, imagine you’ve done a market analysis and found a commercial property in a thriving local market in Detroit that looks like a great investment. However, when you look at regional insights, you discover that Michigan’s population is declining. Despite the property’s local potential, this suggests that long-term investment might be risky.

Advanced strategies in commercial real estate investment

Advanced real estate investment strategies for commercial properties in the USA go beyond basic local and national-level market and financial analyses. These strategies include diversification, value-add investments, technology use, non-traditional financing methods, and sustainable investing.

Diversification strategies

In 2008, Lehman Brothers Holdings Inc. filed for bankruptcy, marking one of the largest bankruptcy proceedings in US history. The firm had focused its entire investment strategy on high-risk real estate and subprime mortgages. When these markets declined, Lehman couldn’t generate enough liquidity, leading to its collapse.

The recent COVID-19 pandemic has also placed pressure on office property investments. The shift towards remote working has impacted the demand for office space and lease renewals. Investors who focused predominantly on office properties now face decreased occupancy and rental income challenges.

The moral of these stories is that diversification is essential in any investment strategy. It’s how you protect yourself against risk and increase your earning potential. There are different diversification strategies you can consider, such as:

- Residential and commercial mix: Investing in both residential and commercial properties can balance your portfolio. Residential properties tend to provide stable rental income, while commercial properties can offer higher returns. This mix helps mitigate risks associated with any single property type.

- Commercial property types: Diversifying within commercial real estate by including office spaces, retail centers, industrial properties, and multifamily units spreads your risk. Each property type responds differently to economic cycles, so a diversified portfolio can provide more stability.

- Geographic diversification: Investing in properties across different regions or cities can protect you from localized economic downturns.

Value-add investments

The most common real estate investment strategy is buy and hold. In this low-risk approach, you purchase high-quality commercial buildings that generate stable returns. This strategy focuses on long-term appreciation and consistent income.

Another effective strategy is value-add investments. In this approach, you purchase properties with the intention of making improvements or renovations to increase their value. While this comes with higher risk, you can achieve higher rental rates and greater returns.

Use of technology

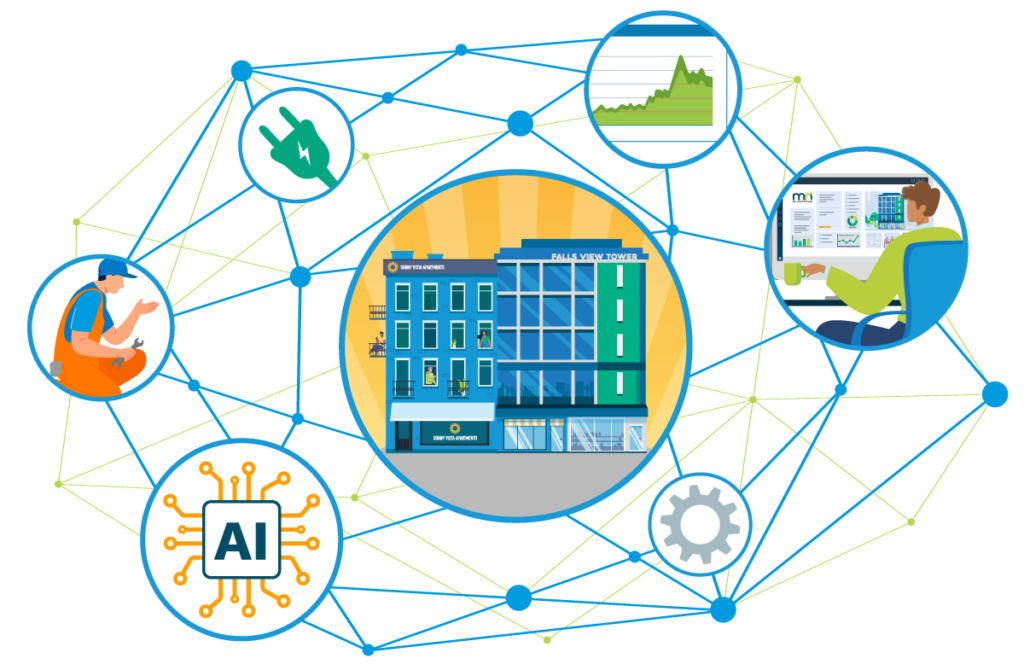

Technology plays a crucial role in new strategies for commercial real estate investment and risk management. Real estate investment software is a critical tool for ensuring data-driven investment decisions. It helps you analyze market trends, forecast financial performance, and manage properties more efficiently by providing real-time data and insights.

If you own multifamily properties, management software can streamline your operations by automating rent collection and maintenance requests. It also provides tools for tenant communication and lease management. This software helps you maintain high occupancy rates and improve tenant satisfaction, resulting in maximized ROI.

Upgrading your commercial properties with IoT devices can offer advanced monitoring and control over building systems. You can use these devices to optimize energy consumption, enhance security, and track maintenance needs. This technology helps you reduce operational costs, leading to higher profitability over time.

Utilizing non-traditional financing methods

The barrier to entry is higher in commercial real estate. You often need substantial upfront investment and must deal with intricate regulatory and market conditions. This makes it challenging for individual investors to enter the commercial real estate market without substantial financial resources.

One commercial real estate strategy to increase your financial flexibility is to use non-traditional financing methods. Crowdfunding, real estate investment trusts (REITs), and private equity partnerships are popular alternatives.

- Crowdfunding: Crowdfunding allows you to pool resources with other investors to fund a real estate project. This method lowers the entry barrier by enabling you to invest smaller amounts compared to traditional financing.

- REITs: REITs offer a way to invest in commercial properties without owning them directly. By purchasing shares in a REIT, you can earn dividends from a portfolio of income-generating real estate assets.

- Private equity partnerships: Private equity partnerships involve collaborating with other investors and firms to acquire and manage commercial properties. This method allows you to leverage the expertise and capital of experienced partners, reducing individual risk.

Sustainable investing

Sustainable commercial investment strategies offer real opportunities for maximizing ROI. These properties are designed to lower environmental impact, often resulting in lower operational costs. For example, using energy-efficient building materials and technologies reduces energy consumption, which can significantly cut expenses.

Sustainable properties can command higher rental income. Many businesses are concerned about their environmental impact and are willing to pay a premium for premises that help them meet their sustainability goals. This demand for eco-friendly spaces can lead to increased rental rates and occupancy levels.

Sustainable properties also offer unique marketing opportunities. Highlighting green certifications and eco-friendly features can attract tenants who prioritize sustainability, especially in multifamily properties. Promoting these benefits can help your property appeal to a growing segment of environmentally conscious renters.

Invest with confidence with MRI Software

With MRI Software, you gain access to real-time data essential for implementing robust commercial real estate strategies. Our advanced tools support market analysis, investment accounting, and fund management. These resources enable you to optimize your portfolios and maximize ROI effectively. Contact us today to schedule a demonstration.

Investment Management Buyer's Guide

Reduce risk and attract investors with real estate investment management technology

AI’s Impact on Real Estate: 8 Experts, 8 Real Scenarios

Artificial intelligence is transforming corporate real estate, streamlining operations, reducing costs, and driving smarter decision-making. In this on-demand webinar, we go beyond the hype to showcase eight real-world scenarios where AI is making a …