Our 16th episode of Whiteboard Wednesday features Andy Welkley, Product Marketing Manager for MRI Software, covers MRI Fixed Asset Software. Andy covers how duplicate entries associated with manual tracking of fixed assets for real estate companies presents risk and inaccuracies. Andy also covers how MRI’s Fixed Asset software automatically tracks, journalizes, and depreciates assets for real estate organizations.

Video Transcription

Andy Welkley: Hi, welcome to today’s edition of Whiteboard Wednesday. My name is Andy Welkley, and today we’re going to cover fixed assets. Why are we diving into this topic today? Well, a recent study by the AMR found that over 65% of fixed assets data is either incomplete or missing altogether, and this can pose a real risk to organizations as they track their fixed assets either for tax purposes, compliance purposes or insurance purposes. Let’s dive into how these errors happen.

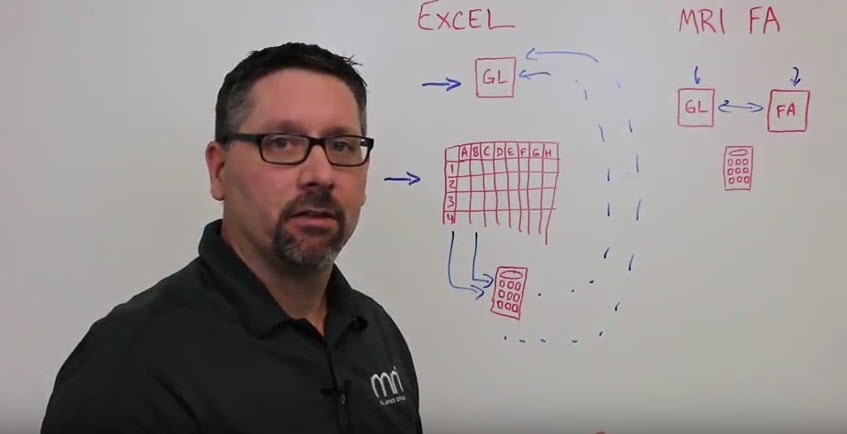

First of all, we find a lot of organizations using spreadsheets to manage an account for their fixed assets. Let’s see how that process generally works. In many cases, an entry into the general ledger gets made, whether it’s from an invoice or another source, that journal entry tracks the creation of a fixed asset, the transaction that formed it.

What then has to happen is a similar entry needs to be made to a spreadsheet. Right out the gate, we’ve got a double entry, some redundant processes which take time and resources to make both of these entries. At the same time, we’re also applying formulas in the spreadsheet to account for the depreciation that is going to be upcoming during the life of that fixed asset.

We face more challenges here. First of all, we see that data errors can be made in the formulas as well. Formulas are often copied and pasted from cell to cell or from spreadsheet to spreadsheet, which introduces more risk into the process. We also can’t see those formulas as most of the time the data is what shows in the spreadsheet. We don’t have the visibility that we’d like to have when we look at our fixed assets inventory.

The third problem is access. Who maintains that spreadsheet? What type of access do other people in the organization have to that information? You can see that the host of problems even grows there. Is there ability to track who has accessed that information, who’s entered that information, when they did it? We see challenges around audit trail when we’re using spreadsheets.

Finally, security. Is it a log in or log out process or procedure? Does anyone have access to that information? We can see a host of challenges caused simply by the choice to use a spreadsheet. Now let’s dive a little deeper into the processes. Once that fixed asset is entered into the spreadsheet, we do a depreciation calculation. That depreciating calculation then must be entered all the way back up into the general ledger.

Again, we have two processes that are in place. One happens in the spreadsheet. A second process has to happen as we journalize that depreciation back to the general ledger. We have to do that every time the depreciation schedule takes effect. We, again, are ripe for error as we increase the variability in our process. We have a very time-consuming process. We introduce a great deal of risk into the process.

As you can tell by the AMR report, there’s a tremendous amount of error that is introduced into this process. How can that be solved using an automated fixed asset tool? With MRI, our fixed asset tool is directly integrated with the general ledger. You have many sources and pathways into this fixed asset life cycle. You could have a piece of equipment or other fixed assets that you enter into the general ledger either through a journal entry or an invoice. That automatically creates the fixed asset over in your fixed asset tool. The pathway could be in the reverse as well.

You could choose to enter a fixed asset into the fixed asset tool and it will automatically journalize in the general ledger. Here we’ve reduced the number of steps and processes that are needed when we look at a general ledger system versus a spreadsheet. It’s just one entry. We’ve reduced the potential for error. We can also identify the depreciation schedule right in the fixed asset tool that we’re going to employ. Now we’ve run that calculation, and that calculation is automatically journalized back into the general ledger.

Again, one step, automated procedures that reduce the risk of error and reduce the risk of the chances that we have to make a mistake as we move things back to the general ledger. Now, if we decide to dispose of an asset, we can do that either in the general ledger or from the fixed asset tool. Again, all that information is processed one time through the system, through the life cycle of that asset.

Finally, when we look at a spreadsheet and a general ledger set up, it’s very difficult to report on this information or even more difficult to forecast, because we’re looking at historical data. We’ve taken a depreciation and we’ve moved it back to the general ledger. With a system like this, we can look forward as well as backward in our reporting and forecast the position we’ll be in as our fixed assets proceed through their life cycle or they’re disposed off.

When we use a fixed asset tool, we reduce compliance risks, we save time, we improve accuracy and visibility, and we create an audit trail. All these things promote a benefit to the organization, and I think it’s time that we showed some appreciation for those that manage the depreciation. That’s your Whiteboard Wednesday for today. I’m Andy Welkley, thanks for your time and we’ll see you again.