Manage fixed assets and enable compliance for your real estate organization

It’s time to get serious about managing your real estate fixed assets. The process can be complex and time consuming, and most organizations are either spending too much money to manage their assets or taking on too much risk by relying on spreadsheets. MRI Fixed Asset Accounting automates manual accounting processes and helps to keep your real estate business compliant with accounting, tax, and financial reporting requirements in Canada and globally. All Sarbanes-Oxley (SOX) compliant organizations must provide a complete audit trail of the asset lifecycle and show full transparency of fixed asset transactions. MRI Fixed Asset Accounting with multi-currency capabilities meets both local and international accounting standards.

Features

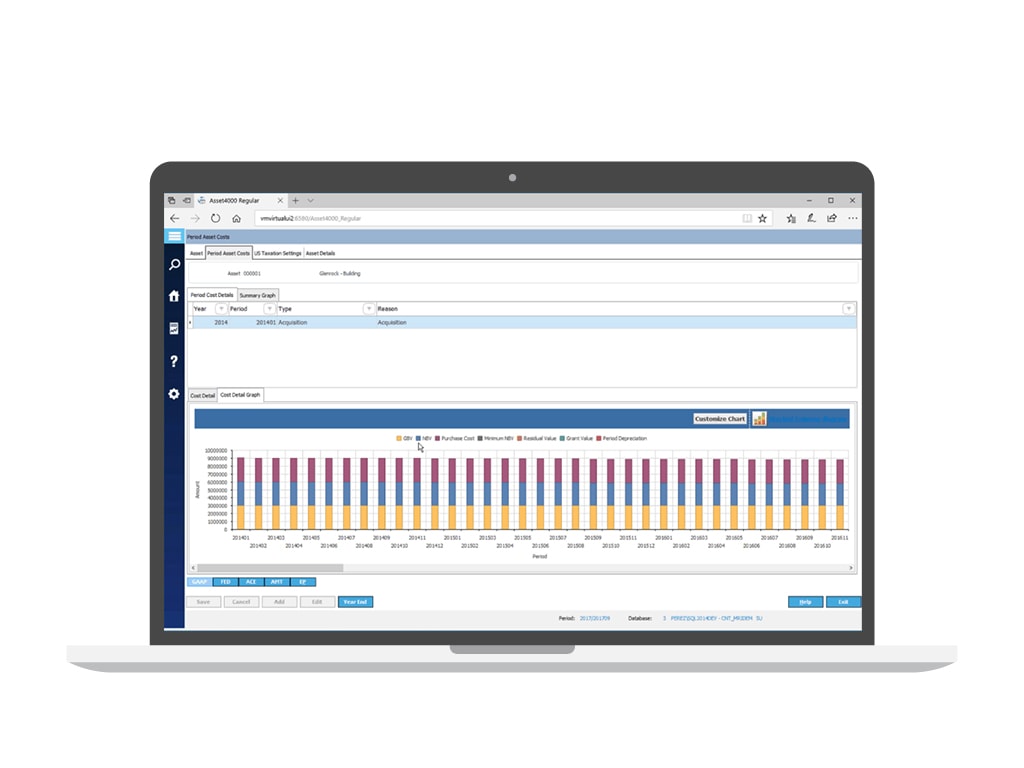

Integration with financials

Streamline your fixed asset transactions and integrate fully with financials, or use fixed asset software with your property management platform of choice.

SOX and IFRS compliance

A full and complete audit trail of the asset lifecycle is required for organizations to be SOX compliant. Maintain compliance for asset accounting and be prepared when new IFRS regulations go into effect.

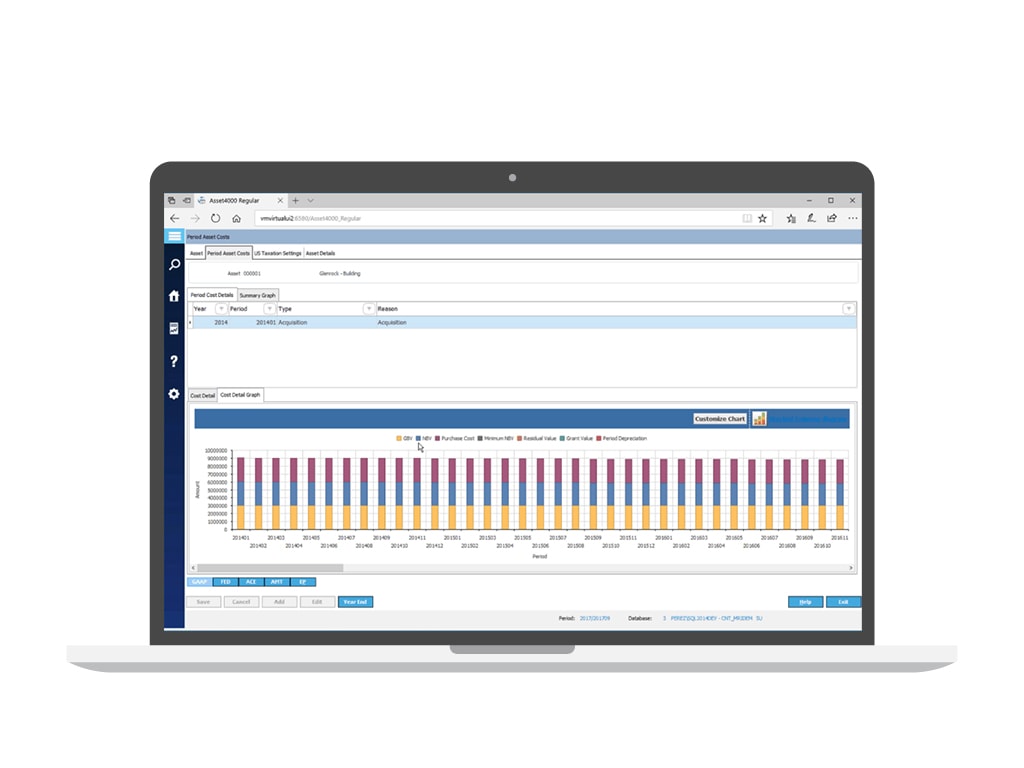

Built-in depreciation flexibility

Stop second-guessing depreciation calculations in spreadsheets by using built-in standard depreciation methodologies – including the ability to configure additional methods.

Meet Canadian and global requirements

Enables compliance with SOX, and IFRS requirements. Consolidate your reporting across multiple companies and books, while meeting international accounting standards.

Ensure compliance and manage the full asset lifecycle

MRI Fixed Asset Accounting software keeps your business in compliance with accounting, tax, and financial reporting requirements.

Learn how you can take control of your fixed assets and automate manual processes with MRI Fixed Asset Accounting.

Advantages

Resources

Let's Connect

Fill in the form to learn more about our open and connected solutions for commercial real estate.