Fewer tenants default for the third consecutive quarter

Despite their financial constraints, more tenants are paying their rent compared to previous quarters. For the third consecutive quarter, there has been a decrease in the number of tenants that did not make any payment towards their rent, indicating that tenants in the formal rental market are successfully navigating constrained household budgets to ensure that they honour their rental payment obligations – or at least make a partial payment.

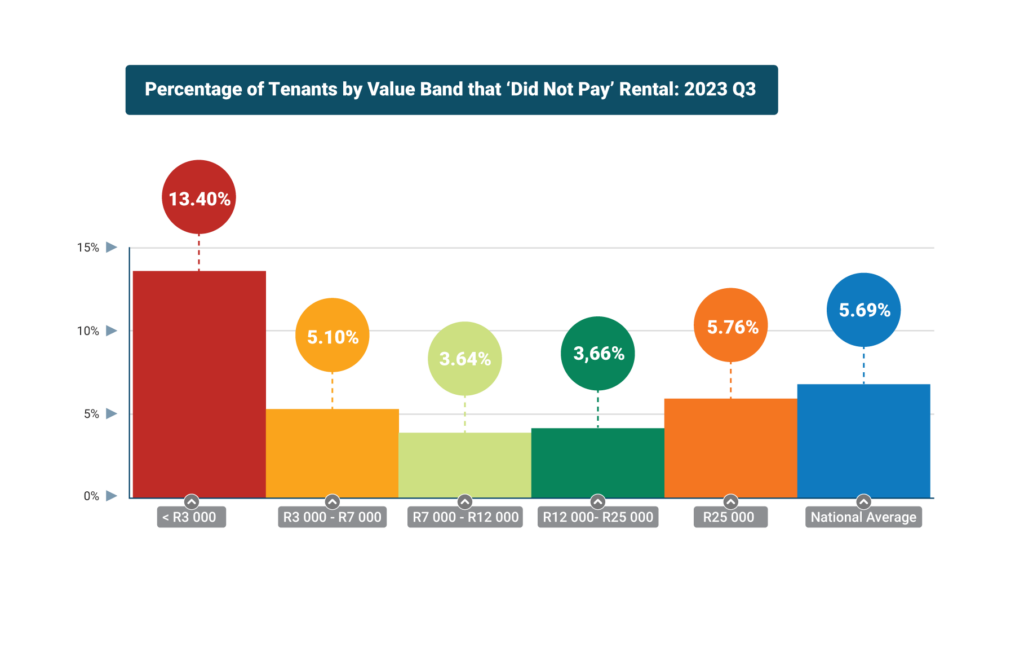

The good news for property investors is that the number of tenants who did not pay any rent decreased from 6.30% in the second quarter of 2023 to 5.69% in the third quarter. In the third quarter of 2017, 5.90% of tenants did not make any payment towards their rent. This figure increased gradually until the pandemic when the number of tenants who made no payment reached record highs of 11.22% in the second quarter of 2020.

Those in the lowest rental value bands (less than R3000 pm) have traditionally struggled the most to pay their landlords. However, two years after the pandemic and the easing of lockdown measures, there is a drop in the number of tenants in the lowest rental bands with did not pay statuses, reducing from 17.34% in the first quarter of 2023 to 16.24% in the second quarter and dropping further to 13.4% in the third quarter.

Good standing trends

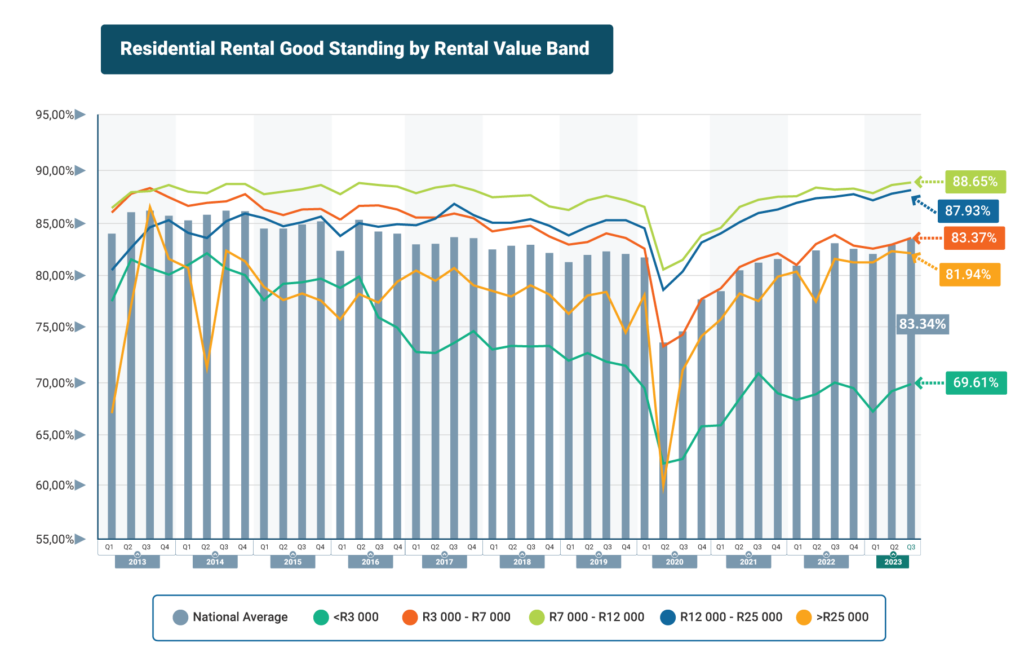

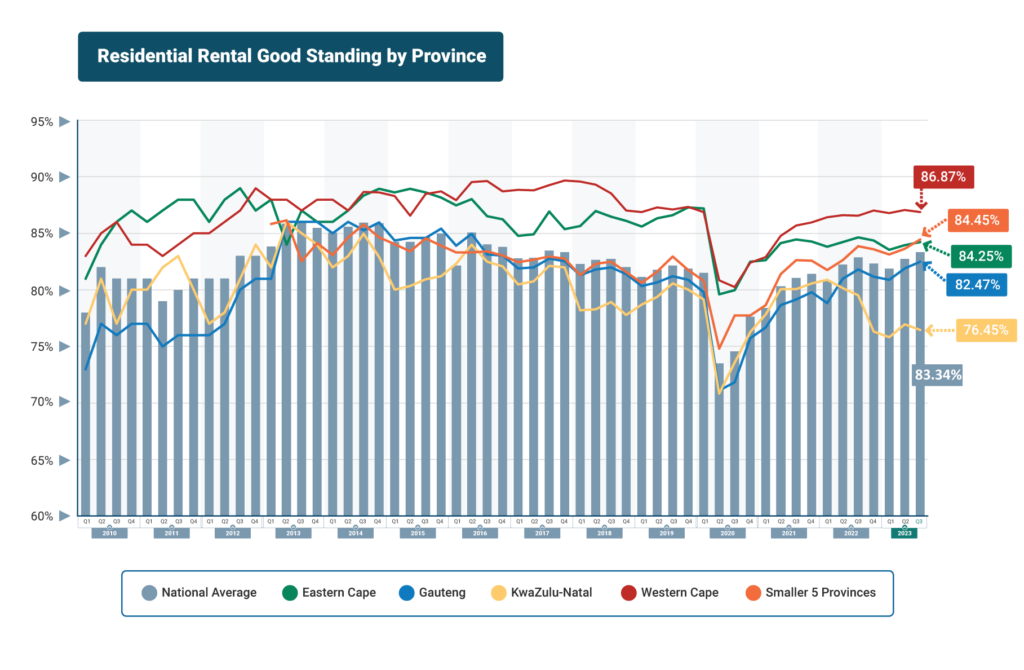

Encouragingly, the overall good standing of tenants continued to improve in the third quarter of this year with 83.34% of tenants classified as in good standing. The number of tenants in good standing has improved for the past three consecutive quarters with 81.86% paying in full in the first quarter, increasing to 8.27% in the second quarter.

A tenant is classified as in good standing if all their rental obligations are met by the end of the month. These include tenants that paid on time (POT), paid within a grace period (GP) afforded by landlords, or paid late (PL) but still ensured they covered their rental payment before month end.

The high cost of capital (including debt), maintenance, security, management fees, and municipal charges, combined with downward pressures on returns with rental growth below the Consumer Price Index (CPI), has been impacting investors. However, although margins are under pressure for these investors, they have been receiving more of their rental on time, easing cashflow strains.

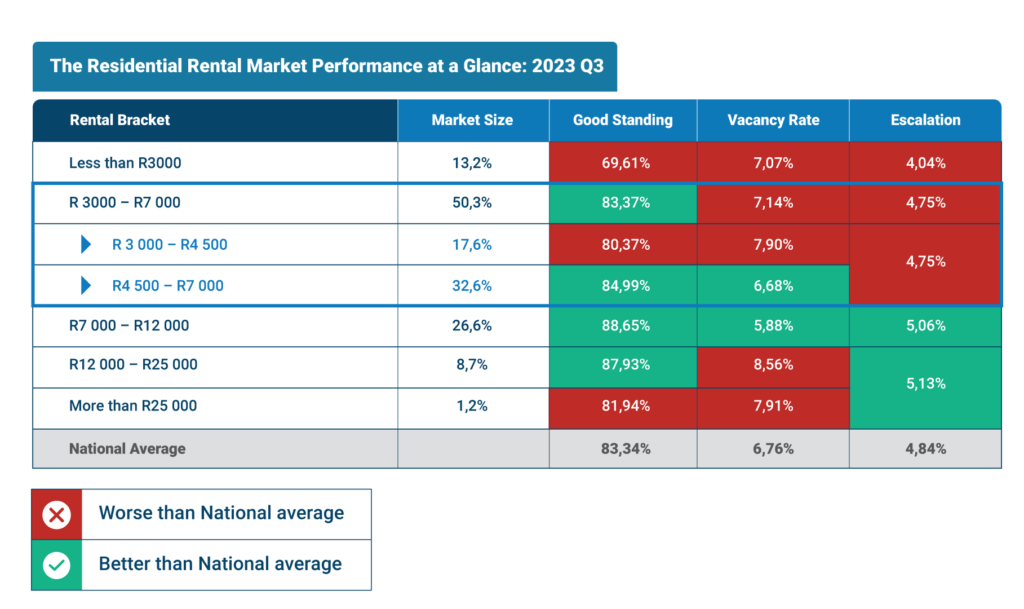

While the longer-term overall good-standing trend is positive, the disparity between the various residential rental value bands continues to paint a concerning picture of the lowest and highest rental value bands which still fall short of the national average.

Tenants in the lowest rental value band improved from 68.95% in the second quarter of 2023 to 69.61% in the third quarter. The highest rental value band – those paying R25 000 or more a month – saw a slight drop in the number of tenants in good standing from 82.15% in the second quarter to 81.94% in the third quarter.

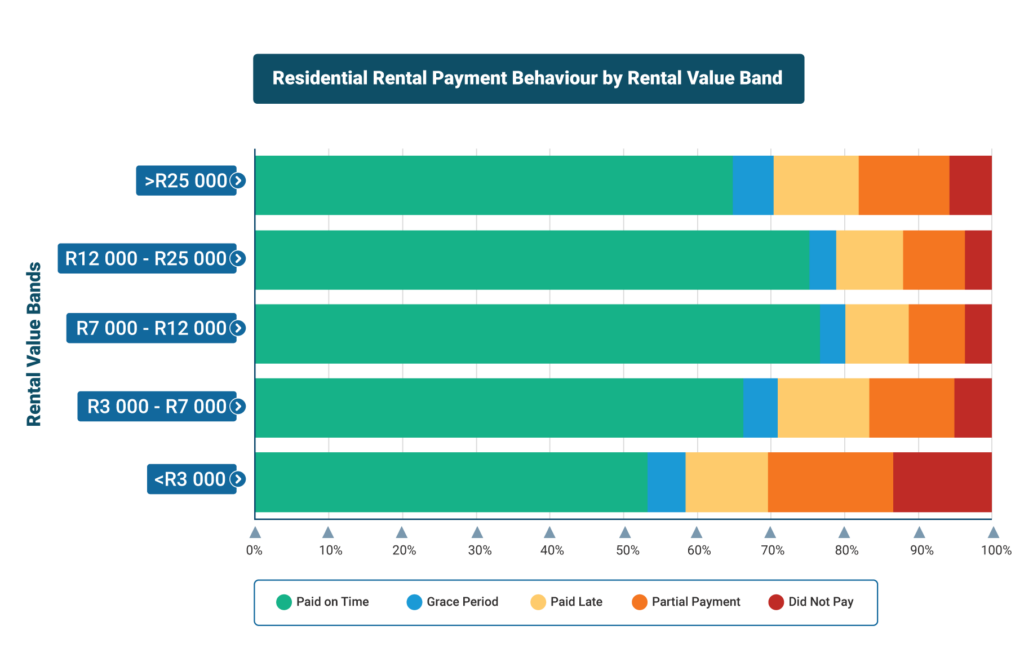

Receiving rental payment on time is critical for investors. Rental properties costing between R7 000 and R12 000 per month have 76.62% of tenants paying their rental on time. Properties costing between R12 000 and R25 000 per month have 75.24% of their tenants paying on time.

Late payment of rental occurs most frequently in the R3 000 to R7 000 band, with 12.41% of tenants paying late. The next highest percentage of late paying tenants is the luxury rental property segment with properties costing over R25 000 per month where 11.56% of tenants pay late.

Value bands shifting as a result of rental escalations

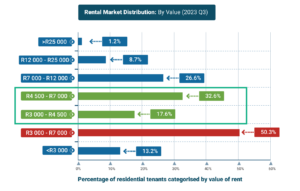

There has been a shift in the percentage of tenants categorised by the various rental value bands. The majority of tenants are paying between R3 000 and R7 000 per month with 50.3% of all tenants in the third quarter of 2023 falling into this category, down from 50.8% in the previous quarter. The average number of tenants in this value band during 2021 was 54.5% and in 2020, 55.4%.

Tenants paying between R7 000 and R12 000 increased from 26% in the second quarter to 26.6% in the third quarter. Rental growth has seen more and more tenants move into higher rental value bands while lower rental value bands are seeing a decrease.

Since 2016, the number of tenants paying R12 000 to R25 000 has almost doubled to 8.7% in the third quarter of 2023. The percentage of tenants renting in this value band has experienced three consecutive growth quarters. In the second quarter of 2022, this value band represented 7.2% of the total rental market, growing to 8.3% in the second quarter of 2023.

The luxury rental market – categorised as tenants paying R25 000 or more per month – hasn’t seen any noticeable change in the past four quarters. It accounts for 1.2% of the formal rental market.

In the first quarter of 2020 (prior to the pandemic), this rental value band made up 1.8% of the rental market but has not recovered to this pre-pandemic level. Historically low interest rates during the pandemic made it very attractive for these tenants to purchase property. With interest rates expected to remain at heightened levels for the foreseeable future and rental growth migrating lower bands upwards, the luxury rental market is likely to start seeing some growth. The question, however, is whether cash-strapped consumers can afford these rentals.

Cautious investor celebrations as rentals escalate

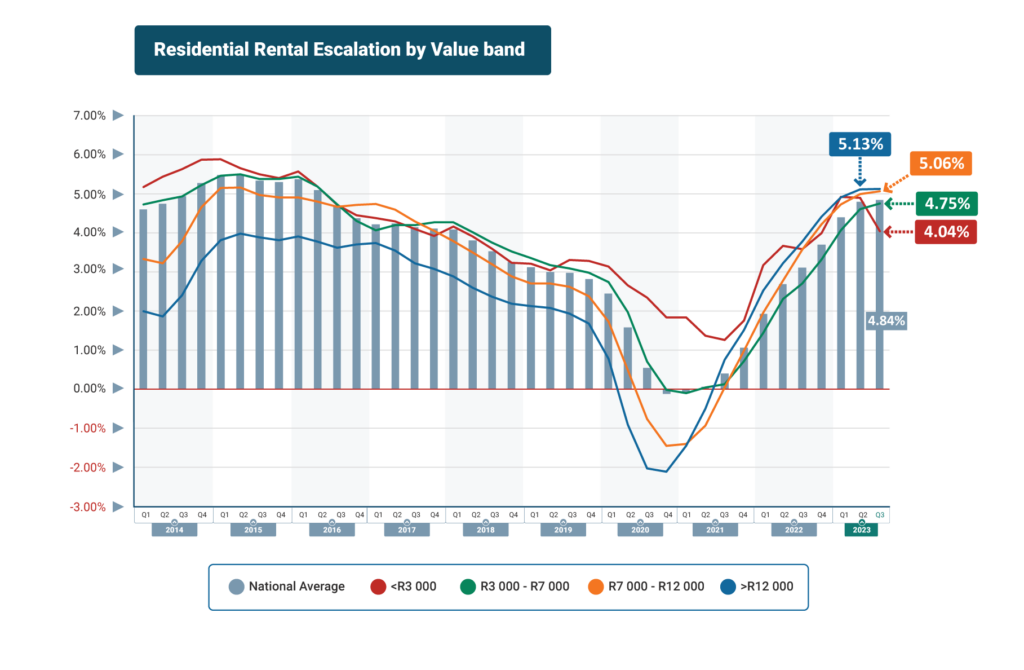

The national rental escalation rate continues to climb from 4.80% in the second quarter to 4.84% in the third quarter of this year which remains slightly below September 2023’s CPI of 5.4%. Higher CPI is primarily driven by the fuel price index. Although fuel price decreases for November are a welcome relief for both consumers and businesses, the higher fuel prices earlier in the year have already been factored into the price of goods and services. Given the huge challenge transport has become for the economy, it is expected that CPI will remain in the higher portion of the South African Reserve Bank’s inflation targets. This could result in another interest rate increase of 25 basis points before the end of the year. Price sensitive consumers appear to have reached a precarious point within the rental market. The national average rental escalation has slowed its upwards trajectory.

The national rental escalation rate continues to climb from 4.80% in the second quarter to 4.84% in the third quarter of this year which remains slightly below September 2023’s CPI of 5.4%. Higher CPI is primarily driven by the fuel price index. Although fuel price decreases for November are a welcome relief for both consumers and businesses, the higher fuel prices earlier in the year have already been factored into the price of goods and services. Given the huge challenge transport has become for the economy, it is expected that CPI will remain in the higher portion of the South African Reserve Bank’s inflation targets. This could result in another interest rate increase of 25 basis points before the end of the year. Price sensitive consumers appear to have reached a precarious point within the rental market. The national average rental escalation has slowed its upwards trajectory.

Rental properties with a monthly rental of less than R3 000 per month dropped from 4.91% in the first quarter of the year to 4.89% in the second quarter. A further decrease in the third quarter saw rental escalations slowing even further to 4.04% as property professionals balance vacancies and rental growth.

Tenants in the R3 000 to R7 000 a month price bracket are paying 4.75% more on their rental in the third quarter of 2023 compared to a year earlier. Rental properties priced between R7 000 and R12 000 are escalating at the second highest rate. In the second quarter, this bracket escalated by 4.99%, increasing further to 5.06% in the third quarter. Rental escalations for this rental value band peaked in the second quarter of 2015 at 5.16%. Should the current trend continue, we expect that this will probably be achieved again in the next couple of quarters.

The rental growth for properties above R12 000 is increasing at the highest rate at 5.13%, marginally up from the second quarter’s 5.11%. The luxury rental band is escalating at its highest levels seen since 2014. Overall, rental escalations are slowing but investors should be cautious as consumers remain under pressure and vacancies could increase due to unaffordable rentals or household consolidation.

House price inflation drops

House price inflation saw a sharp drop to below 0.6% (YoY change, Sept 2023) according to FNB’s House Price Index (HPI)(HPI), the latest FNB. HPI report stating that 30% of sales are attributed to financial pressure.

Higher rentals but slower capital growth in the residential property market have resulted in improvements in national gross yields for both full title and sectional title investments.

The national average yields for full title properties improved from 7.25% in the second quarter to 7.31% in the third quarter. Sectional title property yields improved marginally from 10.47% in the second quarter to 10.49% in the third quarter.

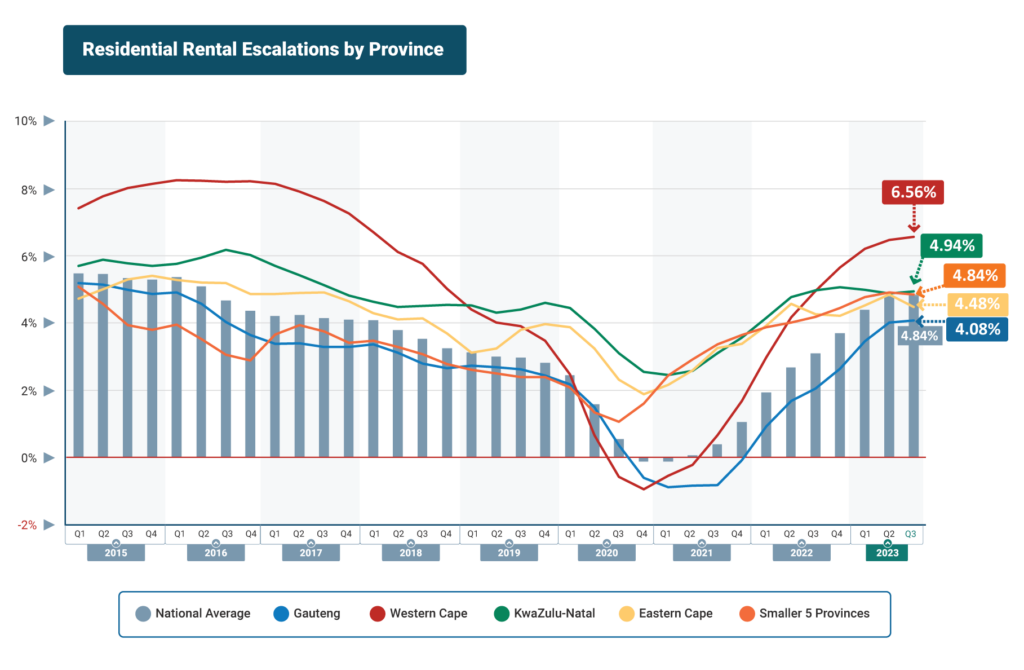

Rental escalations by province: balancing vacancies and growth

Eastern cape: Vacancies in the Eastern Cape have on average remained stubbornly high at 11.3% in 2023 and well above the national average of 6.74% for the same period. Quarter-on-quarter national vacancies decreased from 7.27% in the second quarter to 6.76% in the third quarter. The high vacancy rate in the Eastern Cape requires a fine balancing act between escalating rentals and keeping rental properties occupied. Escalations in the Eastern Cape have slowed from Q2 2023 at 4.85% to 4.48% in Q3 dropping below the national average.

KwaZulu-Natal: High vacancies in KwaZulu-Natal are placing downward pressure on escalations in the province. Double digit vacancies in the first and second quarters slowed rental growth to 4.94%, marginally up from 4.88% in Q2 of 2023. The lower vacancies reported in the third quarter could slow the downward escalation trend in this province with early indicators showing a potential improvement in escalation rates for the rest of the year.

Gauteng: Vacancies in Gauteng decreased from 8.8% in the second quarter to 6.85% in the third quarter. The province is starting to see escalation rates slowing from 4.02% in Q2 to 4.08% in Q3 of 2023. The lower vacancy rate provided property owners with an opportunity to escalate rental but still remains below the national average. Gauteng’s TPN Market Strength Index remains below the equilibrium mark (50) at 47.9 points in the third quarter which explains the reason for the lower rate of escalation.

Western Cape: Lower vacancies in the Western Cape, combined with a Market Strength Index of 70.3 points – the highest in South Africa – has resulted in a further improvement in rental growth. Rentals escalated by 6.47% in the second quarter and by 6.56% in the third quarter. Tenants in the Western Cape are therefore paying almost 6.6% more in the third quarter of this year compared to last year. Vacancies started increasing in the second and third quarters which could result in rental growth slowing early next year.

Provincial tenant performance

Gauteng: More residential tenants in Gauteng paid their rent in the third quarter compared to the second quarter. The number of tenants in good standing in the province improved from 81.9% in the second quarter to 82.47% in the third quarter. The number of tenants that did not pay decreased from 6.84% in the second quarter to 6.07% in the third quarter. The percentage of tenants making partial payments remained around the 11% mark. The province has seen a small improvement in the number of tenants that paid on time, with a similar decrease in the paid late category.

Western Cape: The Western Cape has the lowest did not pay payment profile of all provinces with only 4.43% not making any payment. The province has the highest good standing rating at 86.87%, slightly down from the second quarter when 87.08% of tenants were in good standing. Only 8.7% are making partial payments while stricter landlords have seen less than 3% of tenants paying within a grace period.

KwaZulu-Natal: The province’s good standing rating dropped from 76,95% in the second quarter to 76.45% in the third quarter. This is fueled by 8.7% of tenants not making payments and 14.86% only making partial payment towards their rental. Landlords in KwaZulu-Natal are a bit more lenient with their tenants, giving 4.13% of tenants a grace period in which to pay.

Eastern Cape: A total of 15.75% of tenants in the Eastern Cape are either not paying or only making a partial payment towards their monthly rent while 10.14% of tenants are paying late. Stricter enforcement of rental obligations in the province means its good standing is keeping above the national average at 84.25%.

The smaller five provinces, which include the Northern Cape, Free State, North-West, Limpopo and Mpumalanga have an average good standing of 84.45%. While 4.45% of tenants are not making any payment towards their rental, 11% are making partial payments and 11.4% late payments with the balance of tenants falling within the landlord’s grace period.

Marginally more confident consumers are still very price sensitive.

Consumers are feeling a little more confident this quarter compared to the second quarter. According to the FNB Consumer Confidence Index compiled by the Bureau of Economic Research, confidence levels improved from a minus 25 score in the second quarter to a minus 16 score. But higher inflation, slow economic and employment growth coupled with high interest rates, has resulted in consumers who are very price sensitive.

TPN data is indicating that currently more tenants are paying their rental and are willing to navigate rental escalations. There are however concerns around the fine balance between vacancies and how this is impacting on investors to fill their properties and ask for higher rentals. The data is showing that where higher vacancies exist, lower rental escalations should follow, or rental collections will inevitably suffer as tenants start defaulting on their lease obligations.

TPN Data Notice: Rental escalations have been adjusted for the period 2022 Q3 – 2023 Q3. The adjustments affect Rental Escalation by Province and Value Band. This report reflects the adjusted escalation numbers.