How will the Great Disassociation impact commercial real estate?

In our previous blog, we discussed the role of technology in the “Great Disassociation” and how the COVID-19 pandemic has accelerated existing trends in remote activity and created new challenges for industries where a consumer’s presence is traditionally required. We covered the many ways in which activities like work, banking, retail, dining, entertainment, fitness and education have become more and more disassociated from the locations in which they normally take place.

Commercial real estate owners, operators and investors have some analysis to do as they seek to determine a path forward amid these shifts. This analysis should take place across two dimensions: change drivers and population trends.

Drivers of change

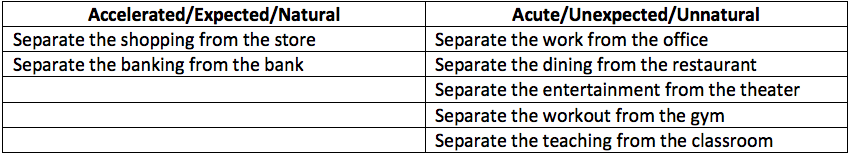

The disassociations listed above should be put into context by assessing if they are a result of the acceleration of pre-existing trends or if they are created by an acute impact of the pandemic – expected vs. unexpected, natural vs. unnatural. The acceleration of an existing trend, like a continued rise in ecommerce, is wholly different than the sudden and drastic impact on restaurant businesses.

The dissociations largely fall into the categories of impact as follows:

The fundamental difference between the two columns is one of transaction vs. experience. While the rationalization of retail stores and bank branches is being driven by retailers and financial institutions, the underlying motivations should be used as a guide for future planning.

If shopping or banking experiences only offer a commoditized transaction, today’s consumers will prefer automation. A more personal experience can, and will, win shoppers, much like Nordstrom, where the guest experience is part of the culture.

Acute disassociations are more challenging to forecast as there is not a point of reference from which to plot a trend in order to determine what the future may look like. The most prevalent driver for these disassociations was the need to be socially distant. The path forward will mostly be defined by changing guidelines and societal norms for what is deemed safe. Eventually, however, the experiences provided at these locations will most likely be desired over what can be done from a distance.

Much like retail and banking, less personal and more commoditized experiences will continue remotely. Collaborative needs for professionals will move back to physical spaces where interactions happen differently and where teams work toward common outcomes. Culture is also created more fully when teams are physically together. More personal experiences in dining, entertainment and fitness will also return as specific capabilities and facilities simply cannot be fully replicated at home.

Impacts of population changes

The other dimension of analysis that needs to be explored is how the population’s post-pandemic habits could alter the locations in which they spend their time, and how changes in the locations themselves could conversely alter the population’s habits.

The number of people commuting into a city for work is sure to decrease. New-found comfort with work from home combined with an aversion to public transportation and the need for social distancing will reduce the daily population in offices without requiring a commensurate reduction of office space as employers reduce office density and create more collaborative space.

The population of city dwellers, especially in dense, major metropolitan areas, is showing some signs of erosion as well. Empowered by the ability to work from home as well as low interest rates, some are seeking more private space in suburban areas and smaller cities. Populations of fans and patrons of sports and the arts remain unable to enjoy these experiences live. Populations of business travelers and tourists remain grounded.

Location, location, location is the mantra of real estate, and typically a great location is a combination of population proximity, access to transportation, convenience of amenities and access to a vibrant cultural scene of dining and entertainment. Unfortunately, each of these elements is under pressure as the pandemic continues to impact the economy.

Most importantly, owners, operators and investors will need to assess if the foot traffic in a building, block, or city will decrease as fewer people transit the area daily, especially when considering the future of service and dining-related establishments.

Moving forward

With a bead on the future, plans for redevelopment, renewal and reinvention will come. Recent strategies will continue, like the combination of retail and entertainment, and new strategies will emerge. Creative thinkers and entrepreneurs will define new uses for current spaces much like they have been doing for years. Factories and warehouses become lofts. Industrial sites get reclaimed for waterfront green space or redeveloped into apartments. Big box retail sites get transformed into a wide array of uses for boutique retail or community programming. The options are virtually endless. With interest rates continuing at historical lows, access to capital should not be a barrier for renewal. The largest challenge will be finding the appropriate use and optimal timing given ongoing uncertainty in the economy due to the pandemic.