A perfect storm for multifamily

20 years ago this week, the movie “The Perfect Storm” was released into theaters. A gripping tale of a fight against unknown forces created by the confluence of a hurricane and two powerful stormfronts. In the movie, the crew of the Andrea Gail had a choice to sail through the storm to save their catch or to wait it out and see the catch spoil. They went for it, with perilous results.

The multifamily industry is now faced with our own perfect storm, and unfortunately, we have no choice but to take it as it comes.

The hurricane in our perfect storm is the COVID-19 pandemic. It is the driver of both a health and an economic crisis. A recent rise in coronavirus cases has caused many states to pause or roll-back reopening, keeping the economy in a constrained state with record unemployment, while dealing with the ongoing public health crisis.

Normalcy is on hold

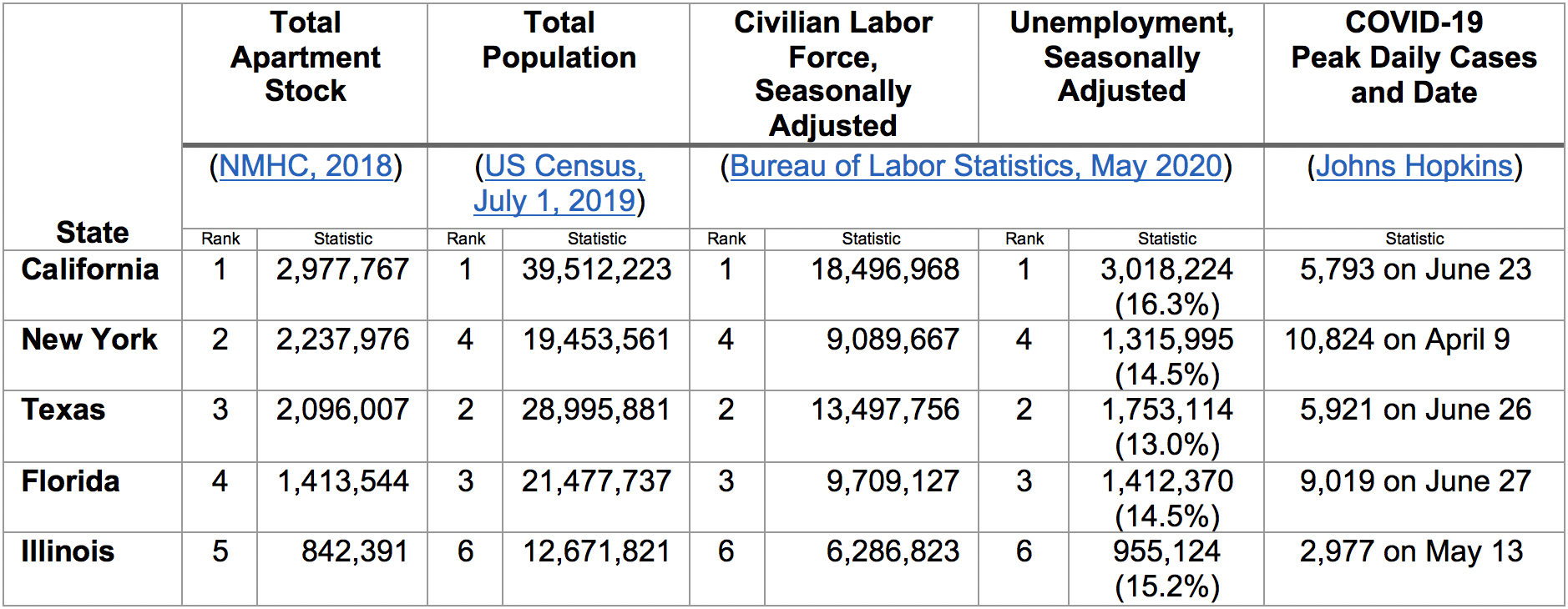

The table below looks at the five largest multifamily markets, which represent five of the top six most populous states. These five states rank similarly in labor force and total unemployment – they make up 35% of the total labor force and hold 39% of overall unemployment in the US.

The table combines the following four important metrics and includes both the actual value as well as the relative 50-state rank:

- Total Apartment Stock

- Total Population

- Unemployment Rate

- Number and date of peak COVID-19 cases

While New York has successfully emerged from the grip of the pandemic, California, Texas and Florida have each set new daily case volume highs in the last week.

The new spikes in case volume have led to a roll-back in reopening plans, putting a pause on a meaningful recovery and return to normalcy. The timing of the pause is unfortunately coincidental with two additional factors that will shape the recovery in multifamily: the coming end of enhanced unemployment benefits and the lifting of eviction moratoriums.

These are the two stormfronts in our perfect storm scenario. They were put in place to help impacted people get to the other side of the pandemic curve, based on a fundamental assumption of reopening and a return to economic normalcy once the virus was contained. Unfortunately, the virus has not abated, and those who have been impacted economically are likely to continue to be impacted beyond the safety net horizons as defined in the CARES Act:

- $600 monthly federal unemployment enhancement is currently scheduled to expire on July 31, 2020

- Eviction moratoriums for tenants in certain rental properties with federal assistance or federally related financing expires on July 25, 2020, plus 30 days for notice or August 23, 2020

Unemployment

As things currently stand, enhanced unemployment benefits will expire by mid-August. Unfortunately, unemployment figures are likely to remain high as long as reopening and a return to normalcy is delayed. And, to be clear, some of the impacts from this pandemic will last well beyond a short-term horizon, specifically on the job front.

The unemployment impact from the pandemic is truly on a scale that we have not experienced in modern times. It hit quickly and broadly and upended the day-to-day for most everyone. From the coffee shop to the bodega to the deli counter, many small businesses are reliant on neighboring large businesses and the foot traffic they bring. That traffic is sure to be reduced as work-from-home scenarios will be more prevalent moving forward and public transport, at least in the short term, feels risky.

Bankruptcies hit many industries with substantial impact on travel (Hertz), retail (J.C. Penney, Neiman Marcus), and oil and gas (McDermott Intl., Chesapeake Energy). Service reductions, permanent location closures, layoffs and furloughs have also happened nationwide, affecting a range of businesses from airlines to hotels, theaters to theme parks, and fine dining to fast casual. Professional sports ground to a stop and are just now trying to find a path forward.

Colleges and universities, while still open, are adapting their in-person and online offerings and changing academic calendars. These changes directly drive uncertainty for local business who are reliant on a vibrant student population and sports programs in their college town, including student housing.

And if all of the above were not enough, education and childcare issues add another layer of challenges for working parents. Many parents became homeschoolers with limited warning and preparation while dealing with their own work upheaval. When the school year ended, the challenges did not, as summer camps and other programs were not available, and uncertainty remains on what the return to the classroom looks like for this fall. Unfortunately, ongoing uncertainty or material scheduling and attendance changes may drive some parents to seek employment changes in order to better care for their family, despite the added risks.

Evictions

The impact of the pandemic on the economy, on the closing of businesses and driving so many to unemployment at the same time, creates the risk for a cascading wave of evictions that landlords have every legal right to process.

To date, as evidenced by the NMHC Rent Payment Tracker, rent collection has been strong and quite similar to last year. Once unemployment benefits reduce, however, we can expect to see more tenants struggle with rent payment, and they will do so just as eviction moratoriums are set to expire.

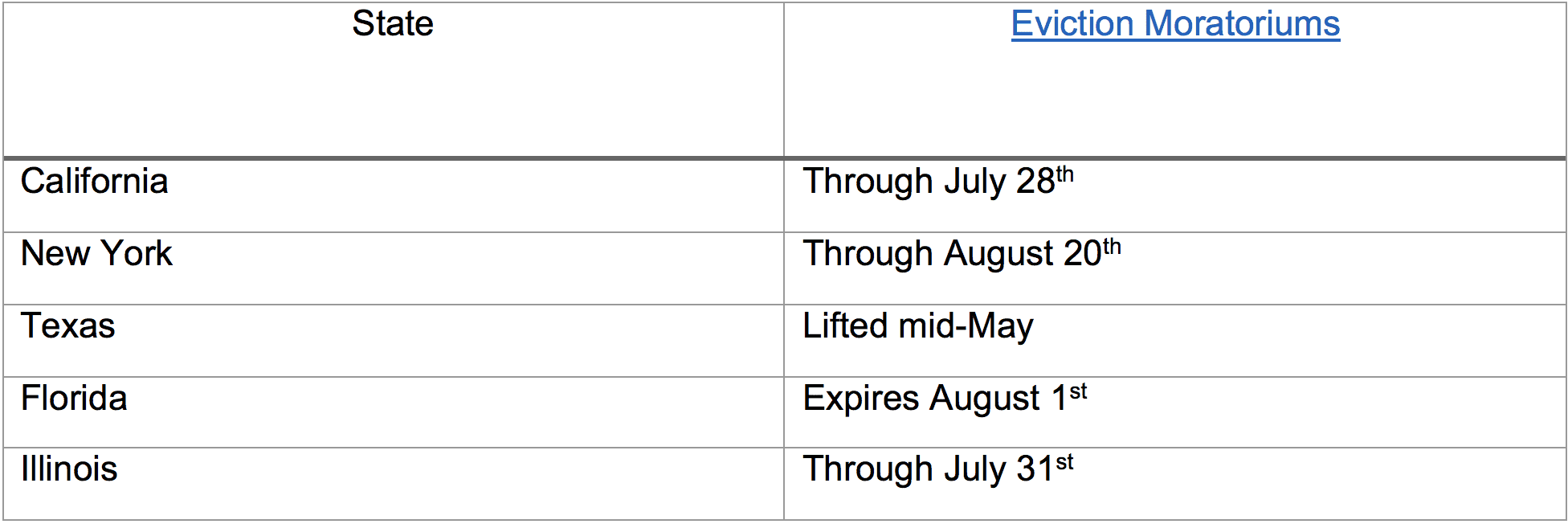

In addition to the CARES act, many states have enacted some form of eviction moratorium (the states noted above are shown in the following table). Additionally, some larger cities have further refined eviction moratorium dates. Unlike the sharp deadline for enhanced unemployment benefits, evictions return in more of a jagged and uneven edge.

As our industry thoughtfully considers evictions at a never before seen scale, we are faced with both ethical and economic considerations that are fully intertwined. Where will the evicted go, and who will replace them in the homes they leave behind?

The next home for the evicted will span the gamut that includes: downsizing, doubling up, going to a family home, seeking housing assistance, seeking shelter or, unfortunately, homelessness. With affordable housing already in short supply, this “migration” is sure to put more pressure on existing systems of support.

Landlords are in new territory with the potential volume of evictions, and they should be as careful with eviction processes as they are with their pricing processes.

As an industry, we closely and carefully manage apartment pricing based on a combination of supply, demand, local market conditions and comparables. A sudden rush of vacancies caused by evictions may have negative impacts on overall economics by creating a flood of supply.

Landlords should be aware that finding replacement renters may be challenging. Our data, through May, does show a recovery in new leasing traffic, but that traffic is not yet converting to applications or new leases as compared to 2019 rates. New lease prices are also falling and concession volume is increasing.

As for the offer of payment plans for tenants who were impacted by the pandemic, landlords should work with individual tenants on outcomes that balance everyone’s interest. When you consider the fixed costs of mortgages, property taxes and insurance, some income may be more beneficial to the landlord than none if cash flow is in question. Certainty may be more beneficial than uncertainty, even if it yields reduced revenue in the short term.

The perfect storm for multifamily is forming, and we have never before seen anything like it – a persistent pandemic-driven employment crisis on a collision course with expiring safety nets. As such, we proceed in largely new and uncharted water fraught with peril for both the landlord and the tenant. Unlike the crew of the Andrea Gail, we have the benefit of being able to plan and adjust without trying to climb our own rogue wave.

MRI Engage for @Work Brochure

Enhance customer experience and connect your communities with a communication and payments portal that provides real-time information The shift towards online working, and accelerated digital transformation, has significantly impacted how owners and …