Affordable and public housing market insights: The impact of COVID-19

While the affordable and public housing industries have faced unique challenges from COVID-19, many residents, prospects, and landlords alike are reacting to the pandemic in the same way as the broader multifamily industry. Residents aren’t keen on leaving their established places of dwelling.

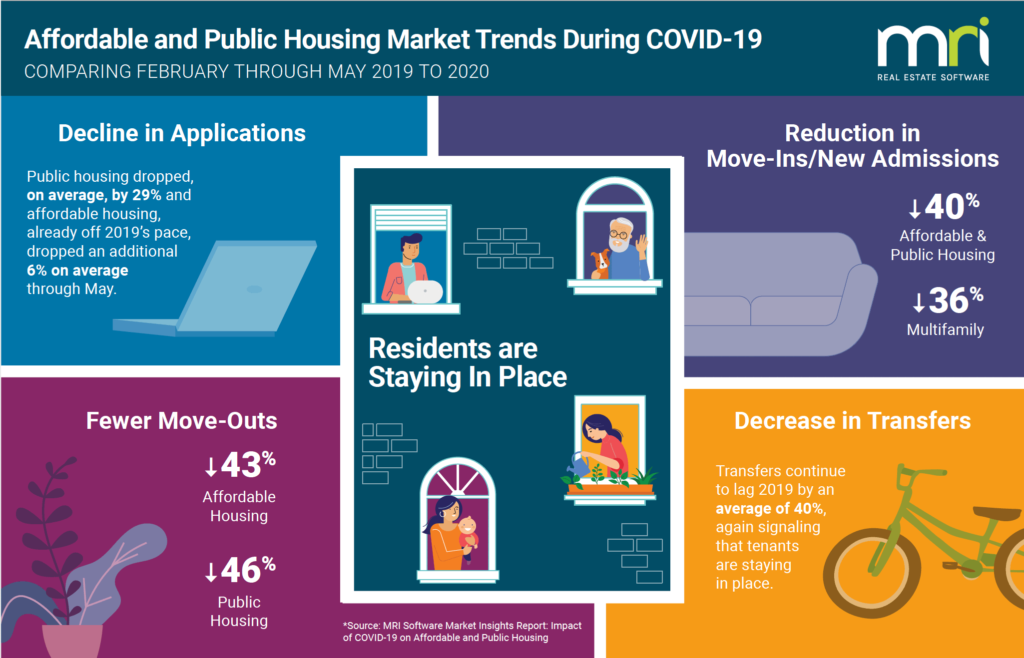

According to a MRI Software Market Insights report on affordable and public housing, applications, new admissions, move-outs, and transfers are all pointing to the conclusion that many residents feel safer staying in place in these times. Below are some of the key findings.

New applications and admissions have slowed

New application data shows that residents are unwilling to change their living situation, which may suggest either a shortage of waitlist openings or decisions made by the applicants themselves. As such, new applications have dropped since the onset of the pandemic in mid-March. Public housing applications have dropped, on average, by 29% as compared to 2019. Affordable housing, already off 2019’s pace, dropped an additional 6% on average through May. Both trail 2019.

With a reduction in applications, of course, comes a similar reduction in new admissions, which are off an average of 36% from mid-March, trailing 2019’s pace. When comparing new admission certifications with conventional move ins, the trends are very similar.

The drops are consistent with the data from the multifamily industry and does not show material signs of recovery as May 2020 closes.

Residents are staying put

As mentioned before, move-out volumes lag 2019, down 43% for affordable and 46% for public housing, from mid-March. Again, as compared to the multifamily industry, move-out volumes are well below 2019 with both public and affordable sectors remaining close to 40% off 2019’s pace. These trends can be explained by the COVID-19 lockdown. Between March and May, fewer people have been able to move, particularly in larger urban areas where a significant portion of the affordable and public sites are located.

Even when residents were able to move with a guaranteed home to move into, MRI’s data indicates that they are still electing not to do so. This can be seen in how transfers continue to lag 2019 by an average of 40%. This again lines up with data from the multifamily sector, where a substantial reduction in transfers is evident.

Taken together, the May data from the report on affordable and public housing industries echo one of the key takeaways from the multifamily market insights: Even when shelter-in-place orders are slowly lifted, the COVID-19 pandemic’s impact will continue to be felt through more people choosing to to stay put. Read the full report on the affordable and public housing industry to learn more.

MRI Engage for @Work Brochure

Enhance customer experience and connect your communities with a communication and payments portal that provides real-time information The shift towards online working, and accelerated digital transformation, has significantly impacted how owners and …