How to mitigate liquidity risk in a real estate investment

Investing in real estate is a good source of passive income, and many of those who have dipped their toes in it are well aware that it is not without risks. The dollar at stake is significant – the rewards are indeed higher, but the risks are also greater. As a long-term investment, real estate poses a challenge in being an illiquid asset in times of a recession, not to mention its value becoming volatile.

The real estate market isn’t always going to be favourable all the time and so it is important for any landlord to understand the liquidity risk that comes from investing and then leasing out properties and the methods they can use to mitigate these risks and reduce the negative impact it can have on the property investment.

What is Liquidity Risk?

Liquidity risk is the risk that a business or individual will have inadequate cash flow and/or working capital to satisfy ongoing expenses, pay creditors and lenders, maintain capital facilities in proper working order, and so on. In terms of real estate investment, this happens when owners become unable to properly maintain their properties because of lack of funds, resulting in tenants relocating. Another scenario is when the investment itself – the property – becomes difficult to sell quickly enough that investors will be holding to it for a longer period than expected or sell at a lower value just to attract buyers.

Tips to mitigate liquidity risk

Mitigating liquidity risk in a property investment basically comes down to minimizing debt and other unpredictable costs to maintain a healthy cash flow. Here are just a few of risk mitigation strategies you can use in your property investment.

- Forecasting and analysis

The most important step in risk reduction and mitigation is conducting analysis which will allow you to make data backed forecasts. By researching critical factors that comes with your investment, not only are you able to make better decisions, you can also reduce unpleasant surprises and device a systematic plan once it arises.

A basic market analysis is a standard when you are thinking of investing in properties and helps answer critical elements that make up your expected ROI and the investment’s accompanying risks. This will help you gauge the direction you should be taking. What locations are most profitable? How much do leases go for in the area? What are the vacancy rates of competing properties? These are just some questions you should be asking before investing. You’ll also find that market data is oftentimes ready and available, online or otherwise, and in cases where it isn’t, you can always talk to a real estate agent and property manager to gain some knowledge.

- Diversify your portfolio

Every investor worth their salt will tell you that diversification is key to maximizing your earnings for the least amount of risk. Real estate investments can be diversified in many ways – through number of properties owned, types and location of the properties. However, because of the value of real estate, diversification can be quite a challenge in practice though not entirely impossible. If you’re an individual investor, consider teaming up with other investors or investing through property trusts, syndicates and fractional investments. These investment alternatives are a great way to diversify your portfolio across different property types and geographic locations without having to outlay large amounts of capital or accumulate debt that comes from directly purchasing a property, hence minimizing your risk.

- Limit risk by getting insurance

It should be common sense to insure an investment as valuable as real estate. Disasters can happen at anytime and insurance can help you minimize the loss that can result from such events. In essence, insurance protects you from being financially crippled in the process of recovering from such loss and helps maintain the solvency of your business.

A general home insurance is good but additional policies can be taken into consideration to help protect your investment thoroughly. For example, there’s landlord insurance which assumes the potential risks that can be incurred by tenants. Your property’s location also dictates which coverage is right for your situation and you might want to consider getting flood, fire or storm damage insurance if the area is prone to such disasters. Additionally, a business interruption insurance can help you cover the loss of income from your property should it befall an unfortunate event.

- If possible, shift risk by two-party contracts

Contracts that you have to undergo to maintain your property are also another area you can look into to minimize your liquidity risk. Consider risk transfer provisions or indemnity clauses that assign responsibility and financial consequences to the other party hired to control the risk exposure, provided that the counter party is willing, of course. For example, a contract with a roofing company can include an indemnity clause that covers losses incurred from a faulty installation. By shifting risks, you minimize cost spent on damages or losses resulting from faulty products and services.

- Set up a reserve fund to protect your investment

Protecting your investment from future price fluctuations and other contingencies by hedging is a good practice to prevent surprises in future events. A simple way to do this is by setting up a reserve fund. This way you’ll have cash available that will otherwise be harder to raise when times are tough.

In conclusion

All investments have risks but with these risk mitigating strategies, you can limit your exposure or avoid liquidity risk altogether. Being aware of risks is perhaps the most important thing that you should always keep in mind when deciding if a particular real estate investment is right for you. This way you can be realistic about the ROI you expect that’s within your tolerance for risk and loss.

Is your property being managed using a trusted software solution? Try MRI’s property management software, a comprehensive technology for today’s real estate owners, occupiers, and property managers in Singapore and Asia. Book a demo and see the MRI difference.

Property Management Software

Multi-discipline technology for property owners, investors and occupiers.

Whiteboard Wednesday – 15 – MRI Callmax for Maintenance Page-outs

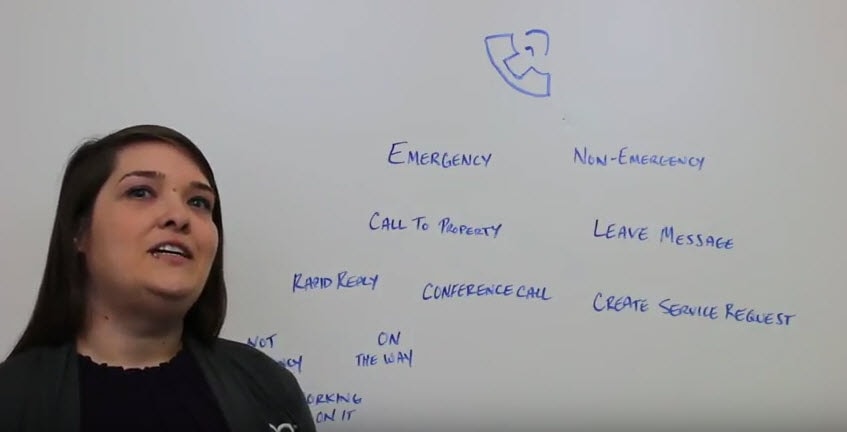

With automated page-outs, your maintenance staff will be automatically alerted to emergency issues and your office staff will be made aware of non-emergencies for follow up. As with all Callmax products, these communications are automated with built-in resident auto-responses.