Multifamily P&L under pressure: What to consider for 2020 reforecasts

As we enter May 2020, the multifamily industry has largely adapted to new operating conditions and is running properties under some semblance of normal. With operational adjustments in place, it is time to focus on running the business, dig into the potential fiscal impacts of the pandemic, and assess how to adjust 2020 operating plans.

Budgets are typically set in the fall and, at the time, 2020 looked to be a continuation of the 10-year expansion which brought steady job growth and an increased demand for housing that fueled steady rent growth. As we settle into the current reality, the budgets set in the fall of 2019 are under pressure due to the impacts of COVID-19. Revenue plans will be a challenge to achieve and expenses are sure to increase in certain categories, requiring a complete reforecast to set realistic expectations for the remainder of 2020.

Multifamily owners, operators and managers should consider the following potential impacts as they formulate revised 2020 forecasts.

Revenue Impacts

In December of 2019, the NAA published their 2020 Apartment Housing Outlook, which forecasted 2020 occupancy between 93.6% and 95.5% with rent growth between 2.3% and 2.7%. 2021 was predicted to be similar, albeit slightly reduced, for both occupancy and revenue growth. Occupancy is achievable but revenue growth will feel pressure on many fronts.

There are several forces working against 2020 planned revenue numbers, and these elements are amplified due to the proximity of macro-economic challenges to the start of the traditional leasing busy season.

- Market pricing, lease terms and lease concessions – As leasing traffic is slowing, prices will likely soften and concessions will become more widely utilized, adding to downward pressure on revenue. If new lease terms lengthen, lower pricing today will also yield lower revenue into 2021.

- Corporate and short-term rentals – With business and leisure travel at a halt, the demand for housing from these channels has ceased, creating additional availability contrary to plan. A combination of shorter lease terms with furnishings, as typical for these units, makes revenue variances greater than standard market rate units.

- Increased renewal rates – As more residents accept renewals to reduce personal uncertainty, the opportunity to lease units at typically higher market rates drops. Longer renewal terms will further delay opportunities to achieve market rates. Concessions given as part of renewals are also likely to increase. An overall increase in renewals goes against the typical assumption of market rate v. renewal mix in revenue projections, leaving a shortfall to plan.

- Waived fees – Typically, fees are collected for several reasons each month. Late fees, settlement fees, lease break fees, and credit card fees, largely being waived in the current moment, will drive an unplanned variance to what was previously budgeted.

- Amenity revenue – With common areas and amenity spaces closed, regular or usage-based fees associated with those spaces are evaporating, adding to downward revenue pressures.

- Guest revenue – Revenue driven by non-resident usage of community features, like gyms and parking, will drop greatly due to closures and shelter-in-place orders.

- Rent collection – While NMHC data through April shows strong rental payment volumes, off only a few percentage points from normal times, May is expected to provide more headwinds given increased unemployment rates and pace of governmental assistance. Payment agreements are deferring collections into future periods where residents are being proactive and eviction moratoriums are preventing action on residents that are not fulfilling their obligations.

One potential upside for revenue may be found in storage unit demand as residents find the need to declutter and free up space as a result of sheltering in place.

Operational Expense Impacts

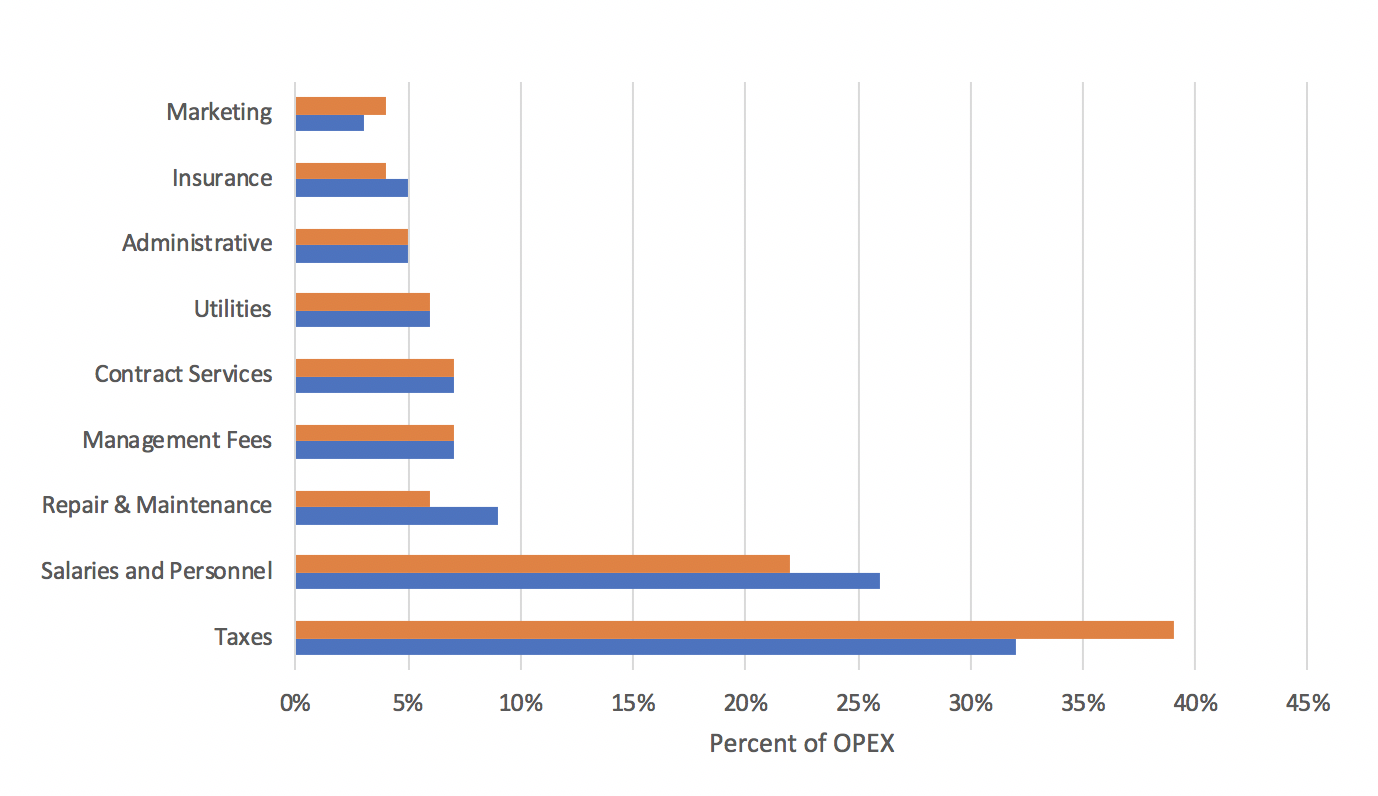

In September of 2018, the NAA did a survey of operational expenses, and we will use that framework for a look at expenses areas.

We can expect a number of expense categories to increase simply because a higher population of residents are at home full-time. This will drive increased usage patterns that will cascade through multiple operating expense areas.

- Repairs and Maintenance: Wear and tear of appliances (e.g. dishwashers), fixtures (e.g. toilets), flooring, and heating and cooling systems will increase, accelerating mean time to failure. Cooling usage compounds with the coming summer season. Depending on individual accounting practices, some of these items may be accounted for as capital expense as opposed to operational expense. Light bulb, filter and other replacements will also increase with higher usage. Costs for cleaning and disinfecting common areas will rise due to increased frequency and tighter standards. Turn costs will decrease, as turn volume decreases, providing some offset to increased wear and tear costs.

- Utilities: While sub-metered properties are well positioned, those using RUBS or including utilities in rents are at risk for resident complaints (RUBS) or increased costs.

- Insurance: While not an immediate impact, policy premiums are at risk for increases as more residents are on site nearly full time, increasing the opportunities for claim volumes beyond standard levels.

Marketing

Social distancing and shelter-in-place orders are the norm, and as such, potential residents have had to leverage digital channels more than ever. Further, self-guided tours, much the talk of recent industry events, has really found a place in a leasing process changed by social distancing. Similarly, video tours, using a number of platforms, have also become a go-to option for showing a unit to a prospect. Better understanding lead source performance should allow for the redistribution of marketing funds across channels.

Adoption of additional technology will likely add to marketing budgets, and additional focus on the digital channel may increase costs for images, videos, 3D tours and drone flyovers. Additional expenders may also be experienced in the production of self-service maintenance videos for simple fixes residents can do on their own.

Administrative

With eviction processes delayed and more residents affected by the economic impacts of the pandemic, bad debt may grow, leading to higher than normal collections costs later in the year.

Technology costs may also increase if bandwidth improvements are needed and if new technologies are deployed to better enable socially distant business practices. In many cases, technology may provide efficiencies that alleviate costs elsewhere, or it might allow for a different deployment of staff.

Salaries and Personnel

Maintenance staff will likely see a change in the mix of their activity, with time previously spent on turn activity now focused on additional maintenance and cleaning. If leasing volume drops, adjustments can be expected in leasing staff or in commissions paid, providing some relief in the second largest area of expense. Alternatively, commission costs could increase to create additional incentives for leasing staff in an effort to drive higher occupancy.

Organizations that successfully manage their properties with smaller or less available staff, by leveraging technology to assist in daily operations, may choose to invest in more technology to transform their business. A less decentralized model, specifically as it relates to resident support, will lead to a net reduction in staffing.

Taxes

Property tax burden does not adjust quickly. Municipal and city tax incomes are sure to be under pressure as revenue from commerce, hospitality, dining, entertainment and even parking have greatly slowed. This will eventually cause cities and municipalities to look for additional revenue.

In addition to the expected changes in operational expenses, capital expenditures will also be impacted.

Capital Expenditures

We can expect that many discretionary capital projects, like renovations and upgrades, will be put on hold, helping organizations conserve cash. At the same time, some new projects may emerge:

- Investing in a contactless move-in capability, including digital locks and building access systems. Modernizing building access and extending it to include new residents will further ease the leasing process and move-in logistics.

- Retrofitting for package delivery at a property or unit level, including provisions for cold and hot storage for food. While package lockers, rooms and delivery services have gained traction, changing resident behaviors will drive further adoption with some properties requiring direct resident deliveries.

- Conversion of amenity spaces, in light of behavioral changes, driving demands for different space utilization.

All these elements, and plus others not mentioned, will lead to clear pressures on revenue achievements and likely increases in expenses, resulting in material variances against the plan of record for 2020. Multifamily owners, managers and operators should quickly assess these impacts and provide a reforecast of 2020 to their stakeholders in order to reset expectations. Reforecasting, a corporate muscle not exercised since 2009, should continue until clarity is achieved on the macro-economic condition and the downstream impact on each property.

Can fraud happen to your multifamily business?

Learn more about how to protect your property and your community with MRI Risk Management.