7 key considerations for better spend control in property management

This blog was written by Andy Hamilton, a Consultant at Proactis.

Proactis, a certified MRI Software Solutions Partner, helps property management companies control 100% of their spend. Their solution transforms the Source-to-Pay processes, which helps organisations save money and create efficiency gains while increasing compliance and reducing risk.

Over the years, I’ve worked with many organisations in the property management sector, including CBRE, Knight Frank and Savills, to help them drive better value from their spend control and management processes. Through this experience, a number of key themes have emerged:

1. React to changing market conditions with flexibility and agility

Whether you’re managing your own company’s properties or those of your clients, controlling and managing spend is critical in terms of getting the best value possible for the goods and services you purchase – no matter how things change.

If the latest events have taught us anything, it’s to expect the unexpected. And with that mindset brings the need to develop agile strategies that can change should your environment shift overnight. Time doesn’t stand still, financial obligations must be respected, and business needs to keep going.

Some companies have been able to adapt their processes. For example, Proactis customer Honeywell expanded its production at its aerospace facility to manufacture N95 masks for Covid-19 protection.

Other institutions, such as the University of Sussex, have embraced technology to ensure they can keep functioning and, in this case, deliver higher education.

Agile Purchase-to-Pay (P2P) also proved critical for Bright Horizons, with a portfolio of over 320 nurseries, as it enabled the company to respond to the pressures Covid placed on the business when it was forced to shut the majority of nurseries during lockdown. Having the ability to control and manage cost effectively and centralise more purchasing was key to successfully navigating through the initial lockdown.

For Finance teams in many organisations, I have found that the situation has actually highlighted a number of areas that can be improved – not only short-term fixes, but for the long-term running of the business. For example, systems that connect teams, simplify reporting, centralise data and connect with the wider organisation can redistribute workload and reduce paperwork.

The impact of Covid forced many to accelerate their journey on the path to digital transformation.

2. Make it simple, but accurate

Obtaining the best value is critical, not only to success, but in some cases to survival. An agile approach to spend management helps achieve this by improving the effectiveness and transparency of both strategic and tactical sourcing processes, while reducing administrative time and effort. Savings can be realised by driving on contract spend and proactive expenditure control through the P2P front-end.

In complex property organisations in particular, it is key to be able to accurately determine who should authorise spend, how the recoverability should be classed, and ultimately where it should be allocated through the underlying property management system.

3. Gain visibility and control

Visibility of spend, through the entire process – from request, through comparison against service charge, to summary analysis – is invaluable to every level of decision-making. Budgets are tight across most businesses, with many having to do more with less.

It’s crucial for property management firms to closely manage costs against budgets, ensure that costs are controlled within the boundaries of the service charge provision, and have the flexibility to react to operating changes at any stage in a process.

4. Improve efficiency

A common objective, and challenge, that I often hear is whether Finance functions can improve process efficiency or not. For example, a strong P2P process, underpinned by well-integrated technology, supports ‘right first time’ invoice submission. This in turn reduces invoice queries and processing time. Imagine the value and reduced time when an invoice can be matched first time to an approved PO, goods receipted, and suppliers validated!

5. Eliminate overpayment and reduce fraud

Another important goal for Finance teams is eliminate overpayments and reduce invoice fraud. Well-adopted and efficient P2P processes prevent payments to unknown suppliers, duplicate payments, or payments when goods or services are missing. I have found that this often results in significant reductions in wasted resources for the buying organisation.

6. Add value without duplicating functionality

My experiences have proved that you can deploy effective spend control around just about any core system. In fact, deploying spend control that’s aligned with your property management system is the only sensible approach when seeking to deliver truly quantifiable value.

True best-in-class, agile P2P systems are “agnostic” of other systems but are built with clear integration points that utilise industry standards and tools to make integration into a product management system easy to implement and manage. Such integration ensures that you can get best-in-class procurement capabilities aligned with the familiarity of your property management system to deliver simplicity and maximise user adoption.

7. Integration is not just a suggestion

Proactis and MRI Software work in partnership to provide a complete end-to-end system for property companies around the world. Combined, our systems are truly agile and integrate seamlessly with each other. They create a complete solution that enables property management organisations to operate in a more effective way and ultimately better serve their customers.

As we mentioned above, Proactis is an MRI integration Partner! Their procurement and spend management solutions can streamline business processes, ensure compliance and drive down costs. To learn more about Proactis, visit their website.

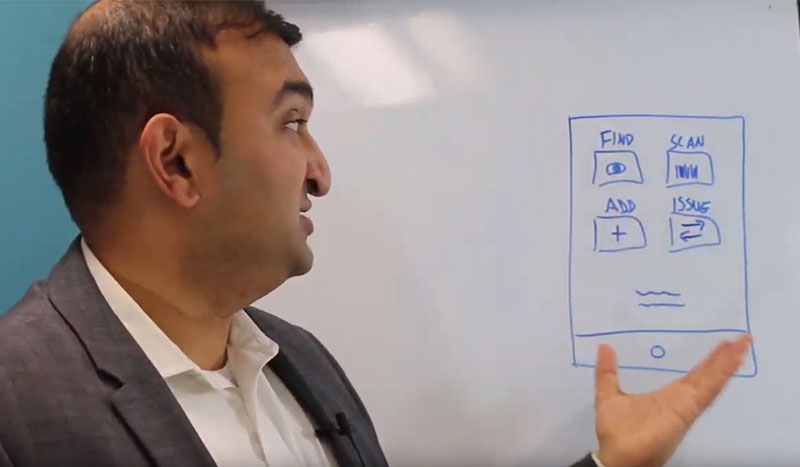

Whiteboard Wednesday – Asset Tracking Mobile App

Transcript Sachin: Hi, welcome to Whiteboard Wednesday. My name is Sachin, working out of the EMEA sales team for MRI Software. Today, I’m going to talk about our Asset Tracking App that we have that integrates with our fixed-asset accounting s…