This week’s Whiteboard Wednesday follows up from last week’s video and our own Eva Chamberlain dives into MRI’s Data Validations. You’ll learn how our data management software combines both human and computer analysis as part of our data validation. Eva walks through the entire process that MRI uses to ensure that your real estate investment data is accurate and complete.

Video Transcription

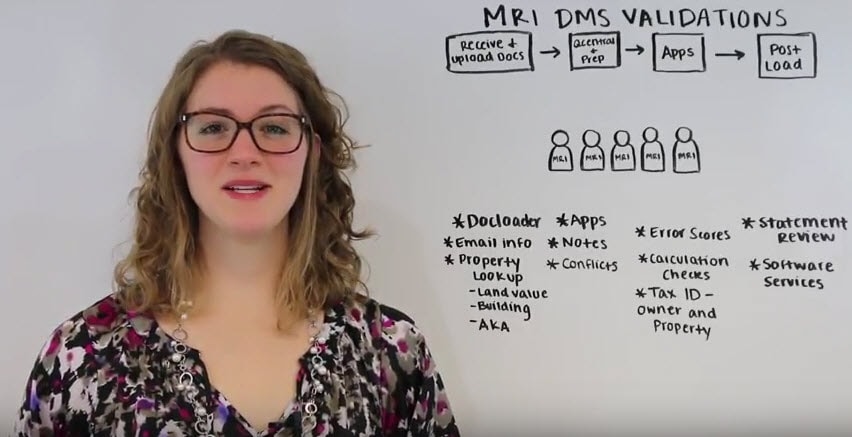

Eva Chamberlain: Hi, I’m Eva Chamberlain. In the last Whiteboard Wednesday video, we discussed the data processing within the MRI data management services department. In today’s video, we’re going to be discussing the validations within that workflow. Validations are everywhere in our software and with our analysts. We’d like to say that we maintain the three C’s. That the data is consistent, complete and correct. Now when we’re talking about validations, we like to say that we’re a hybrid of human and computer analysis.

Every file that comes through our system, all the data that’s loaded goes through a person and the computer inside of our applications, in our software. There are so many different things making sure the data is correct. I’m going to go through each step of the workflow process and show you the validations that are within them. Now the first step when we receive and upload the documents, the data goes through an analyst on the data management team.

It also goes through what you see here. The docloader is our application. This application is connected directly to our email inbox so all of the information that comes on any email that you receive is in this application. That way we know who it comes from, what the email body says and any related information that could be imported in order to process the data. We have the email info and then we’re also able to look at properties via certain types of information.

This information never changes so we make sure that the properties are correctly researched and we know which ones we’re working with. Now in the next step, within Q-central within our proprietary software, we prep the data, we make sure that it’s correct and through that process, it also goes through an analyst. The data in the files are also going to go through our applications. There are going to be notes on the records inside of Q-central and then have something called conflicts.

Conflicts is our version of a red flag that allows us to look at data, look at documents again and make sure that they’re correct. It’s sort of a check on how many documents are in there for any particular property, for any particular data type. We like to make sure we pay really close attention to that. In the next step when we’re actually loading the data within the applications, the applications themselves have checks on them.

Again your data and your files go through an analyst. They go through human eyes. We have knowledge here that allows us to identify problems, allows to identify discrepancies and allows us to make sure that what our client is going to see in the end is correct. Now through the analyst and then on to the applications. The applications have calculation checks within them. They also have checks on tax IDs for not only the property but also for the owners in that investment.

We like to make sure those are correct, all the numbers are right and that the data is going to reported correctly. One of the most important validations are error scores. Error scores appear right before we load data into this equal database. They tell us, there are discrepancies in this data. It’s either too high, too low, it’s not consistent. Remember the three C’s. Consistent was one of our three C’s.

The error score validation helps us maintain that. Now after we load the data we even have more validations. The data continues to go through an analyst. Our analysts are our rock here. We’d like to make sure they’re involved in every single step of the process. After loading, they are involved and then we also have another application called statement review. Statement review allows us to view statements that go back months, years. We can see all the different properties, we can look at several different data types at once.

That’s a really good review tool that we have access to to make sure that our work is correct and that every step in the process leading up to loading was the correct step. Now the last validation we have is in our sister department software services. Software services, they run reports for our clients and I’m pretty sure you’ll see a video on them soon. They if there’s any sort of discrepancy, if there’s a problem with the data or the reports that they’re running they’re going to come over and tell us. The analysts are very responsive to the software services department and we work with them very closely.

That’s the validation process. That’s it for today’s Whiteboard Wednesday. Make sure to like, comment or subscribe.