On this week’s Whiteboard Wednesday, Eva Chamberlain continues (from our last two videos in the series, here: https://youtu.be/b8r2fETCwvs and here: https://youtu.be/9HkIVqQWEXg) our real estate investment data analysis journey with an overview of how MRI Investment Central fits into the process. Eva walks through how her team coordinates with MRI’s real estate investment clients to review, reclassify, and report on data in the MRI Investment Central portal.

Video Transcription

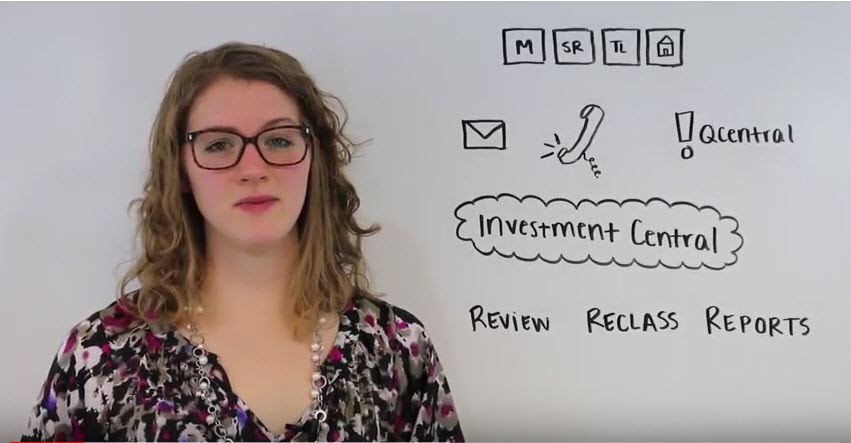

Eva Chambaerlain: Hi, I’m Eva Chamberlain. In the last video we talked about validations within the data processing workflow in the MRI data management services department. This time, we’re going to talk about what happens after that data is loaded. If you remember from the last video, I talked about the three C’s. Our data is consistent, complete and correct when we load it into our system. We can load it via several applications. You see just four of them here, although that is not our comprehensive list. What happens after we load the data, we try to get to what we call the three R’s. Review, reclass and reports. I’ll show you how we get there.

Now, after the data is loaded via our applications, we can be contacted via email or via phone with request to reload the data if something doesn’t look right on the client’s end. We’re more than happy to fix it, we just need to know the information and we need to figure out what happened within the loading process that made that data look incorrect or off or if there are any discrepancies, our client is more than welcome to talk to us about that.

Now, another way that they can communicate information to us is through QCentral. They can leave us information on the actual data records saying, “I need this changed. There was an owner on a tax return that wasn’t loaded.” Those are examples of things that we might be contacted about. We monitor all three of these platforms to make sure that we catch all the information that the client is sending us. After these three platforms, after we’ve checked all these, the data is also in our platform called Investment Central.

Investment Central is our customized client site that is created at implementation. When we have a new client come on, our sister department software services, helps us create a brand new client site with all the screens and all the data that the client wants to see. Now, third parties can log in and report information but that’s also up to the client. In Investment Central is where the three R’s come into play. The client or any third party can review the data. They can make several decisions when they review the data. One of those decisions might be to reclass an account.

What that means is during the loading process, when we’re consolidating all of those thousands of charts of accounts that I told you, when we’re consolidating them into one simplified chart of account, we make decisions as to where certain accounts are assigned to in that one simple chart of accounts. Our client can reclass that decision and make it more customized and make sure that it’s what they want to see. That’s what reclass is. It’s probably one of the most common actions taken by our client, so we like to make sure that that option’s available and help their data look as correct and as relevant to them as possible.

The last R is reports. Reports can be customized, reports can be standardized. You can run a report several times or you can talk to our software services department and run a very customized report. One of the most common reports that I’ve seen is when monthly or quarterly operations are compared to the budget for that year. That’s an example. You can also do 12-month trend of occupancy, 12-month trend of income statements and so on and so forth. Reports can be created via our software services department or the clients who have been, I’ll say, trained on this platform, can go in and run their own reports to present them to their investors or their executive board.

That’s why reports is one of our three R’s. It’s very, very important and it’s one of the best ways for our clients to make sure that their data meets their needs and they can identify any problems with properties or funds. I’d say that’s definitely one of the most important. All right, that’s it for today’s Whiteboard Wednesday. Make sure to like, comment or subscribe.