Multifamily rental growth update through October 2023

This analysis looks at current rental growth trends for twelve markets across Texas, Arizona, Georgia, Tennessee, North Carolina, and Florida.

Occupancy

Seasonal slowness has come into play for October occupancy levels in all metro areas.

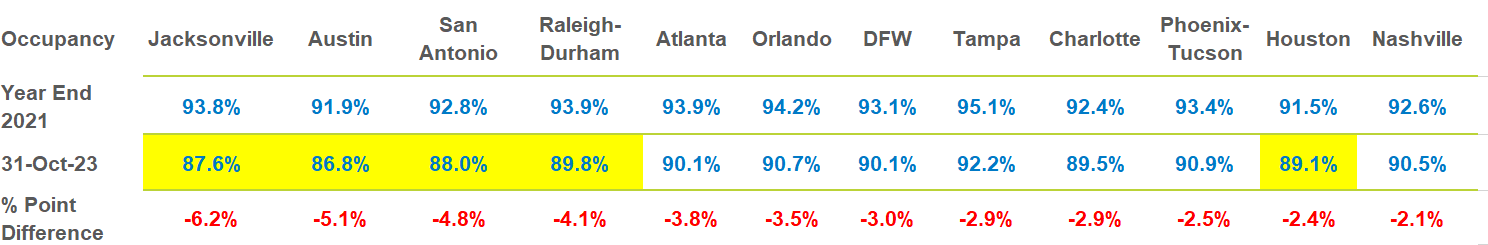

A drop in traffic and leases, combined with heavy doses of new supply, established lower occupancy percentages across the board. Jacksonville suffered the largest drop of the twelve metros listed below at 6.2% The magnitude of occupancy decline lessens as you move from left to right on Figure A below with Nashville dropping only 2.1 percentage points from the highs of 2021 to the most current reading of 90.5%. The yellow highlights draw your attention to those markets whose overall average occupancy dropped below 90% in October, a threshold known as the point where a market transitions from a ‘Landlord Market’ to a ‘Renter Market.’

Figure A – Occupancy Trend – Year-end 2021 through October 2023

The forces pushing occupancy lower have been in place for many months now. Deliveries are outpacing demand. New construction deliveries in 2023, as well as in the coming years of 2024 and 2025, will be greater than the best year of deliveries since the Great Financial Crisis, or since 2010. These elevated deliveries are poorly timed as job growth is settling back to long-term average growth in the 2% to 3% range.

The additional demand that multifamily lease-ups once enjoyed from home buyers who became renters due to high mortgage rates has faded. Home builders have reclaimed such demand by buying-down mortgage rates to a sweet spot of 5%. New home sales, as reported by the Department of Housing and Urban Development for September 2023, are 33.9% above home sales reported last September.

Another factor leading to the erosion of occupancy levels in all markets are move-outs from Classes B, C and D. Prior to 2022, these classes behaved in a very stable manner. Higher prices for these product levels can explain the anecdotal scenarios of ‘doubling-up,’ or moving back in with relatives. However, there is a bigger, more concerning supply/demand paradigm shift to Single Family Rentals (SFR’s) that has occurred, attracting renters from professionally managed apartments to this growing SFR Shadow Market.

Current rent growth

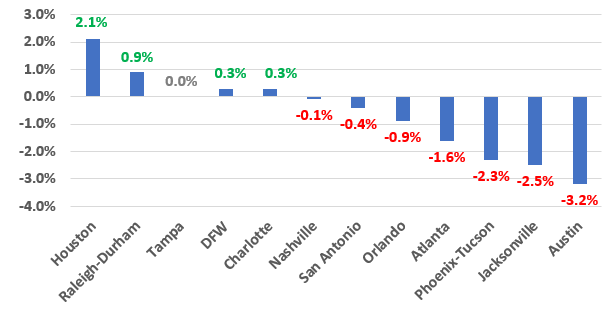

Lower occupancy puts rent levels under pressure. As of the end of October, seven of the 12 markets we cover experienced negative rent growth over the last 12 months. Another four markets are either marginally positive or flat. Houston’s rent growth continues to outpace all other markets at 2.1%.

Figure B – 12 Month Rent Trend as of October 2023

What this means for 2023 and 2024

2023 continues to be a challenging year as supply and demand issues persist. With only two more months left in the year and the typical effects of seasonal slowness, rent growth will likely decline.

2024 is shaping up to be another challenging year with construction levels reaching historic highs. The impact of these hefty new construction levels will be spread over 2023 and 2024, which will be considered poor timing as job growth is settling back to long-term averages of around 3.0 percent. This level of new units will keep a lid on Class A rent growth as concessions increase in quantity and magnitude.

A big question mark concerning the direction of 2024’s performance is whether move-outs will continue to persist, or if they will ease to allow occupancy of Class B, C and D product to improve. This unusual phenomenon of stabilized product move-outs began late in 2021 and has become a steady drain on occupancy.

If the SFR rental market continues its growth, 2024 will look very similar to 2023 when a flat rental trend performance was considered a win.

Stay tuned as we continue this series with updated reporting on market conditions through the end of 2023.

Interested in learning more? View additional detail on rental rate, occupancy and absorption trends in our monthly Market Line Reports.

Multifamily market transitions: the changing dynamics of supply, demand, and financing

The multifamily market activity we’ve witnessed since the end of the global pandemic has become a familiar pattern of instability, characterized by extreme shifts in rental growth, supply levels, and absorption rates. Several factors, including the m…