Multifamily rental trends for April 2023

This analysis looks at rental growth trends for twelve multifamily markets across Texas, Arizona, Georgia, Tennessee, North Carolina, and Florida.

Rent growth

In our post-pandemic multifamily landscape, waves of pandemic-era economic activity continue to impact rental growth trends. All the markets we serve are currently trending below their long-term averages, with five of our 12 markets experiencing negative rent growth over the last 12 months.

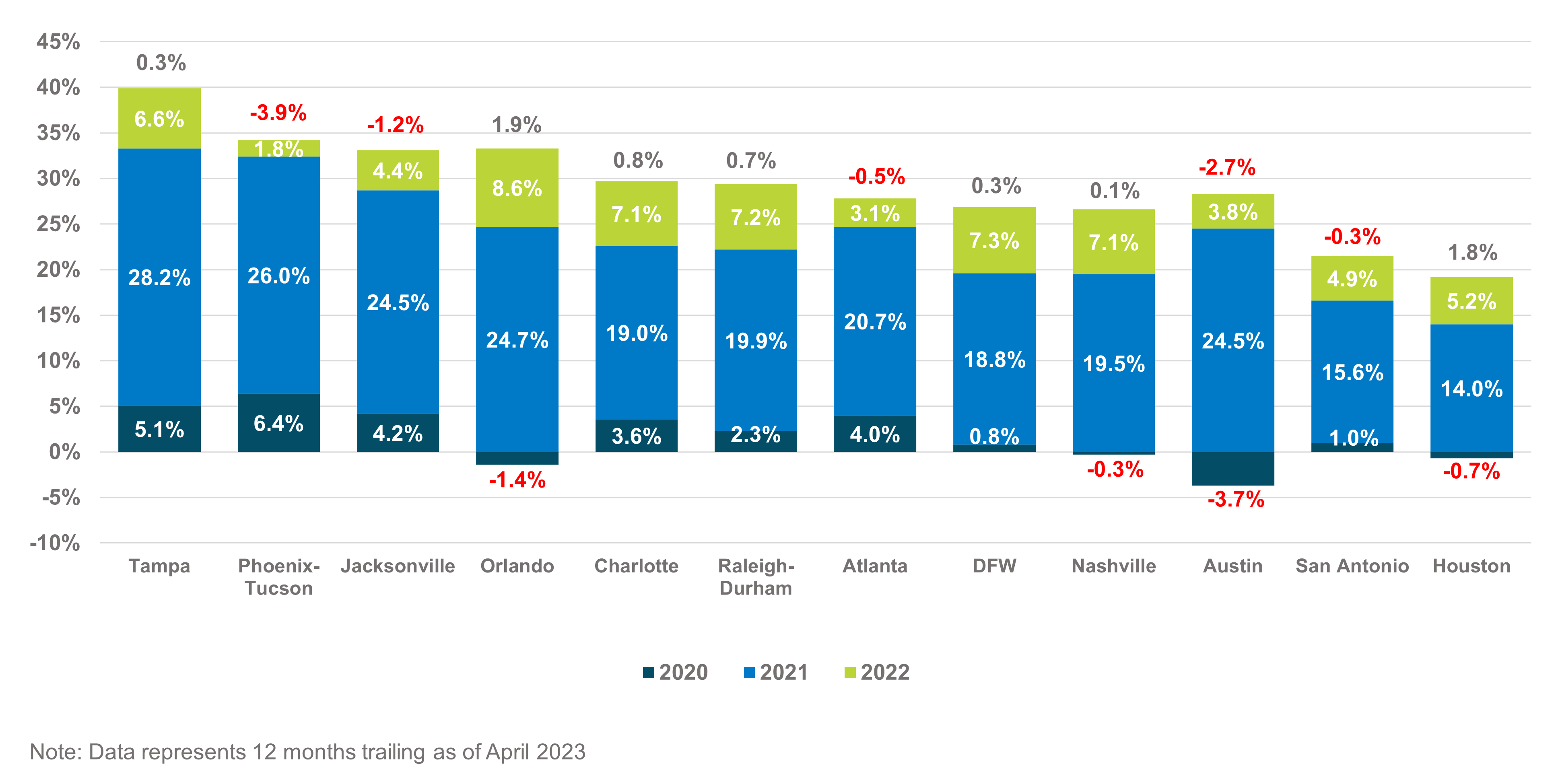

Figure A – Rent Growth Since Pandemic as of April 2023

Figure A demonstrates the rent growth that occurred each year since 2020. The value in the blue section at the bottom of each bar represents 2020 when rent growth was constrained due to the outset of pandemic and economic lockdown conditions. The orange portion of each bar represents growth in 2021 due to the economic reopening that sent rents soaring. The top grey portion of each bar represents 2022 rent growth, when rents were expected to revert to long-term averages but remained elevated well over anticipated levels. The values hovering over the top of each bar are the most current trends as of the end of April.

What this means for 2023

2023 is proving to be a challenging year as rent growth has turned negative in five markets and remains very flat in the rest. Although the negative-to-flat direction of these trends is concerning, we may still experience the traditional seasonal pivot where demand increases from now through July. However, pandemic-induced fluctuations are likely to continue sending shock waves through the established seasonal patterns we have come to expect. Stay tuned as we continue this series with updated reporting on market conditions for 2023.

Interested in learning more? View additional detail on rental rate, occupancy and absorption trends in our monthly Market Line Reports.

Multifamily Industry Review: Leaving 2023 Behind and Discussing 2024 Trends

The economic fluctuations, slowing job growth, and surging supply that defined the multifamily market in 2023 are poised to prolong the pattern of market unpredictability that has become the new normal. As rent trends and job growth settle back into …